The euphoria of Biden’s signature over the executive order fizzled after inflation in the world’s largest economy shot up to new four decade highs.

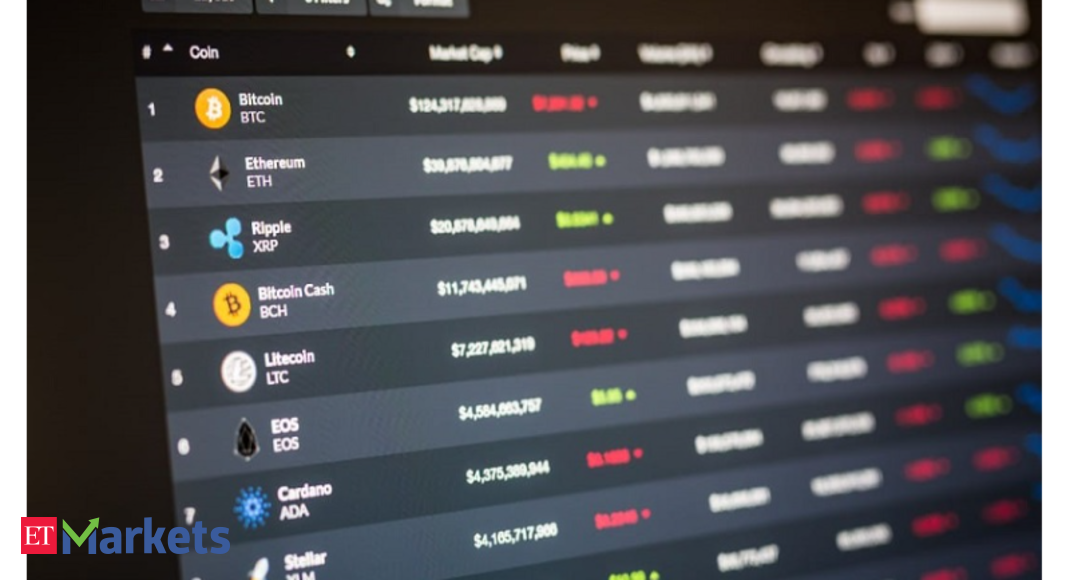

Barring the dollar-pegged Tether and Avalanche, all of the top digital tokens were trading lower on Friday. Bitcoin and BNB fell 6 per cent each, followed by a 5 per cent fall in Ethereum, Shiba Inu and Cardano each.

The global cryptocurrency market cap today tumbled down to $1.72 trillion, shedding almost 5 per cent in the last 24 hours. Total cryptocurrency trading volume dropped as much as 9 per cent to $88.94 billion.

What’s cooking in India

India, one of the world’s biggest crypto markets by trading volume and users, has seen an exodus of funds from foreign investors.

Expert Take

According to market cap, the top cryptocurrencies are also running in the red over the past day, said Edul Patel, CEO and Co-founder of Mudrex

“The situation is due to the ongoing war crisis between Russia and Ukraine affecting the economy, hiking the inflation rates. We could see a lot of high volatility in the crypto market this month due to the war tension,” he added.

Crypto space is showing signs of maturity as the markets are moving in tandem with the global macroeconomic environment, said Kunal Jagdale, Founder, BitsAir Exchange.

“Regulatory buzz, legitimacy and movement according to events are a big booster for the sector, which can not be ignored,” he added. “If the inflation remains elevated, we might see more interest from the institutions. Markets, on the other hand, continued to remain volatile and investors should not jump to take any leverage positions. ”

Global

updates

- New York-based cryptocurrency trading and custody platform Paxos has received a license from the Monetary Authority of Singapore (MAS), making the firm the first crypto player to snag regulatory approval in both New York and Singapore.

- Crypto exchange FTX has picked payment infrastructure company Stripe to build onboarding and identify verification features.

- Also, the HBAR Foundation, which drives the development of the Hedera network by providing grants and resources to developers, launched a $100 million fund for sustainable ventures.

- In other news, JustCarbon and Likvidi both announced the start of trading platforms for tokenized carbon credits, giving participants the ability to trade greenhouse-gas emissions and lower their carbon footprints.

Tech View from Sahicoin

BTC has been sideways for a month without having a major breakout. It has twice tested the level around $34200-34400, which is a strong demand zone and $45500-45800 level which is a strong supply zone.

We can observe a trendline on a daily timeframe and fibonacci retracement too shows a 61.8% support level at $37900 which indicates that we can expect a short term bounce that can retest the supply zone. It will be interesting to observe the next couple of weeks in anticipation of a major breakout, till then traders will enjoy short term trading opportunities.

Market sentiments have been neutral, the Ukraine-Russia war had an impact on BTC prices. However, a recent executive order by president Joe Biden has given hope to cryptocurrency investors and we may see a good recovery in the market.

(Views and recommendations given in this section are the analysts’ own and do not represent those of ETMarkets.com. Please consult your financial adviser before taking any position in the asset/s mentioned.)

This news is republished from another source. You can check the original article here

Be the first to comment