(MENAFN- News Direct)

London, UK | May 27, 2022 09:00 AM Eastern Daylight Time

Current fixed-rate products available in the Decentralized Finance (DeFi) industry are a critical component in the financial derivatives market; but drawbacks, such as low interest rates, intense competition and lower overall attractiveness to investors remain. A revamp that consists of integrating a variety of lending protocols offering higher interest rates is needed so fixed-rate DeFi products remain relevant to investors, says a report by Huobi Research Institute in partnership with Huobi Tech and EmergentX.

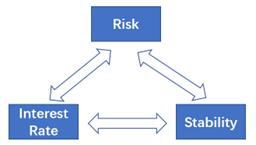

Named“ Fixed-rate DeFi Protocols: A Bear Market Haven? ”, the report notes that fixed-rate products serve a vital function especially during a bear market by allowing investors to hedge risk. However, a disadvantage occurs during periods of market fluctuation, where it is an almost foregone conclusion that one party will enjoy the perks while the other swallows the loss. The report observes an impossible trilemma in the design of a typical DeFi product: that of balancing risk, interest rate and stability (Figure 1).

Figure 1: The triangular paradox of DeFi products (Source: Huobi Research Institute)

The report further examines the three most commonly adopted fixed-rate protocols in the DeFi market today: zero-coupon bond, separated principal and interest and junior and senior bond.

According to the report, Notional, an example of zero-coupon bond which functions on a simple supply and demand curve where interest is fixed at time of borrowing, demonstrates notable disadvantages in the form of low interest rates due to insufficient fund turnover and inflexible maturity periods of just three months and six months, which might be insufficient for both lenders and borrowers.

In a separated principal and interest model, the Principal Token (PT) is put up for sale at a discounted price whereas the Yield Token (YT) functions to broaden the income spread while remaining under the liquidation line. Pricing is a significant drawback for this protocol, the report notes, due to challenges associated with market prediction.

Frequently adopted in the traditional financial market, the junior and senior bond classifies funds into different tiers with various risk aversion levels; essentially transferring extra risk exposure from investors who prefer obtaining a stable income to those who are willing to shoulder increased risk.

The report noted that Notional, despite its disadvantages, stands out among the lending protocols TVL-wise. However, the Terra collapse and prospect of a looming bear market have not helped uptake, which the report attributes to three reasons: systemic risks brought about by large fluctuations in the crypto market; liquidation risks faced by loan-type fixed rate products and how investors will need more time to figure out their investment strategies, given the diversity of fixed-rate product structures currently available.

“Fixed-rate products are facing intense competition from professional investors and reputed financial institutions,” says Hugo Hou, a researcher at Huobi Research Institute and co-author of the report.“Low interest remains a headache for fixed-rate in DeFi and impedes the industry from further growth.”

“An increase in interest rate can only be achieved by fair pricing, redistribution of profits to participants and increasing profit from underlying assets,” says Yeyan Wei, a researcher at Huobi Research Institute and co-author of the report.“We hope more innovative fixed-rate products will emerge soon.”

Click here to download the full report.

About Huobi Research Institute

Huobi Blockchain Application Research Institute (referred to as ‘Huobi Research Institute’) was established in April 2016. It is committed to researching and exploring new developments in the global blockchain industry. Its goal is to accelerate the research and development of blockchain technology, promote its applications, and improve the global blockchain industry ecosystem. Huobi Research Institute covers industry trends, emerging technologies, innovative applications, new business models, and more. Huobi Research Institute partners with governments, enterprises, universities and other institutions to build a research platform that covers the entire blockchain industry. Its professionals provide a solid theoretical basis and analyze new trends to promote the development of the industry.

MENAFN29052022005728012573ID1104287191

Legal Disclaimer: MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

This news is republished from another source. You can check the original article here

Be the first to comment