.jpg)

CryptoCompare’s Exchange Benchmark report was launched in 2019 to bring clarity to the digital asset exchange sector. The report has since become an industry standard for ranking digital asset exchanges.

The latest edition of the benchmark includes a new industry-first framework for ranking and assessing the risk associated with decentralised exchanges (DEXs) in addition to centralised exchanges.

You can access the Exchange Benchmark here.

Key Findings:

- Bitstamp and Coinbase were the top-scoring centralised exchanges, whilst Uniswap debuted as #1 in the first-ever DEX Benchmark, followed by Curve, Balancer & dYdX.

- CEX industry consolidation continues as the market share of Top-Tier exchanges increased from 91% in the six-month period between September 2021 and February 2022 to 92% in the six-month period between March 2022 and August 2022.

- A total of 17 exchanges received a maximum score within the KYC category of the Benchmark, all of these being Top-Tier exchanges (rated B or above). Furthermore, only 21% of exchanges are now deemed to have inadequate KYC practices according to CipherTrace, a significant improvement from 35% in April 2022.

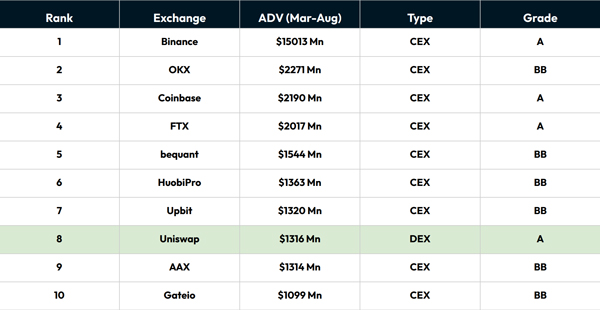

- DEX market share is still limited when comparing average daily volumes (ADV) of AA, A, and BB-ranked CEXs and DEXs. Uniswap, the highest-ranked and most active DEX, averages $1.32bn in daily volume, ranking 8th when compared to the entire AA-BB exchange universe.

- The total value locked (TVL) of the 33 assessed DEXs has fallen 60.8% (in $ terms) from the start of 2022 to the end of September, closing Q3 at $21.7bn. However, TVL among DEXs has not fallen at the same pace as ETH or other tokens, suggesting that TVL is sticky.

Download Report

Crypto Exchange Grades Updated & DEXs Receive First Ranking

Bitstamp, Coinbase, and Gemini have received the highest scores in the latest Exchange Benchmark. However, Bitstamp was the only exchange to receive an AA CryptoCompare Grade after Coinbase and Gemini failed to meet all required thresholds, thus receiving an A rating.

Uniswap v3 has received the highest score in our first DEX Benchmark and is the only DEX eligible for an A rating. Curve, Balancer, SushiSwap and dYdX also scored highly, achieving BB ratings.

DEX Market Share Limited Despite Uniswap Gaining Ground

When looking at the Average Daily Volumes (ADV) of AA, A, and BB ranked CEXs and DEXs, it is clear that DEX market share is still limited.

Uniswap, the highest ranked and most active DEX, averages $1.32bn in daily volume, ranking 8th when compared to the entire AA-BB exchange universe. dYdX, PancakeSwap, and Curve are the other three DEXs with a BB rating or higher – they sit at 11th, 16th, and 17th with an ADV of $1.04bn, $420mn and $352mn respectively.

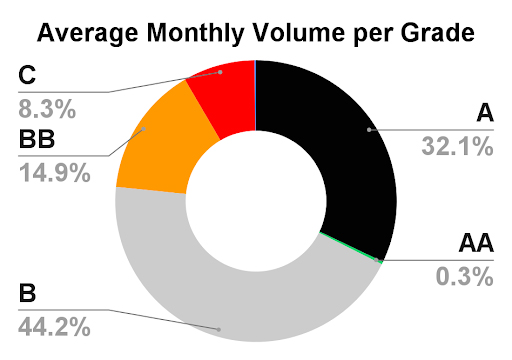

Top-Tier Exchanges Account for 92% of Centralised Crypto Volumes

92% of total CEX volumes, from March 2022 to August 2022, took place on Top-Tier exchanges based on CryptoCompare’s updated exchange rankings, increasing from 91% in the previous Exchange Benchmark. Top-Tier exchanges continue to increase volumes market share as market participants gravitate towards the lowest risk trading venues.

This news is republished from another source. You can check the original article here

Be the first to comment