rayisa

Bitcoin: This Time Is Different!

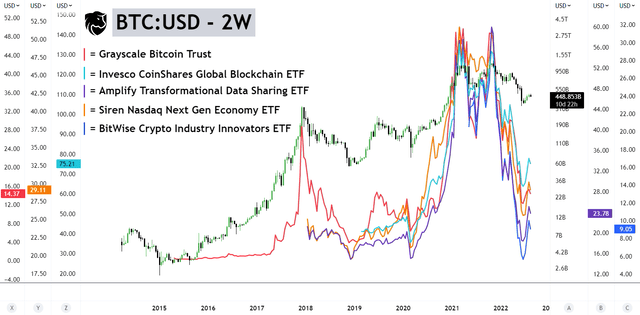

As opposed to the grassroots movement it once was, institutional fund flows primarily drove Bitcoin’s (BTC-USD) most recent bull trend. In 2020, the US Federal Reserve lowered interest rates to 0 and provided over $2.3 trillion in loans to support the economy. This, combined with Covid-19 stimulus checks given directly to citizens, worked to funnel billions of excess liquidity into the crypto casino.

With Bitcoin’s unraveling and dip below $20k, much of the magic surrounding cryptocurrencies has diminished. We believe the current bear market is forcing investors to realize numerous hard truths, including:

- Bitcoin’s unsustainable growth rate,

- Incoming regulations for Ethereum (ETH-USD) and DeFi,

- The crypto market’s over-reliance on loose monetary policy and a bullish stock market.

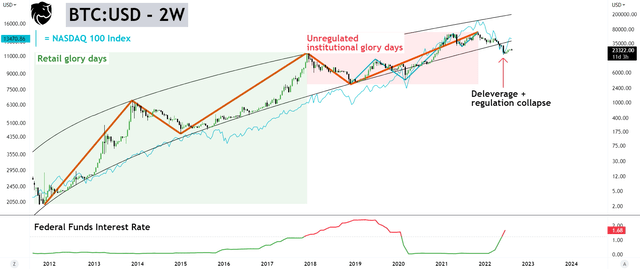

After a violent rally from June 18th to August 15th, Bitcoin’s all-time chart has one of the most bearish patterns I’ve ever seen. To understand this, you must note that a backdrop of favorable financial conditions has characterized Bitcoin’s entire existence. This includes 13 years with a Federal Funds rate between 0% – 2%, promoting a consistently bullish market for stocks.

Now, when faced with a bearish stock market and high rates, we expect Bitcoin’s price will plummet.

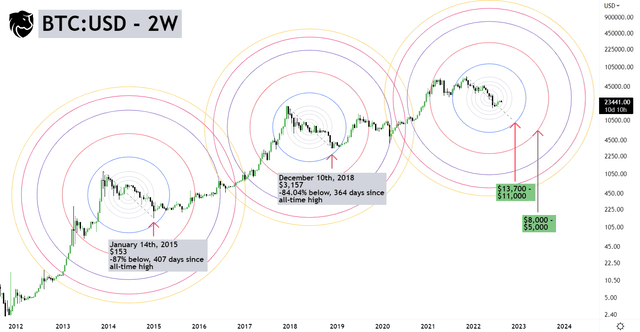

Bitcoin All-Time Price Chart

The chart below compares Bitcoin vs. the NASDAQ-100 index (NDX). Observably, an increasing stock market has always supported Bitcoin:

Amidst such extensively beneficial market conditions, Bitcoin’s price has swung bullishly between two massive hype cycles (firstly driven by retail from 2012 to 2017 and secondly by institutions from 2018 to 2021). These hype cycles are identified with the green and red boxes in the chart above.

- Bitcoin’s hype cycles together form a decade-long 5-wave impulsive movement that peaks at $68k/BTC (identified with the orange lines).

Therefore, the data shows that Bitcoin’s growth rate has always been supported by a beneficial market that promoted increasing hype. This hype emerged as retail FOMO in 2017 and institutional FOMO in 2021. (Up next could be nation-state FOMO. We aren’t kidding. If there is another “cryptocurrency cycle,” it could see governments FOMO into Bitcoin in efforts to mitigate inflation).

As monetary conditions tighten and stocks collapse, we believe Bitcoin’s previous growth trend is no longer sustainable. Consequently, we expect Bitcoin will decline to at least $13.7k (precisely 80% below its all-time high) by November.

- Going forward, further downside in Bitcoin (and all other cryptocurrencies) can be powered by worsening economic conditions, increasing regulatory pressure, and the shattering of many deeply held cryptocurrency beliefs.

- We expect new regulations will soon require Ethereum applications to collect user information.

- We’re also exceedingly worried about the ongoing DOJ probe into Tether (USDT-USD); we suspect more crypto exchange insolvencies are on the way, and we expect global Monkeypox cases will worsen into 2023.

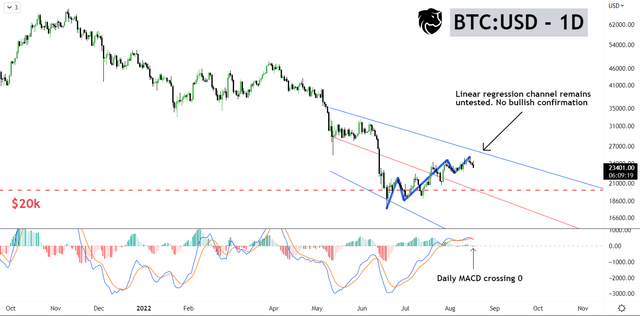

Bitcoin TA Shows Another 60% Decline

Technically speaking, Bitcoin has moved impressively bullish since bottoming at $17,637 on June 18th, 2022. However, indicators have since rapidly shifted bearish, prompting us to believe the rally is over. Currently, the most significant bearish indicators include:

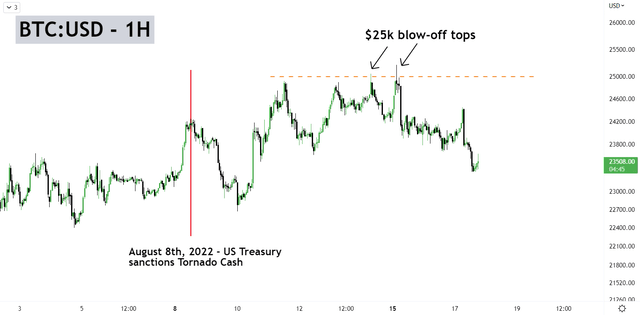

- A 5-wave impulsive movement that ended with a blow-off top at $25k,

- the daily MACD negatively crossing 0,

- the daily/weekly trendlines remain untested.

In our previous article, we identified Bitcoin was moving in a reflexive rally powered by less bad economic conditions and positive investor sentiment. Although we expected the bull trend to last until mid-September, recent government action against Tornado Cash appears to have killed the hype:

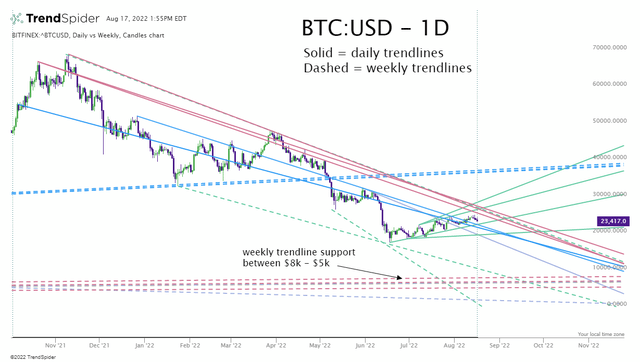

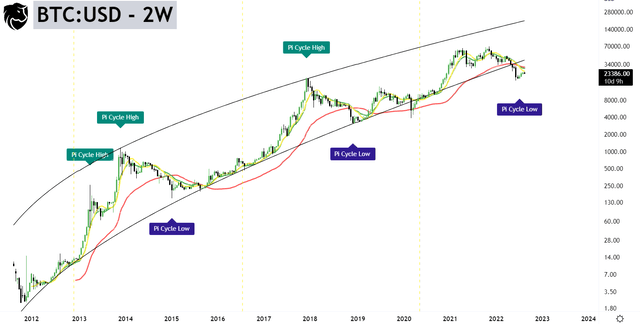

The chart below uses multi-timeframe trendlines to determine Bitcoin’s speed, direction, and significant support levels. TrendSpider indicates Bitcoin is moving in an approximately 35-degree downtrend, projected to reach weekly support at $8k – $5k between October and November 2022. This projection is over 60% below Bitcoin’s current price!

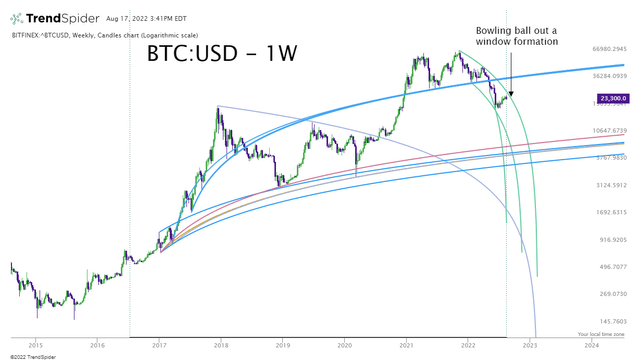

Zooming out, we believe TrendSpider’s weekly trendlines reflect Bitcoin’s real logarithmic growth curves (as opposed to the fake curve often circulated, see here). Accordingly, we expect Bitcoin to move like a “bowling ball thrown out a window” until reaching $10k psychological support or weekly trendline support between $8k – $5k.

Hence, Bitcoin’s technicals are all signaling bearish. To conclude, we’re planning for three possibilities to trade Bitcoin’s bottom:

- The bottom is in, and Bitcoin will now resume its long-term bull trend.

- Bitcoin will mirror previous cycles and bottom approximately 80% below its all-time high, located around $13.7k – $11k.

- Fear caused by new cryptocurrency regulations and worsening financial conditions will push Bitcoin below $10k. In this scenario, we expect BTC to find support at its weekly trendlines between $8k – $5k.

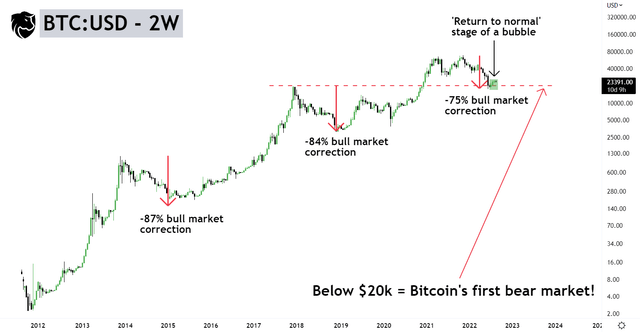

Bitcoin’s First True Bear Market

By observing Bitcoin’s lifetime of price action, we can see that Bitcoin’s long-term bull trend has always been powered by hype (where investors allocate funds in anticipation of more investors entering crypto) as well as beneficial circumstances (including loose monetary policy, an increasing stock market, and lack of regulations). After over a decade of advantageous conditions, Bitcoin is now facing the opposite of each of these dynamics.

In our view, Bitcoin’s recent 75% downtrend from November 2021 to June 2022 represents ‘phase 1’ of a much larger bear market. In fact, we believe Bitcoin is currently entering its first-ever real bear market.

As shown in the chart below, the last two Bitcoin ‘bear markets’ weren’t actually bear markets. Instead, they were bull market corrections!

At the time of writing, Bitcoin has yet to enter its true bear market territory. We believe Bitcoin’s first bear market begins below $20k, upon which all of the most famous bull trend indicators will become invalid.

While Bitcoin’s stock-to-flow model and logarithmic growth curves are already broken, we expect Bitcoin’s Pi Cycle indicator (shown below) is the next to break:

Incoming Black Swan Events

So far, we’ve covered Bitcoin’s bearish technicals and fundamentals. We also explained why we expect an impending crash will be Bitcoin’s worst ever. Going forward, we’re anticipating the following ‘Black Swan’ events will power a violent downturn:

1) Stock Market Collapse

Despite the past 7-month downtrend, the NASDAQ-100 index is still overvalued relative to its long-term base-level trendline:

As shown above, the similarities between the Nasdaq’s current structure to 2008 and 1999 are uncanny. If NDX is destined to crash like the dot-com bubble, this will decrease the index by another 64%.

2) Cryptocurrency Regulation

As previously stated, the US government sanctioned the Ethereum mixer application ‘Tornado Cash’ on August 8th, 2022. As regulatory uncertainty has haunted cryptocurrencies for years, we believe the recent government action against Tornado Cash represents one of many attacks soon to come.

Furthermore, the Tornado Cash sanction proved that Ethereum is not censorship-resistant. This flies in the face of millions of ETH investors (including myself) who previously assumed Ethereum applications were immune to government censorship.

Therefore, we expect increasing regulation and the relinquishment of previously held beliefs will drive the prices of Ethereum and its DeFi economy much lower.

Laura Shin’s ‘Unchained’ podcast episode with Dave Jevans, CEO of Cipher Trace, is the best source I’ve found to discover incoming cryptocurrency regulations.

3) Tether Collapse

The Tether stablecoin represents another dynamic that has haunted the crypto market for years. In 2018, two university professors released a 60-page report detailing how Tether used market manipulation tactics to boost Bitcoin’s price during the 2017 rally.

Although the crypto market has ignored this controversy for years, the US Department of Justice has recently moved to re-open their investigation into Tether. As the crypto market’s largest stablecoin (valued at $43 billion), it’s reasonable to assume that a Tether bank fraud conviction would negatively affect cryptocurrency prices.

4) Exchange Insolvencies

“Phase 1” of Bitcoin’s bear market (from $68k to $17k) saw numerous cryptocurrency lenders declare insolvency. During Phase 2 of the downtrend (which will bring Bitcoin below $20k), we believe more exchanges and lenders will declare insolvency/bankruptcy.

Notably, in a move similar to Celsius and Voyager’s pre-insolvency actions, Crypto.com (CRO-USD) has recently decreased the rewards paid to its credit card holders. Although this doesn’t prove anything, it’s objectively not a good sign.

5) Monkeypox

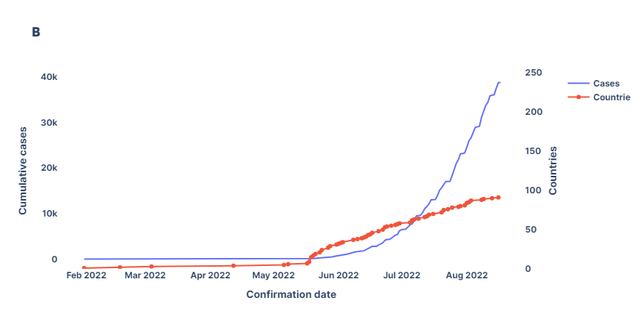

Lastly, we believe the Monkeypox virus represents a significant ‘black swan’ event that markets aren’t pricing in. As of August 18th, 2022, there are 38,735 confirmed global Monkeypox cases and 2,446 suspected cases:

Cumulative Confirmed Monkeypox Cases (monkeypox.global.health)

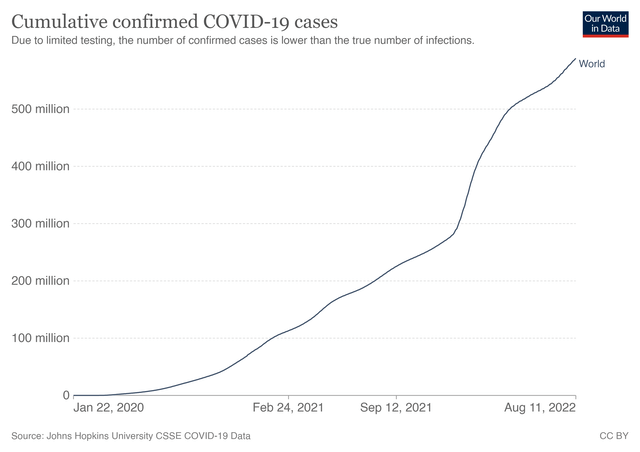

Although it’s unlikely that Monkeypox will spread as quickly as Covid-19, it is worth noting that cumulative international Monkeypox cases are currently at the same number as Covid-19 during February 2020:

Covid-19 Cumulative Confirmed Cases (Our World In Data)

We anticipate Monkeypox will develop into a much larger issue as cases increase into 2023. Raising monkeypox cases could frighten many citizens, prompting them to seek vaccinations from a dwindling supply.

Short Trades

Currently, we’re margin short Bitcoin with an entry at $24.2k, and we’re short Ethereum at $1902. We’re also short Uniswap (UNI-USD) and Curve Finance (CRV-USD), as we expect incoming cryptocurrency regulations will seriously damage these protocols.

Risks

Trends in macroeconomics and central bank policy support our bearish outlook for Bitcoin. Risks include any hint of dovishness from the Fed (which would rocket markets higher) and uncertainties surrounding the November 2022 Congressional elections. Markets may bounce if the Republicans win the majority in the House of Representatives. Alternatively, we expect a heavy dump if the Democrats win.

Additionally, investors should continue to expect each month’s inflation print and economic data to affect prices heavily.

Key Takeaways

- After 13 years of beneficial financial conditions and two massive hype cycles, Bitcoin is poised for its biggest crash ever (its first real bear market).

- We anticipate this downturn can push Bitcoin to $13k – $11k or to $8k – $5k.

- Majorly detrimental events are brewing beneath the crypto market’s surface, including regulatory encroachment, a worsening economy, poor financial conditions, and the spread of the Monkeypox virus.

This news is republished from another source. You can check the original article here

Be the first to comment