Sold-out collection HypeBears finally revealed their art yesterday but the bigger surprise was the dodgy transactions uncovered by an eagle-eyed NFT enthusiast. Abraham.eth created an extensive thread backed up by Etherscan transactions to warn the NFT community. He was a former NFT holder and now thinks that the project is a possible rug pull!

HypeBears’ Questionable Transactions and Decisions

According to Abraham.eth, the team withdrew over $10 Million in ETH from the mint sale into centralized exchanges like Binance US and FTX. He argues that this was not in any way a reasonable decision because doing so eats some short-term capital gains tax of 50%. What’s even more surprising is that there’s no business entity registered, so “business deductions” have no value for it.

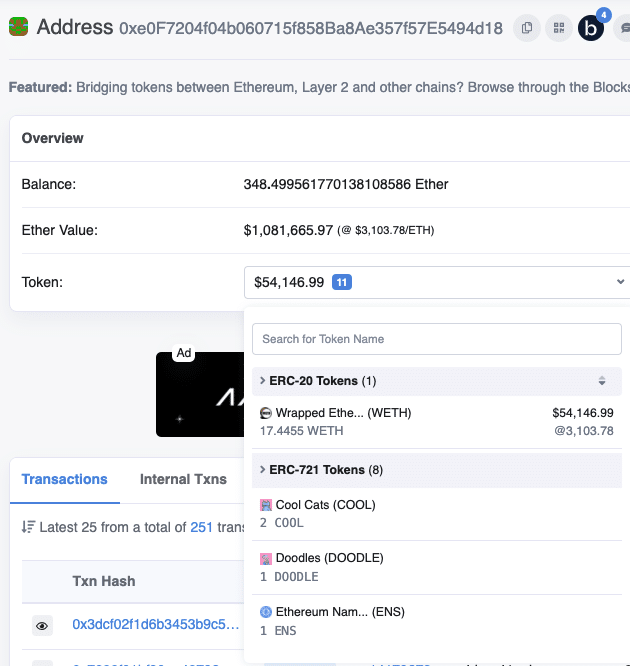

He also noted that the address listed on OpenSea as the collection’s creator is a fairly new account. It has some funds in ETH (about $1M), some WETH and blue-chip NFT Collectibles like Doodles and Cool Cats. He discovered that the ENS token transaction shows that the sender is jpegenthusiast.eth, the project’s founder.

He is accusing the founder of masking the transaction trail through multiple wallets, which eventually circles back in an identical wallet. If you check the “ERC 721 Token Txns” tab, you’ll see several outgoing transactions to different Ethereum addresses that jpegenthusiast.eth created. Take note that these are not partnerships or team members” but fresh accounts.

In these accounts, funds that were sent off to exchanges resurfaced as initial transactions. Then, the founder wrapped the ETH tokes in WETH to “further create delusion as it now populates in a different TXN tab.” Lastly, he sent back the funds to the creator address listed on OpenSea in WETH to consolidate “stolen” funds.

You can view the complete technical analysis on the Twitter thread.

More Red Flags

The project had a stellar launch has pulled in over 14,200 ETH (around $41 Million) in tradeable volume. In addition, it’s a verified project on OpenSea with ver 6300 NFT holders, so the stakes are high. The post is starting to get traction. Some collectors expressed their gratitude towards Abraham.eth for sounding the alarm.

Aside from the blockchain records, the team also has questionable business decisions. For example, they only purchased a 1-year registration for the domain, which is only worth $5. So it says much about a brand that’s looking to be around in the long term. He also queried through the smart contract himself and found zero IPFS data.

He also questioned why the team is leveraging so much on whitelists and positioning it as a partnership. For him, it is not sustainable and adds no value because there should be synergy between the partners. Abraham.eth is definitely done with HypeBears. He tweeted, “Even if the project doesn’t turn out to be an outright sham, it violated some NFT project standards for me.”

Are you tired of missing important NFT drops?

Just check out our NFT Calendar !

Subscribe to our hot social media and don’t miss anything else

If you’re old school :

All investment/financial opinions expressed by NFTevening.com are not recommendations.

This article is educational material.

As always, make your own research prior to making any kind of investments.

Owners, holders, fans, community members, whales… Want to boost this article by featuring it on top of the Homepage? ==> Contact us!

This news is republished from another source. You can check the original article here

Be the first to comment