jpgfactory/iStock Unreleased via Getty Images

Investment thesis

A gathering storm, coming from multiple directions, including growing scarcities across the global economy, which are fueling inflation, global economic and trade frictions as well as other factors are now putting the viability of the fiat system into question perhaps like never before. Within this context, the investor community is increasingly concerned with the question of whether one should hedge against a worst-case scenario of fiat system collapse by relying on the medium of exchange with thousands of years of history behind it, or whether they should embrace new tech solutions, such as the growing list of cryptocurrency options available to investors. Weighing the advantages and disadvantages of both asset classes, and looking at the latest developments, it seems that gold is the best bet, mostly because central banks are treating it as a hedge against the flaws within the very system they promote, while cryptocurrencies are increasingly treated as the enemy. The tried and tested advice to avoid fighting the Fed as well as other central banks seems to be relevant, and investors should strongly consider it in this particular case.

The evolving threat to the global fiat system

It was thought back in 2008 that there was a very real threat of global financial system collapse. Those worries were put to rest courtesy of major central bank actions around the world, accompanied by massive government spending programs. Those monetary and fiscal policies were seen by those who follow classical economic theory as being a threat to the stability of the fiat systems that national governments around the world rely on. Classical economic theory was proven to be flawed within the context of the last decade, mostly because one ingredient was missing, namely scarcity. Manufactured goods continued to be plentiful, courtesy of China and other manufacturing centers in Asia and elsewhere. The manufacture and transport of those goods in sufficient volumes were made possible by the shale boom, which singlehandedly covered most of the global increase in oil & gas demand for most of the last decade. Without the scarcity factor, the stimulative policies of central banks and governments did not lead to inflationary pressures as it was initially feared. In fact, low-interest rates led to business operations savings, which were then passed on to consumers, leading to a subdued inflationary environment, which at times was seen as a deflationary threat.

Just because that was the way things played out following the 2008 financial crisis, it does not mean that we will see another repeat of it this time around. For a number of reasons, things are in fact different this time. “This time is different” is often seen as a losing bet, but the facts support this view. Rising inflation in the post-COVID economic crisis era is the most obvious sign of it. The inflationary trend is driven by three main factors that converged on us simultaneously.

One of the factors is the ongoing disruption in economic activities around the world, caused by the endless waves of COVID infections. This factor is likely to see some improvement starting this year, with governments increasingly announcing an end to emergency pandemic fighting measures. We are opting to learn to live with it. Having said that, even if we will not see further government measures that impede economic activity, such as lockdowns, vaccine mandates, and so on, the virus itself can cause temporary worker shortages at various operations if we will continue seeing large numbers of people getting infected each time a new strain of the virus appears. Regular periods of global disruption in economic activities are likely to continue.

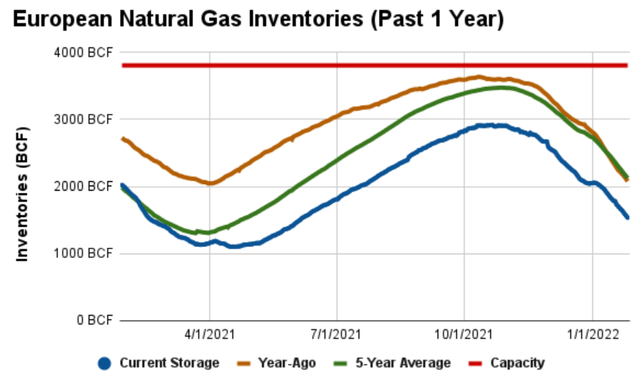

The factor that we can do the least about is the growing evidence that we are entering a prolonged period of shortages or supply tightness in prime materials, ranging from oil to lumber. The first sign that suggested that everything is not all right in this regard was the gap in European natural gas inventories that appeared last year and continues to persist currently, despite demand destruction as well as an effort in the past few months to divert more LNG shipments to the continent.

Europe natural gas storage (Celsius Energy.net)

As we can see, the gap started to grow in the spring of last year and it persists currently. It should be noted that this original shortfall is having a chain effect within the EU economy, where it is affecting fertilizer production, aluminum, zinc, a number of petrochemicals, as well as ceramics output on the continent. The chain effect is set to continue as high fertilizer prices are likely to cause a shortfall in global food output this year as farmers cut back on its use in response to the high prices.

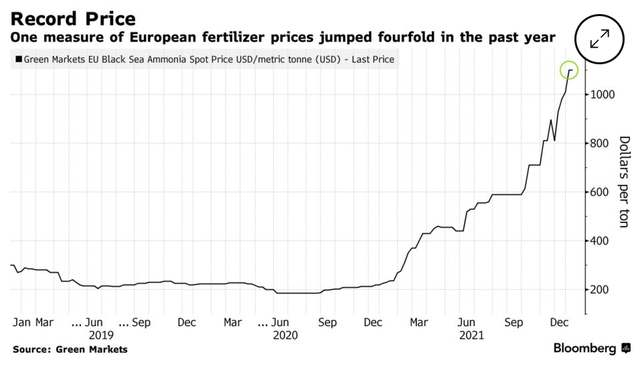

EU fertilizer prices (Bloomberg)

Fertilizer prices are rising across the world, and at some point, it will lead to higher food prices. That in turn could cause unrest in the developing world, which can then lead to further disruptions of the global supply chain.

Oil & gas prices are also rising on the back of tight supplies, with little reason to expect supply-side relief any time soon. Based on Rystad’s most recent data, the world discovered less than 5 billion barrels of oil equivalent last year, while we are currently consuming about 45 billion barrels of oil equivalent every year. We have been producing far more conventional oil & gas every year than we have been discovering every year this century, which is starting to catch up to us. As far as unconventional supply growth, there is some potential for it in a best-case scenario, but it is not going to be anything like we saw last decade. Higher oil prices tend to cause inflation in all goods in the economy that need to be transported. Higher oil & gas prices tend to feedback into the costs of producing oil, which is causing further strains on the supply side of the equation.

Beyond oil & gas, lumber, metals and other base materials are increasingly in short supply. Some of it is due to oil & gas prices rising, making some mining or processing activities too expensive. Others are scarce as a direct consequence of geological realities. Aside from these factors, we have ESG investment trends that tend to penalize mining activities and companies. At this stage, the market is underestimating the damage that we are doing to our economic well-being, as well as our collective social welfare with such trends gaining traction. The effect on the overall economy within the current context may become catastrophic, given that we have an environment that has no shortage of asset inflation and liquidity, but it is increasingly experiencing an actual shortage of goods and some services. The only thing we could do about it is to reconsider the ESG concept. There is very little that we can do about geological realities, aside from relying on the hope that some miracle discoveries of new technological innovations will allow us to extract more of what we were initially endowed with.

Finally, the third factor has to do with trade, economic, and geopolitical frictions. I will not spend much time describing the situation. I just want to highlight the overall situation in this regard. It is increasingly clear that there is a Russia-China coalition of sorts emerging, meant to counter Western use of economic coercion. It is drawing a number of other countries that found themselves on the receiving end of Western economic sanctions and restrictions of all sorts, such as Iran, as well as Turkey, most of Central Asia, and a number of developing world countries in the ME, Africa, Asia as well as South America. On the other side, there is the US-led NATO-centered alliance, which is supposed to be military in nature, but it is in fact increasingly becoming an alliance that also tends to look at economic confrontation as a new front. The US-led AUKUS alliance in the Pacific region is another group that is also meant to help check China’s rising dominance of the region.

The US-led coalitions feel that they have the economic edge at the moment, so they are more likely to push for economic confrontation, ranging from undermining Chinese and Russian tech from rising to bans on certain products, pressure on various countries to shun their products, sanctions, bans on tech exports and so on.

China is the least interested in launching a mutually-damaging economic confrontation, mostly because it has been on the rise, so time is on its side. Russia on the other hand, while seemingly economically weak by many measures, is by far the most well-adapted actor when it comes to facing an economic showdown. It has few vulnerabilities, especially since the post-COVID recovery paved the way for a new seller’s market in commodities, which might last the entire decade and beyond.

Mostly based on considerations such as the relative size of the economy of both sides, as well as an edge in technological advantages, there is an air of misplaced confidence within the US-led camp, which makes an economic conflict more likely. In reality, both sides have strengths and weaknesses and it is hard to determine which side would prevail in the event that we end up on a slippery slope of measures and countermeasures. It is also hard to gauge what prevailing might look like in the event that we are headed for an all-out economic confrontation. It might not feel like victory for either side, regardless of the outcome.

We should keep in mind that just because China mostly opted not to retaliate in the face of some of the economic measures introduced by the US and others in the past few years, it does not mean that it will not in the future. Russia’s decision to become more aggressive and confrontational this decade now that we are in a new commodities boom market is a reflection of the strategy to pick a fight only when one is on a strong footing. China will also opt to bide its time, as long as it can, given that it is getting stronger with every year that passes. This will remain true only for as long as our actions do not prevent it from further gaining in terms of relative economic strength. Once our actions will make it no longer worth it for China to continue down the passive path, we may be in for a massive, potentially very unpleasant surprise.

At the moment economic frictions between the two camps are growing and with it, so does the risk that we get past the point of no return, where both sides throw caution to the wind and start implementing policies meant to damage each other economically. From that point of no return, it would not take long in my view before Russia & China, together with a number of other allies around the world will opt for the financial nuclear strike, namely choosing to no longer accept US dollars, Euros, UK pounds as well as other currencies as payment, nor to pay for imports in any of these currencies. The damage that such a move would inflict on the global fiat-based financial system would be cataclysmic, perhaps terminal to the entire concept of having fiat currencies that are not backed by anything as a medium of exchange and as FX reserves. This may seem as an unlikely scenario, but we should remember that Russia and China have been preparing for precisely such a measure for years now. Currency swaps meant to encourage bilateral trade in domestic currencies were never meant to be a gradual instrument meant to reduce the use of Euros and US dollars in global trade, but rather as a mechanism meant to facilitate a sharp turn away from the current global fiat order, if and when time comes to do so.

Gold Versus Crypto

The fiat-based system is facing in the best-case scenario a loss of its quality as a store of value, as inflationary pressures continue to build. In a worst-case scenario a complete collapse of the system could occur, given the growing threat of a global economic confrontation, as well as the pressures on the global supply system posed by commodities shortages, as well as continued COVID disruptions. The question arises, whether either gold or cryptocurrencies are the best insurance and hedge against a worsening outlook for the overall health of the fiat system. Given that both have some potential advantages as well as disadvantages, it may be worth considering using a mix of both as a hedge. Although, with cryptocurrencies, in particular, it can be a bit of a gamble, given that not all cryptocurrencies that are currently available will find a role in a new post-fiat world if the worst-case scenario comes to pass.

Gold has some strengths and some weaknesses. It is unlikely to ever lose all of its value, which makes it an ideal safe haven.

With thousands of years of history as a medium of exchange, store of value, as well as an ornamental metal, gold will always be worth something. As we discover the need for ever more efficient conductors, gold is also an emerging ingredient in high tech industries. These factors may not necessarily propel the price of gold higher, but they do provide a price floor, where mined supply will most likely sell at a price that provides miners with at least a long-term average breakeven price. This price floor, together with the scarcity value of the metal makes it an enticing investment asset. Gold’s history, together with the above-mentioned factors makes it an attractive reserve currency that central banks around the world wish to have in their vaults.

Gold’s weakness is that it does not make for a very practical facilitator of transactions. It is this original flaw that started the practice of gold-backed promissory notes hundreds of years ago, which in turn led to the birth of fiat money. It is when jewelers started issuing more promissory notes than the amount of gold they had in their vault that gave birth to the concept of unbacked currencies.

It is possible that cryptocurrencies, that are seen as a threat to gold’s continued relevance as a mode of transaction and store of value, might actually create an avenue for gold to become a viable means of facilitating transactions again. There are already a large number of gold-backed cryptocurrencies in circulation, like Tether Gold (XAUT-USD) or GoldCoin (GLD-USD). I should note that there are also silver-backed cryptocurrencies like SilverCoin and we may soon see all sorts of asset-backed cryptocurrencies floating around.

While a whole range of physical assets may get monetized through the rise of asset-backed cryptocurrencies, gold-backed assets will most likely be the most popular, given its history, as well as continued central bank reliance on gold assets as an insurance against fiat risk. Gold-backed cryptocurrencies may emerge as a way for companies as well as nations to conduct business using gold-backed assets. Central banks may opt to issue such cryptocurrencies backed by their massive reserves at some point as well. For instance, Iran recently used gold payments to get around sanctions. It may be seen as a worthwhile option that could be exercised not only in case of sanctions but also as a way to avoid using US dollars or Euros out of geopolitical considerations. Russia is one country that reportedly has been looking at this option.

I personally do not see cryptocurrencies as a serious threat to gold. In fact, the asset-backed cryptocurrency concept may become the next big stage in cryptocurrency evolution, in which case, it can lead to an expansion of gold’s role in the global economy as not only a store of value, but also a mode of transaction. Such options may become especially popular in the face of growing inflation all around the world in fiat currency terms, which is eroding the store of value role of fiat and fiat-denominated assets. This may be the case, especially since government bond yields increasingly fail to cover current rates of inflation. The latest CPI numbers came in at 7.5%, while the 10-year government bond yield is under 2%. Any fees associated with holding an asset-backed cryptocurrency may be seen as a far more benign threat to one’s aim to preserve wealth than inflation rates running as high as they are, which is cutting into the buying power of our fiat savings at a robust rate.

Main cryptocurrencies are not backed by any tangible assets, just like fiat

There are many potential benefits to using cryptocurrencies as a means to conduct transactions. Those benefits can be seen from a different perspective depending on particular circumstances. As it was the case with gold, Iran is also a good recent example in regards to how cryptocurrencies can play a role in circumventing sanctions, restrictions on trade or simply provide some stealth when it comes to making business deals. Iran encouraged Bitcoin (BTC-USD) mining and then used those Bitcoins to secure goods from around the world as a means to circumvent sanctions. This example highlights some of the advantages offered, including less oversight of transactions if anyone wishes for it, for whatever reason. Arguably, it could also become a more attractive store of value, especially if fiat-denominated inflation rates continue to rise. If one does want to conduct business in assets other than fiat money, cryptocurrencies have a distinct advantage over gold, namely the ease of transaction.

All the above-mentioned advantages make for a seemingly very positive story for all cryptocurrencies. There are however some things worth taking into consideration that are relevant for all who think that cryptocurrencies make for a good hedge against an eventual collapse of the global fiat-based financial system. First and foremost, the most popular cryptocurrencies that currently dominate are all backed by nothing tangible. The only claims to value are built-in systems meant to maintain the scarcity of coin supplies, and the willingness of individuals and institutions to buy, hold and transact by using these currencies as an intermediary system. The flaw in it all is the fact that there is nothing stopping government entities around the world, and even powerful multinationals from crushing any of these currencies, by simply refusing to accept them as a means of facilitating trade or business deals.

Because any cryptocurrency that is not backed by tangible assets can be crushed at will, there is simply no way to know which ones may come on top and which ones may get canceled, leaving investors potentially with nothing, or close to it. We should keep in mind that there will be plenty of reasons for governments to crush certain or all cryptocurrencies, especially those that are not backed by assets or by central banks.

Even though we are still at a stage where cryptocurrencies do not play a major role in global transactions, with most people who own cryptocurrencies mostly just holding on to them, we arguably already saw what an impact a ban on the use of cryptocurrencies can have on their value. China, which makes up less than one-fifth of the global economy banned all cryptocurrency activities late last year and there seems to be a correlation between that and the performance of cryptocurrencies such as Bitcoin.

Bitcoin Chart (Seeking Alpha)

As we can see, the value of Bitcoin stalled out, seemingly coinciding with the moves made by China late last year. It remains to be seen whether it can break higher to new records going forward, as long as China continues to keep a lid on cryptocurrency transactions and investments.

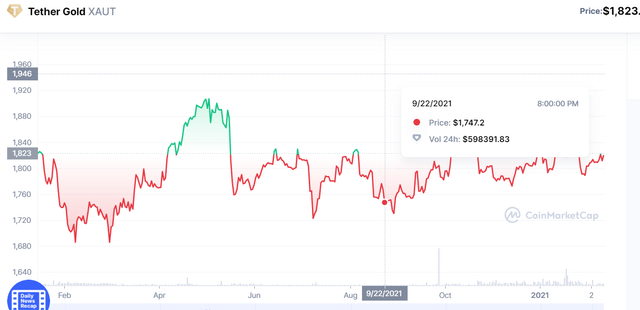

It should be noted that cryptocurrencies that are backed by tangible assets such as gold, like Tether Gold for instance were not affected by the Chinese ban on cryptocurrencies.

Tether Gold (Coin Marketcap.com)

The price of Tether Gold tends to follow the price of gold as one might expect. It is also limited in its upside potential by the price of gold, while if we look at the five-year performance chart for Bitcoin, we can see why investors have so much interest in it. Few assets out there gained over 4,000% in the past five years. The prospects of a repeat of such gains in other cryptocurrencies or even in Bitcoin makes cryptocurrencies that are not tied to the price of other assets very enticing to investors.

Investment implications

Because there is no way of knowing how public policies as well as certain corporate decisions may affect the future of most cryptocurrencies, I opted to stay out of cryptocurrencies as an investment choice thus far. I have been building up my positions in gold, with physical gold, GLD (GLD), as well as Barrick Gold (GOLD). The GLD fund has been flagged by many investors as not being a suitable candidate in case of extreme financial turbulence, because one can never redeem the physical gold. While I understand the concern of investors in this regard, I find it to be a convenient tool for shorter-term gold investment strategies. One can always sell GLD and use the proceeds to buy the physical gold. Barrick stock has been inexplicably cheap given its recent financial results as I pointed out in a recent article. I expect we will see an improvement in this regard, even though it is currently trading at a forward P/E ratio of over 18, which is not overly cheap for a mining company. Net earnings to revenue ratios are looking very healthy, which is what makes Barrick an enticing option, especially within the context of gold prices potentially going much higher going forward.

While there is a solid argument to be made for cryptocurrencies as a hedge against the potential for a fiat system meltdown, there are also plenty of reasons to be cautious. The potential for governments and even large corporate entities to pick winners and losers within the non-backed cryptocurrencies segment makes it too much of a lottery. There is safety within the asset-backed cryptocurrency segment, but there is also a limited upside. I don’t see gold-backed cryptocurrencies having any more upside than holding the actual physical gold. I do think that investors need to weigh carefully the need to consider cryptocurrencies as an asset that can provide a hedge against fiat assets losing value, but at this point, it is hard to assess which ones are likely to find favor with governments and other institutions that may pick the winners and losers from within the current pack.

Turkey recently announced that it is looking to attract billions of dollars worth of gold back into its financial system by encouraging citizens to turn in some gold for cash. It is an attempt to shore up the fiat system, which is faltering with inflation in the 50% range. It may be an early indication of how governments around the world might react to inflation getting out of control, at least in fiat-denominated terms. Gold remains an asset that central banks around the world feel the need to maintain as reserves, which ironically can be seen as a sign that they do not have full faith in the fiat global system themselves. At the same time, there is no evidence to date that central banks are looking at storing Bitcoin, Ethereum or any other cryptocurrency that is currently making a splash. At most, they are looking to start their own crypto version of fiat currencies as an alternative to cash. Clearly, gold is seen as the asset to shore up global finance by the US Federal Reserve as well as most of the other major central banks around the world. Central banks have been net buyers of gold for some years now and are collectively sitting on one fifth of all the gold that was ever mined on the planet. At the same time, central banks around the world are increasingly opting to treat cryptocurrencies as the enemy. Perhaps this is a good time to remember the old saying, namely that investors should never try to fight the Fed.

This news is republished from another source. You can check the original article here

Be the first to comment