ChainLink price analysis for September 21, 2022, reveals the market following a positive movement, obtaining significant positive momentum, signifying a gain of positivity for the LINK market. The price of ChainLink has remained negative over the past few hours. On September 20, 2022, the price crashed from $7.2 to $6.7. However, the market increased in value soon after and gained more value. Moreover, ChainLink has peaked and reached $7, just shying away from the $8 mark.

The current price of ChainLink is $7, with a trading volume of $425,929,894. Chainlink has been down 0.95% in the last 24 hours. ChainLink currently ranks at #23 with a live market cap of $3,458,001,335.

LINK/USD 4-hour price analysis: Latest developments

ChainLink price analysis reveals the market’s volatility following a closing movement. This means that the price of ChainLink is becoming less prone to the movement towards either extreme, showing increasing dynamics. The Bollinger’s band’s upper limit is $7.8, which is the strongest resistance point for LINK. Conversely, the lower limit of Bollinger’s band is $6.6, which is the support point for LINK.

The LINK/USD price appears to be moving over the price of the Moving Average, signifying a bullish movement. The market’s trend seems to be dominated by bulls. The LINK/USD price appears to be moving upward, illustrating an increasing market. The market appears to be showing further bullish potential.

ChainLink price analysis reveals that the Relative Strength Index (RSI) is 40, showing a stable cryptocurrency market. This means that the cryptocurrency falls in the lower-neutral region. Furthermore, the RSI appears to move linearly, indicating a constant market. The equivalence of selling and buying activities causes the RSI score to increase.

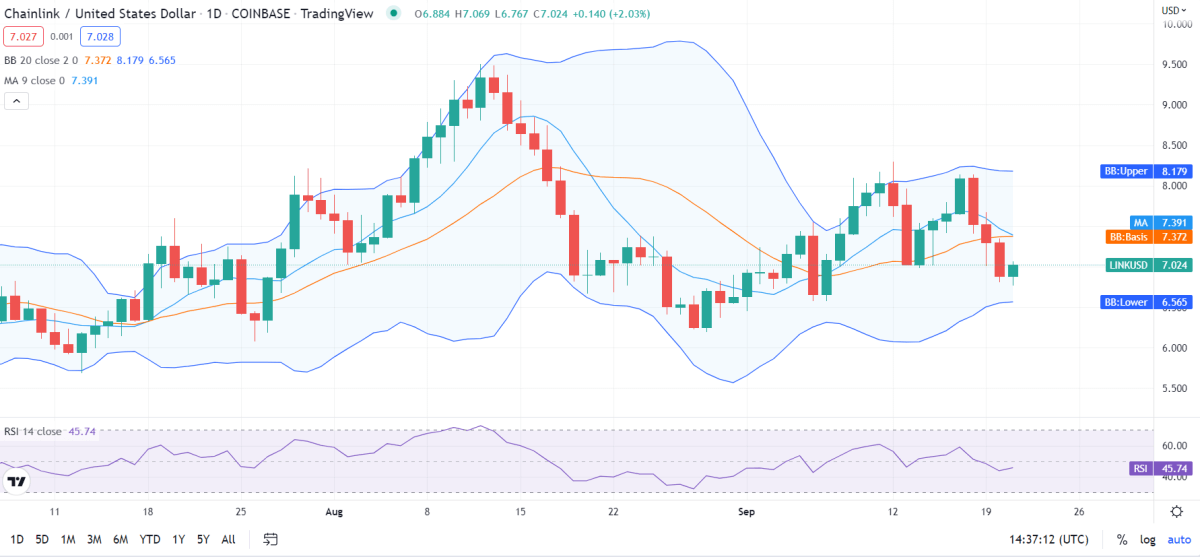

ChainLink price analysis for 1-day

ChainLink price analysis reveals the market’s volatility following an increasing movement, which means that the price of ChainLink is becoming more prone to experience variable change on either extreme. The Bollinger’s band’s upper limit is $8.1, serving as LINK’s strongest resistance point. Conversely, the lower limit of Bollinger’s band is $6.5, which is the strongest support point for LINK.

The LINK/USD price appears to be moving under the price of the Moving Average, signifying a bearish movement. The market’s trend seems to have shown bullish dynamics in the last few days. However, the market has decided on a positive approach. As a result, the trend has shifted today, the price started moving upward, and the market started opening its volatility. This change has played a crucial role in the development of ChainLink. However, the price attempts to move towards the resistance of the market.

Chainlink price analysis shows the Relative Strength Index (RSI) to be 45, signifying a stable cryptocurrency. This means that the cryptocurrency falls in the central-neutral region. Furthermore, the RSI path seems to have shifted to an upwards movement. The increasing RSI score also means dominant buying activities.

ChainLink Price Analysis Conclusion

Chainlink price analysis reveals that cryptocurrency follows an upward trend with much room for activity on the positive extreme. Moreover, the market’s current condition appears to be following a positive approach, as it shows the potential to move to either bullish extreme. The market shows much potential for development towards the increasing end of the market.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

This news is republished from another source. You can check the original article here

Be the first to comment