Diamond Dogs/iStock via Getty Images

Investment Thesis

Nvidia (NASDAQ:NVDA) is expected to report earnings for FQ1’23 on 25 May 2022. However, investors should not be rushing to play the earnings game, considering the macro pessimism. Furthermore, given how NVDA had been closely tied to the cryptocurrency mining, we may expect reduced sales moving forward, seeing how the whole market had lost over $1T of combined value in recent days.

However, we encourage NVDA investors to ignore the noise as the stock remains a solid investment for the next decade. Nonetheless, please do not buy the dip as we expect the stock to retrace in the next few weeks, as the market grapples with the macro pessimism and crypto crash.

Why Did NVDA Fall From Grace?

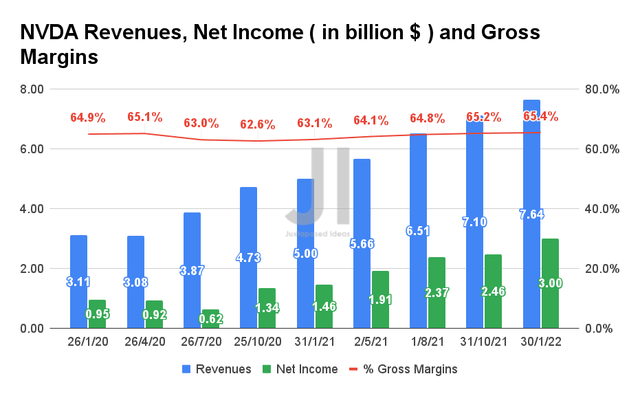

NVDA Revenue, Net Income, and Gross Margin

Pre-pandemic, NVDA had grown its revenue and net income at a steady CAGR of 16.44% and 18.9%. It obviously grew exponentially in the past two years, given the massive demand for personal devices due to the increased remote work/ study/ entertainment options during the COVID-19 pandemic. As a result, NVDA grew its revenues at a tremendous CAGR of 57.05%, while its net income rose even faster at a CAGR of 86.94%. The company also steadily improved its gross margins from 58.8% in FY2017 to 64.9% in FY2022.

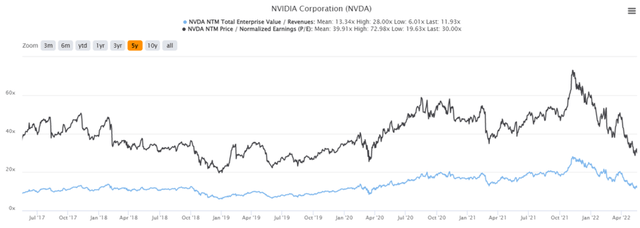

NVDA 5Y Stock Price

As a result, it is evident that NVDA investors had benefited from its stellar growth, given that the stock had risen by 580% in the past two years, before the drastic moderation that occurred in late 2021.

NVDA 5Y EV/Revenue and P/E Valuations

However, we believe that the market correction is expected, given that NVDA was trading at ridiculous valuations at its peak, with 3Y EV/Revenue of 28x and P/E of 72.98x. That is way higher than Intel’s (INTC) valuation of 3Y EV/Revenue of 4.19x and P/E of 15.47x in the past three years, and even AMD (AMD) at 10.59x and 65.39x, respectively. In hindsight, it is evident that NVDA has been highly (maybe over) valued, given its exposure to multiple market segments, such as AI technology, autonomous EVs, cloud computing servers, cryptocurrency, and metaverse, amongst others.

Nonetheless, we may also see a short-term impact, given Meta’s (FB) slowing investments in the Reality Labs ( metaverse), reduced demand for GPUs from the crypto mining, and impacted auto production outputs from China’s Zero Covid Policy. As a result, given the uncertainties, we expect the pain to continue for a while longer as the market consolidates in the next few quarters.

In the meantime, we encourage you to read our previous article on NVDA, which would help you better understand its market opportunities in the AI technology, automotive, and data center industries.

NVDA Is Still Investing In Growth, Though We See Short-Term Impacts

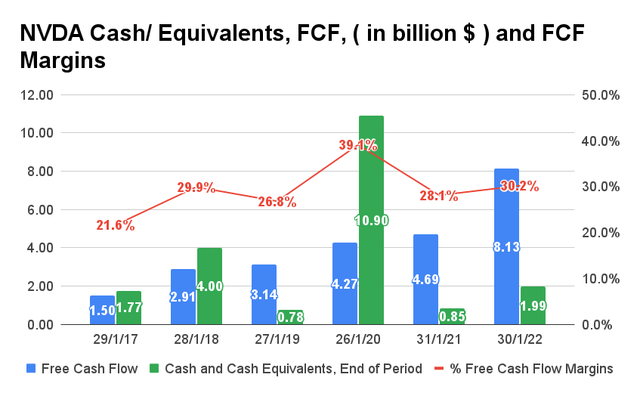

NVDA Cash/ Equivalents, FCF, and FCF Margins

Nonetheless, NVDA has been an excellent Free Cash Flow (FCF) generator, while reporting its record-breaking FCF of $8.13B and FCF margins of 30.2% in FY2022. The company also ended the year with a decent $1.99B of cash and equivalents, which will prove helpful for its expanding R&D expenses at an average of 21.5% to its annual revenues in the past five years.

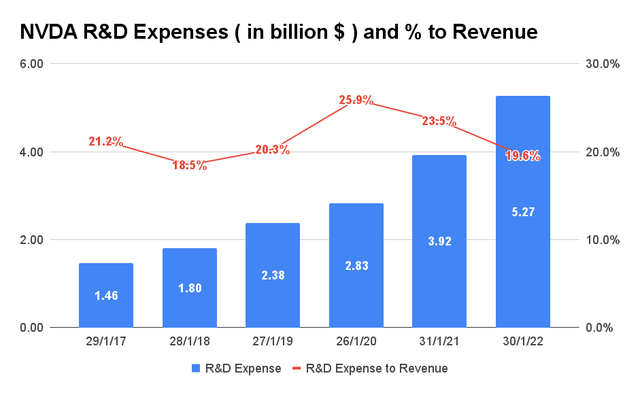

NVDA R&D Expenses and % to Revenue

Assuming that NVDA continues its reinvestments, we may expect the company to spend up to $7.4B in R&D expenses for FY2023. As an investor myself, I believe that high-growth tech companies, such as NVDA, should build up their future capabilities and product innovations, to keep their advantage in the highly competitive semiconductor industry moving forward. Nonetheless, the risks are also inherent that many companies may slow down their Capex investments in the next few quarters, given the impending recession and rising interest rates. Consequently, NVDA may also reduce its R&D expenses for the short term, given the potential deceleration in revenue growth.

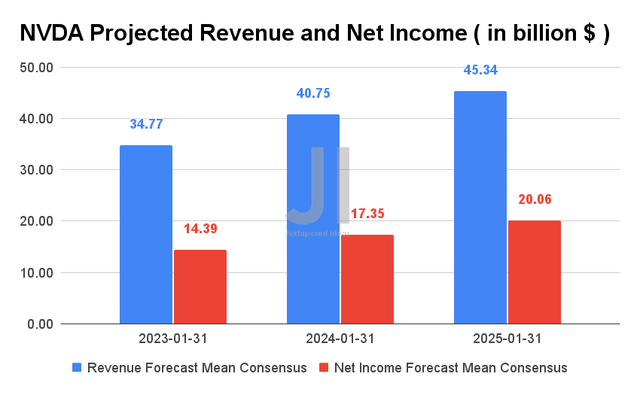

NVDA Projected Revenue and Net Income

Over the next three years, NVDA is expected to report impressive revenue and net income growth at a CAGR of 18.99% and 27.19%, respectively. For FY2023, consensus estimates that the company will report revenues of $34.77B and a net income of $14.39B, representing remarkable YoY growth of 29.2% and 47.5%, respectively.

Investors will be looking closely at NVDA’s FQ1’23 performance, in which it had guided for revenues of $8.1B and gross margins of 65.2%. Assuming that the company successfully smashed its own and consensus estimates of $8.09B, we can be sure of a short-term recovery. However, it is also important to note that NVDA is expected to record a one-time write-off worth $1.36B for the quarter, due to the collapse of the ARM acquisition. In addition, given the quarter’s exposure to the prolonged lockdowns in China, NVDA’s revenue may also be impacted negatively. As a result, we expect a mixed FQ1’23 performance, potentially leading to a further decline in its stock performance. We shall see.

So, Is NVDA Stock A Buy, Sell, Or Hold?

NVDA is currently trading at an EV/NTM Revenue of 11.93x, and NTM P/E of 30x, lower than its 5Y mean of 13.34x and 39.91x, respectively. The stock is also trading at $171.24 on 19 May 2022, down 50% from 52 weeks high of $346.47. Given the recent market pessimism, there is a likelihood that the stock may retrace further below its 52 weeks low of $135.43 in the next few days, before recovering upon a positive catalyst, namely its FQ1’23 earnings call on 25 May 2022.

Even then, the NVDA stock could potentially remain stagnant post-earnings, similar to its peer, AMD. The latter had reported stellar FQ1’22 earnings, while also raising its FY2022 guidance. In response, the stock rose by 9% from $91.13 to $99.42 on 3 May 2022, before drifting sideways for the next two weeks to reach $96.67 on 19 May 2022. We can be sure that if such an upbeat earnings call had occurred during the heights of the pandemic, AMD would have seen a more pronounced growth in valuation and stock price, similar to the 25% growth after FQ3’21 earnings and 15% growth after FQ2’21 earnings. As a result, interested tech investors must be aware that we are in the midst of maximum pain, significantly worsened by the cryptocurrency winter, the ongoing Ukraine war, and China’s Zero Covid Policy.

Given the uncertainties and reasons listed above, we may expect softer FQ2’23 guidance from NVDA’s management as well. Though the stock may seem an attractive buy at its current “undervaluation,” given its growth potential and promising pipeline, we would encourage prudence for now. We expect a more attractive entry point moving forward, after more clarity from its FQ1’23 earnings call. Patient investors will be awarded.

Therefore, we rate NVDA stock as a Hold for now.

This news is republished from another source. You can check the original article here

Be the first to comment