Ethereum paves the way to double digit gains for many major cryptos.

A price spike throughout the majority of cryptocurrencies has seen the total crypto marketcap climb back above US$1 trillion. As is often the case, Bitcoin and Ethereum led the way.

- Bitcoin formed a double-top pattern, currently retesting resistance of AUD$34,000 (US$24,000).

- Ethereum outperformed much of the market with 48 hour gains of +20%. ETH reached a high of over AUD$2,500 (US$1,750), a price not seen in over a month.

- Other notable performers include Bitcoin Cash, Ethereum Classic, Lido and Uniswap, all of which all climbed +20% in the last 2 days.

The positive growth seen by ETH is likely attributed to development advancements surrounding the upcoming Merge. The Merge is a highly anticipated update in which Ethereum will converge its execution layer, or Mainnet, with its consensus layer known as the Beacon Chain.

The Merge will eliminate resource heavy proof-of-work (PoW) mining on the Ethereum blockchain, and transition fully to a proof-of-stake (PoS) consensus mechanism. The Merge upgrade aims to reduce energy consumption by over 99% and is set to be completed as early as September.

So why now?

In preparation for the upgrade, Ethereum has been completing a number of “shadow forks”. This process involves data being copied from the Mainnet to a test environment to help ensure a smooth transition come release day. Ethereum recently completed its 10th shadow fork, which reportedly went off without a hiccup.

Shortly after this, Tim Beiko from the Ethereum Foundation tweeted an expected timeline for the Goerli/Prater testnet merge, marking another significant milestone.

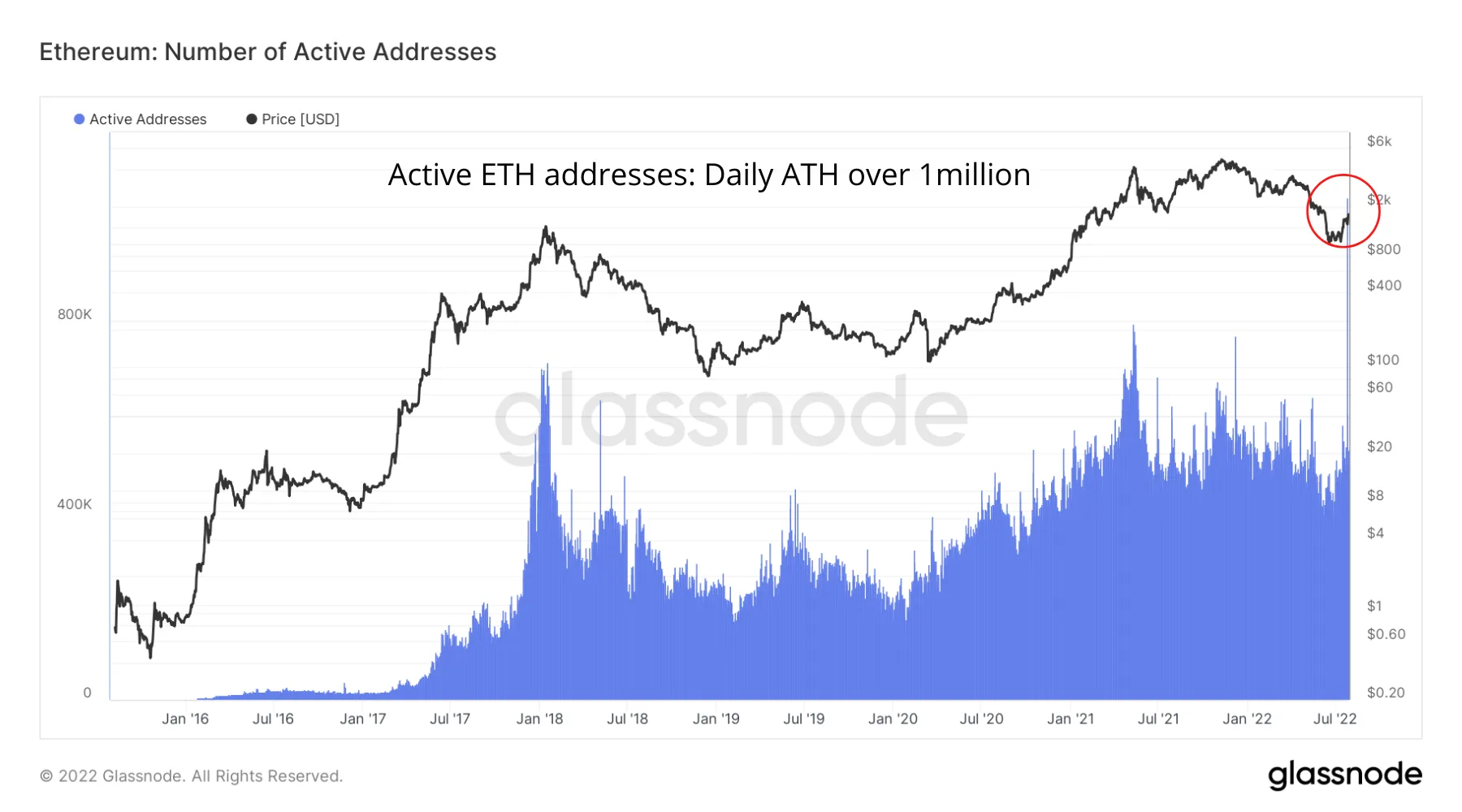

Ethereum: Number of Active Addresses | Source: glassnode | Image: Finder

Following these development advancements, the number of daily active Ethereum addresses skyrocketed to 1,062,036. A 48% increase compared to the previous all-time-high.

While the Merge and the growing number of daily active Ethereum addresses are positive signs for the Ethereum community, there are also a number of other coins and tokens that could be impacted by these factors.

Ethereum Classic: A fork of the original Ethereum blockchain, Ethereum classic will remain a PoS network post Merge. The recent price action witnessed by Ethereum Classic may be a result of current ETH miners transitioning their operations to ETC in preparation for the Merge.

Increased attention has also been brought upon Ethereum Classic after the mining company AntPool came forward with a $10 million investment to support the continuation of ETC mining and help promote the network.

Uniswap: The token price of Uniswap is heavily dependent on the total value locked (TVL) in the exchange. The fact that there is a growing number of active daily users on the Ethereum blockchain shows that there is still faith in the DeFi ecosystem and a revival could be just around the corner.

If all goes to plan in the upcoming Merge updates and the number of blockchain users continue to grow, it is likely that a portion of this money will flow back into DeFi and UNI holders are likely to be some of the first to reap the rewards.

Lido DAO: Lido is a crypto that is set to directly benefit from the Merge. Lido is a DeFi platform that supports Ethereum staking through stETH.

While 32 ETH is required to stake directly on the Beacon Chain, Lido allows users to pool together their Ethereum balance which is then, by proxy, staked by Lido. If the amount of stETH grows, it is likely that the price of LDO will follow.

Investors are clearly paying close attention to the Merge and the responding price action has so far been positive. With more Merge-related announcements yet to come and ETH climbing closer to its US$2,000 resistance zone, the next few months are set to be exciting.

Trying to get a handle on the markets? Cut through the noise with our overview of the best cryptos to buy right now, explore some strategies for how to trade crypto or see if there’s a better platform for you with our guide to the best crypto exchanges.

Disclaimer: Cryptocurrencies are speculative, complex and involve significant risks – they are highly volatile and sensitive to secondary activity. Performance is unpredictable and past performance is no guarantee of future performance. Consider your own circumstances, and obtain your own advice, before relying on this information. You should also verify the nature of any product or service (including its legal status and relevant regulatory requirements) and consult the relevant Regulators’ websites before making any decision. Finder, or the author, may have holdings in the cryptocurrencies discussed.

Billy Endres owns cryptocurrencies as of the publishing date.

This news is republished from another source. You can check the original article here

Be the first to comment