As May began, we looked into the best and worst performers of April. The ‘surprisingly robust’ bitcoin slipped lower as the market was waiting for the next Fed’s move, which soon raised interest rates by 0.5 percentage points, and bitcoin funds saw the largest weekly outflows in a year, with ethereum following. Speaking of which, ethereum’s price target for 2022 got cut yet again but new highs are still in play, and while most Otherdeed buyers were unable to sell their NFT at a profit due to high Ethereum fees and decreasing demand, Vitalik Buterin said L2 fees need to be under USD 0.05 to become “truly acceptable”. Then, ADA jumped as Cardano launched a testnet version of the Djed stablecoin, a panel estimated that APE could hit USD 27 by the end of this year, CRO trimmed losses as Crypto.com decided to scrap its plan to cut rewards after the community backlash, SOL didn’t seem overly affected by Solana’s troubles after at least nine days with reported outages in 2022, and Polkadot became a ‘fully interoperable multichain’ with the launch of its cross-consensus messaging format.

Coinbase’s CEO said that the number of people who have used or tried cryptoassets will reach 1bn within a decade, Kraken started inviting users to sign up on a waitlist for its new NFT marketplace, OKX announced that it has become the “largest primary partner of the McLaren Formula 1 team, and Kakao Bank refused to confirm or deny that it struck a partnership with Coinone. While there were reports that Elon Musk may launch a Twitter IPO after he buys it, Binance is backing Musk’s takeover of Twitter with a USD 500m investment. Gucci will be accepting crypto payments in the USA, MicroStrategy is considering yield generation options on BTC 95,643 holdings, a new service has enabled users to get tipped in bitcoin to read emails, and major US-based Bitcoin and crypto companies were warning about ‘extreme’ risk in the PoS systems.

South Korea’s President-Elect could end an ICO ban that dates back to 2017, and the Salvadoran government is “waiting for a bitcoin price rise” before releasing its BTC bonds. Banco Galicia will allow some of its customers to trade, sell, and hold crypto while Argentina’s tax body has called for tighter crypto monitoring, and as Argentina’s miners warn that they will be ordered to cease operations first in the event of power shortages, the crypto bills in Panama and Brazil are progressing fast. Meanwhile, the number of central banks involved in CBDCs nearly doubled in a year. In legal news, ex-BitMEX chief Arthur Hayes wants a court not to give him jail time, and the court handed out BitMEX founders USD 30m in fines for AML violations, while the police in Norway issued a warning to crypto owners following an armed robbery.

Let’s laugh at some jokes now.

__________

Hey, CT! What’s on your mind?

__

Let’s check on the markets.

__

A valid question at this point.

__

Don’t be a panic seller.

__

All’s good.

__

Is it too much to ask, goddammit?!

__

What if Saylor confused Bitcoin with Pokemon and is now trying to catch them all?

__

Smart answer. As expected from a smart investor.

__

How it starts.

__

How it progresses.

__

How it ends.

__

No dip for you.

__

Absolutely no dippity dip for you.

__

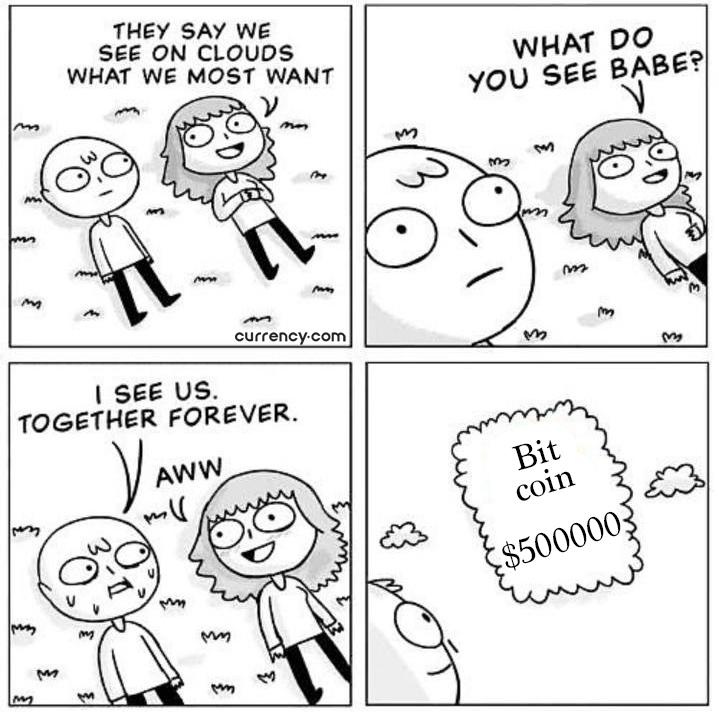

Setting goals early.

__

So you’re not late for at least one of these things.

__

Make it large.

__

‘Dumbaaaas!’

__

A progress you understand when you turn crypto.

__

‘Bro, wake up. They’re using more than the entire Denmark, bro. Bro?’

__

And for the end: be greedy.

This news is republished from another source. You can check the original article here

Be the first to comment