The overall sentiment in the crypto market is still one of “fear”, but Bitcoin has a post-Easter spring in its step today after recovering back above US$41k.

Elsewhere, but worth paying attention to for the inverse-correlation thesis, the US dollar is apparently showing signs of weakness this week with a “bearish divergence” – at least according to the Dutch trader Michaël van de Poppe. That said, the DXY has been chopping sideways today, currently up 0.10% on this time yesterday.

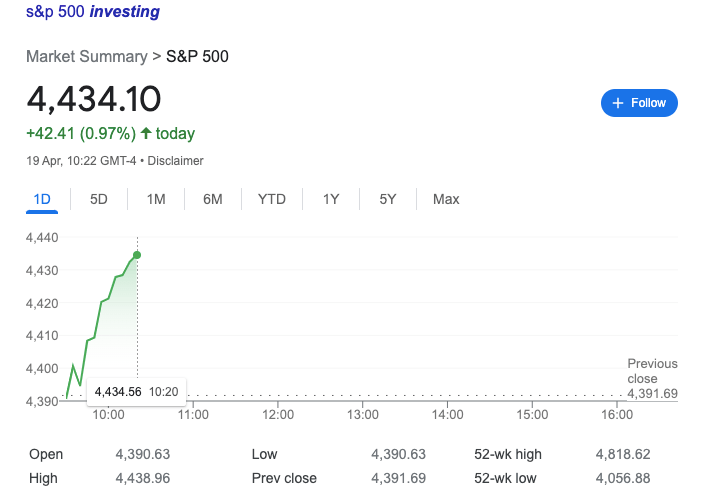

Stonks, though… which Bitcoin and friends definitely still take their cues from, these have had a refreshingly strong opening to the equities trading week on Wall Street. The S&P 500 is moving in this direction at the time of writing…

Sustainable strength? That’d be a particularly bold call considering the macro environment and potential headwinds from the interest-raising Fed among others.

But Aurélien Ohayon, CEO of software firm XOR Strategy, seems to think it’s possible, citing a bullish, potentially bottoming-out move related to the relative strength index (RSI) on the S&P 500’s three-week chart…

#BITCOIN ONE OF THE MOST ACCURATE BOTTOM DETECTORS I HAVE FOUND. 🔥🔥🔥

When the 3W-Stochastic RSI K-line of the S&P500 touched the 0 line, a #BTC bottom has been reached and a huge bull run has followed.

It just touched the the 0 line.#SPX $SPX $BTC #Crypto pic.twitter.com/DKRJv6FqIq

— TAnalyst (@AurelienOhayon) April 18, 2022

Something to consider, at the very least.

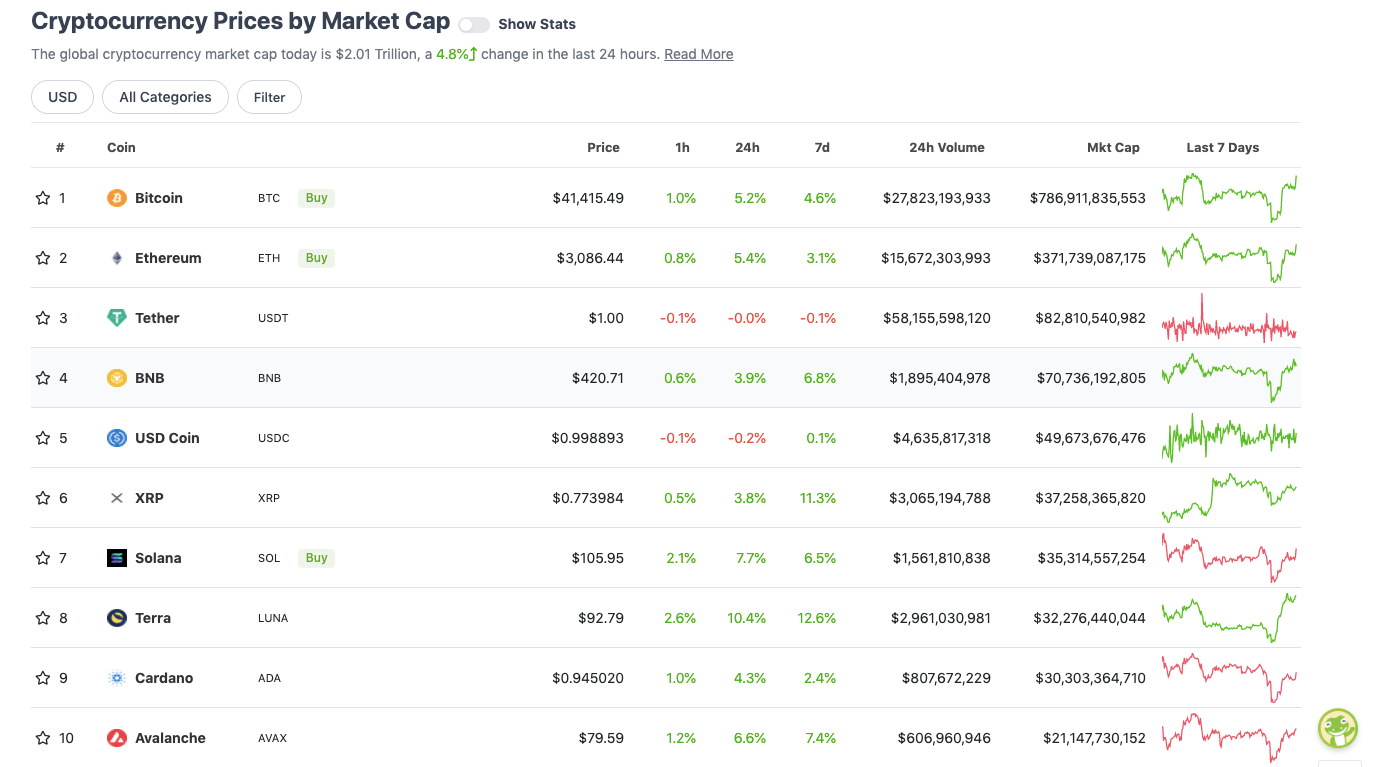

Top 10 overview

With the overall crypto market cap a bit over US$2 trillion, up about 4.8% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

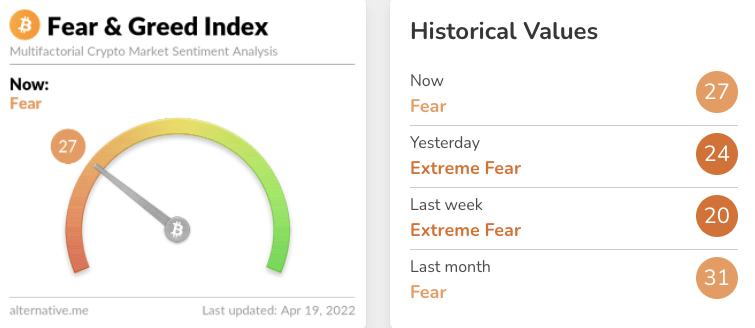

As mentioned above, and as per the Crypto Fear & Greed Index, the cryptoverse sentiment right now is still in a fearful state (albeit less “extreme” than last week’s mood)…

However, scanning around for various purportedly expert takes on Crypto Twitter, we’re seeing a reasonable amount of hopium-inducing analysis. Here’s Aurélien again…

#BTC REPEATS 2019-2021.

VERY BULLISH 🔥🔥🔥

A RUN TO $100K : CONSISTENT WITH THIS MODEL.#Bitcoin #Crypto pic.twitter.com/V0L4oTdaJz

— TAnalyst (@AurelienOhayon) April 19, 2022

And a couple of other large-account chartists…

As soon as #Bitcoin breaks that $48k region. We will trade at ATHs within 6 weeks.

That’s my prediction. pic.twitter.com/bjjepJxxRy

— Crypto Rover (@rovercrc) April 19, 2022

#Bitcoin holding crucial level and continuing upwards, meaning that $43K is next.

— Michaël van de Poppe (@CryptoMichNL) April 19, 2022

Although, for a touch of balance, let’s bring the mood down again with a “Roman Trading” reality check…

$BTC Daily

Don’t long into resistance. This is a simple breakdown and retest. Unless we see candle closes above 42.5, there is no reason to get excited.

Volume is low, spot is selling, derivatives are buying.

This has happened on each pump.#bitcoin #cryptocurrency pic.twitter.com/q2oiXR2e1W

— Roman (@Roman_Trading) April 19, 2022

Beyond Bitcoin, we’ve got some other strong movers in the majors today, including layer 1 protocols Ethereum (ETH), Solana (SOL) and Avalanche (AVAX). But Terra’s governance token LUNA is clearly the main top-ten mooner of the past 24 hours.

You can put that partly down to the continued strengthening of Terra’s ecosystem, to which LUNA is tied. Terra’s stablecoin UST, for instance, has now toppled Binance USD (BUSD) to become the third-largest stablecoin by circulation.

Translation: $UST needs to only 5x in mktcap before it becomes the largest stablecoin

— Do Kwon 🌕 (@stablekwon) April 19, 2022

Uppers and downers: 11–100

Sweeping a market-cap range of about US$20.6 billion to about US$977 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• THORChain (RUNE), (market cap: US$2.74 billion) 22%

• ApeCoin (APE), (mc: US$3.67 billion) +15%

• The Sandbox (SAND), (mc: US$3.46 billion) +13%

• NEAR Protocol (NEAR), (mc: US$11.7 billion) +12%

• STEPN (GMT), (mc: US$1.97 billion) +11%

DAILY SLUMPERS

• Monero (XMR), (mc: US$4.63 billion) -1%

Only one coin here in the red in the top 100 at the time of publishing – privacy coin Monero, which has actually had a good week, up about 14% over the past seven days. A cool-off today, then?

A “bank run” of sorts has been staged by participating Monero holders in an effort to test the strength of XMR reserves on exchanges. It’s alleged that some crypto exchanges may be selling more of the token than they actually possess…

A group of @monero enthusiasts alleges that some exchanges may be selling more #XMR than held in reserve. So they’re planning a “bank run” to find out. https://t.co/IfPuXhwhWs pic.twitter.com/HsYcOnPQ7n

— Decrypt (@decryptmedia) April 17, 2022

Uppers and downers: lower caps

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• InsurAce (INSUR), (market cap: US$42 million) +34%

• DOSE (DOSE), (mc: US$21m) +33%

• Shiba Predator (QOM), (mc: US$131m) +33%

• XMON (XMON), (mc: US$88m) +27%

• Everscale (EVER), (mc: US$374m) +26%

DAILY SLUMPERS

• SafeMoon (SFM), (mc: US$368m) -13%

• apM Coin (APM), (mc: US$14.6m) -7%

• pSTAKE Finance (PSTAKE), (mc: US$40.5m) -7%

• Syntropy (NOIA), (mc: US$65.6m) -5%

• DerivaDAO (DDX), (mc: US$58m) -4%

Around the blocks

The world’s best fiat currency will lose 99.9% of its value in a single century. #Bitcoin

— Michael Saylor⚡️ (@saylor) April 19, 2022

Meanwhile, in NFT land… the biggest story of the past week, and biggest mooner (by a very long way) has been Moonbirds.

It’s a Proof Collective initiative, co-founded by renowned US internet entrepreneur Kevin Rose, and is currently the most-traded NFT profile-pic collection on OpenSea with more than 74,000 ETH worth of volume. That’s a lot.

Intially priced at 2.5 ETH a handful of days ago, the floor price for the collection is now hovering around the 19 ETH mark. That means the cheapest Moonbird will now set you back about US$59,000. Yup, for a digital owl.

Why are these 10,000 pixelated owl jpegs garnering so much attention? Some see them as the next Bored Ape Yacht Club-style success story. Owning a Moonbird gives the holder entry to an exclusive Discord club, and “nesting” (think staking) the bird holds the promise of future benefits and airdrops that might potentially prove lucrative. At least, that’s the premise.

This observer (below) has some in-depth thoughts on it all, centred around the evolving utility and power of NFTs as a fundraising mechanism. (Which, incidentally, pretty much also describes the idea behind another NFT project – Ethlizards, which Illuvium’s Kieran Warwick told Stockhead about recently.)

Moonbirds marks a turning point in NFTs.

It’s not about @moonbirds_xyz specifically. It’s about the whole market.

As an experienced startup person, I can see a pattern emerging here. It has some important implications for the future of NFTs.

Read on to find out more.

— Daniel Tenner (swombat.eth) (@swombat) April 18, 2022

There are some great thoughts in that thread. That said, “STACCED” probably also makes a fair point here, too…

After being off of Twitter for the past 3 days I can confidently say that an entire world exists without NFTs. I think adoption is much further than some may believe.

— STACCΞD (@staystacced) April 18, 2022

This news is republished from another source. You can check the original article here

Be the first to comment