Disclaimer: This is a sponsored press release. Readers should conduct their own research prior to taking any actions related to the content mentioned in this article. Learn more ›

The trading volume of cryptocurrencies in centralized exchanges is mainly concentrated in contract transactions, of which perpetual futures contracts are the main ones. In the decentralized exchange (DEX), contract trading is considered to be a possible explosive direction, but there is no DEX that can achieve the same experience as the centralized exchange in terms of liquidity and transaction volume. With the collective launch of the second-layer expansion plan of Ethereum, the improvement in liquidity of Derify V1 and Perpetual Protocol V2, and the liquidity incentives after dYdX issues governance tokens, the direction of decentralized perpetual futures contracts may usher in rapid development.

Perpetual Protocol V1

Whether it is a traditional order book or a decentralized exchange (DEX) in the form of an AMM that has become popular with DeFi, market makers are needed to provide liquidity for transactions. Only in AMM, liquidity providers only need to deposit at least two tokens into the liquidity pool, and the liquidity of the transaction can be satisfied without active management. Liquidity providers need to own funds and need to bear the risk of impermanent losses. In leveraged derivatives trading, as the currency price fluctuates, the risk of users providing liquidity will increase exponentially.

Perpetual Protocol has built a virtual liquidity market maker vAMM, which can guarantee the liquidity of transactions without the participation of market makers. Without real market makers, there will be no impermanent losses.

Perpetual Protocol’s vAMM uses the same x*y=k constant product formula as regular AMMs. But unlike AMM, vAMM does not require investors to provide real liquidity, and users’ funds are stored in smart contracts that manage collateral. Perpetual determines the liquidity of the transaction by defining a virtual value of k, but it must also be within a reasonable range. If the value of k is too small, the liquidity of the transaction is low, and the user’s transaction slippage may be large, which affects the trading experience; if the value of k is too large, the arbitrageur may need a large amount of funds to keep the price consistent.

The user’s counterparty is vAMM itself, and the user always participates in USDC, and eventually withdraws USDC. Futures trading is a zero-sum game. Everyone’s profits come from other people’s losses. The vAMM model is used to calculate everyone’s income.

Perpetual Protocol V2 (Curie)

The V2 version of Perpetual Protocol is named Curie and is deployed on the Ethereum Layer 2 network Arbitrum. Curie will use Uniswap V3’s centralized liquidity pool and execute transactions in its perpetual contracts. Every transaction occurs between opposing counterparties. The protocol will have stronger scalability, liquidity aggregation, and free market. Create and other characteristics. According to the official introduction, Curie will be implemented in four stages:

- Mainnet launch, centralized liquidity and market maker strategy using Uniswap V3 on Arbitrum.

- Limit orders and liquidity mining.

- Multi-asset collateral including USDC.

- Create permissionless private marketplaces with Uniswap V3.

In addition to the advantages of cross-margining, reducing the protocol’s dependence on insurance funds, creating a permissionless trading market, and improving fee sharing, Curie also provides multiple strategies to improve the liquidity of transactions.

Curie’s transactions will be executed directly in Uniswap V3, and the centralized liquidity of Uniswap V3 will solve the problem of liquidity fragmentation in AMM. While Perpetual Protocol V1 uses vAMM, liquidity is still spread across the range. In Uniswap V3, liquidity is usually concentrated near the market price, which increases the liquidity of transactions and reduces slippage while improving capital efficiency.

Liquidity providers will be able to use leverage (Leveraged LPs), and market makers can provide amplified liquidity on Uniswap V3. For established market makers with liquidity strategies, this will further amplify revenue.

Establish the Perpetual Economic System Fund and introduce Charm, dHEDGE, Lemma, etc. to help improve liquidity. For example, Charm Finance is the automatic liquidity manager of Uniswap V3. Charm will cooperate with Perpetual Protocol to establish a liquidity vault (Alpha Vault) for Perpetual’s liquidity providers. Market makers only need to deposit USDC into Charm’s liquidity vault to start earning transaction fees.

Perpetual Protocol V1 can guarantee the liquidity of transactions through vAMM without real market making funds. The V2 version is deeply bound to Uniswap V3. Leveraged LPs further amplifies the profits of market makers, but the requirements for market makers are also higher, and active management strategies are required.

DYDX

For traders who prefer an order book approach to trading, dYdX is the ideal place for a decentralized world. dYdX is the only perpetual trading protocol that uses a traditional order book. USDC acts as a single margin asset stored in a cross margin account. 15 markets are available for trading, and markets are added by the protocol’s core team.

The order book-based dYdX offers traders more advanced order types compared to AMM-based platforms. In addition to the Good-Till-Date, Fill or Kill or Post-Only order options, market orders, limit orders, stop orders and trailing stop orders are available. Market makers are required to provide liquidity for each market and tend to provide it algorithmically through dYdX’s API interface.

Like a traditional perpetual market, dYdX charges a financing rate to the unbalanced side of the transaction. Financing rates are calculated algorithmically based on index prices and perpetual mid-market sample prices. These payments are facilitated by the protocol, but are only exchanged between traders (exchanges neither pay nor receive).

Derify Protocol

Derify Protocol is an innovative decentralized derivatives trading protocol. In view of the characteristics of derivatives trading, Derify protocol has created a hedged automated market making mechanism and position mining rules.

HAMM (Hedged Automated Market Making)

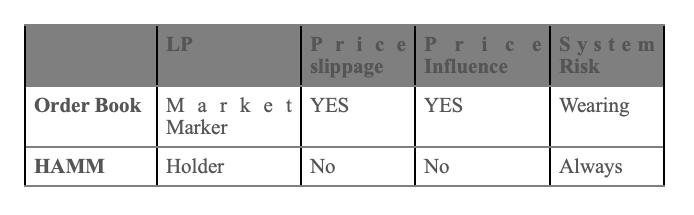

The order book has always been the most classic and mature trading model in traditional financial trading products, and it is also applicable to the products of centralized exchanges in the field of digital assets. In the order book mode, the user’s transaction cost (average transaction price/slippage) depends on the depth of the opponent’s market (price, quantity and other factors of the optimal position). In addition, the depth of the market will also affect the mark price of the perpetual contract system (for example, the market depth is poor, it is easy to cause the pin-pin market), which may eventually lead to the risk of innocent liquidation of other positions. Therefore, trading liquidity in the order book mode is essential for user experience and system security.

In order to provide users with better trading liquidity, exchanges often need to introduce as many professional market makers as possible to place orders for trading markets (the founding team of derify was once the head market maker of many exchanges in the industry) However, due to the performance and cost of the blockchain, the traditional order book model cannot create products with better user experience in decentralized trading products. With the success of uniswap’s AMM mechanism, more and more The more people realize how well the AMM mechanism fits with decentralized products. Similar to spot trading, the trading of contract products can also solve liquidity problems through the AMM mechanism.

The paths of hAMM and AMM to achieve their goals are consistent, that is, the system state transition caused by each transaction in the system creates a reasonable arbitrage space for the system, thereby attracting external arbitrageurs to carry out risk-free arbitrage and restoring the system state to balance Status (in AMM, the internal price is in line with the external market).

Position Mining

Holding a position means providing liquidity to Derify, so unlike typical liquidity mining projects, Derify does not have a separate “liquidity pool” for miners to stake assets and create liquidity. Since Derify calculates all liquidity in the position pool, and all positions create liquidity, Derify has a position mining mechanism that can directly reward all held positions, regardless of their direction, quantity and position holder.

By rewarding all held positions with earnings, traders are also Derify’s miners, which creates multiple advantages: first, liquidity miners use leverage to provide liquidity, and leverage leverage to gain returns, improving capital efficiency and investment returns; second , traders can now directly benefit from their daily trading activities; third, it is easier for everyone to participate in liquidity mining, rather than splitting their money into different mining pools, which incur gas fees.

On the other hand, because the position pool is always somewhat unbalanced, which means that the liquidity of longs and shorts is not equal, if there are few longs and few shorts, Derify’s liquidity exposure will be very large. Therefore, Derify also dynamically adjusts the mining reward: if there are more long positions than short positions in the position pool, long position holders will receive less than short positions.

Generally speaking, to get mining rewards, you only need to open a position and hold it.

The future of DEX: trade-offs and evolution

As a representative of order book DEX, dYdX will provide token incentives for all links in the protocol, such as transactions and liquidity provision, for five years. In the just-concluded Epoch0 stage, this incentive may exceed the transaction requirements. the cost of.

Perpetual Protocol V2 is deeply bound to Uniswap V3, and cooperates with active liquidity management protocols such as Charm. When providing liquidity, leverage can be used to amplify the profits of liquidity providers, but active strategies are required to adjust positions.

Derify Protocol will use its own technological innovation, holding mining and HAMM to bring a better product experience to Dex users

Share this Post

This news is republished from another source. You can check the original article here

Be the first to comment