salarko

Acala Network (ACA-USD) has been dubbed the “decentralized stablecoin of Polkadot” (DOT-USD). Last year, Acala won a Polkadot parachain slot auction which made it one of the first Polkadot parachain slot holders, of which there will only be 100. This is important for a variety of reasons, but the main point is getting a parachain slot is validation that Acala Network is an important piece of what Polkadot is trying to build.

Acala has two coins; ACA is the governance token of the protocol and aUSD is the algorithmic stablecoin for DeFi activity on Polkadot. Algorithmic stablecoins are different from traditional stablecoins because they’re not collateralized by real dollars or other assets. Instead, they rely on math and incentives to maintain dollar pegs. The most famous example of an algorithmic stablecoin is the recently obliterated TerraUSD (UST-USD). The collapse of which was the first domino in the crypto contagion that also took out Celsius Network (CEL-USD), Voyager Digital (VGX-USD)(OTCPK:VYGVQ), and 3 Arrows Capital, among others.

Acala’s stablecoin has been on a wild ride over the last few days and in this article we’ll explore what happened, the impact on Polkadot, and whether we may now have an arbitrage opportunity.

aUSD loses its peg

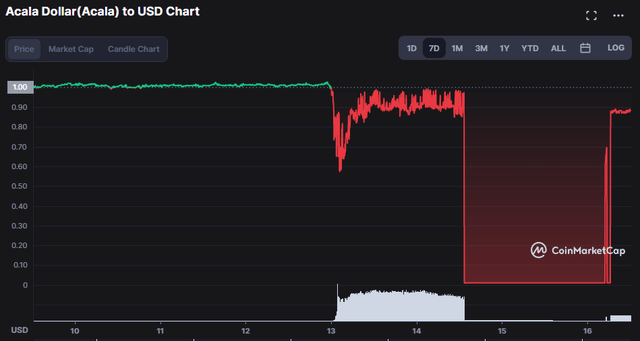

Problems started in the aUSD peg late Saturday when the token slipped down to 58 cents before quickly returning to a range between 87 and 92 cents. It stayed in that range for about 30 hours before collapsing down to a penny early Monday morning. On Twitter, the Acala team described what caused the token to lose its peg:

We have identified the issue as a misconfiguration of the iBTC/aUSD liquidity pool (which went live earlier today) that resulted in error mints of a significant amount of aUSD

Since aUSD can be minted with several different forms of collateral, the collateral ratio varies among the tokens. For instance, DOT, the native token of the entire Polkadot ecosystem requires a 400% collateral ratio and a 200% liquidation ratio. Meaning, if a user wanted to mint 500 aUSD tokens, they’d have to supply $2,000 worth of DOT and if the value of that DOT gets cut in half by the market, the user is in jeopardy of triggering a liquidation. The misconfiguration in the iBTC/aUSD pool allowed bad actors to mint 3.02 billion aUSD tokens that weren’t properly collateralized and the de-pegging started.

Current situation

The response from the Acala community has been pretty swift. A proposal was put forward to burn 1.3 billion erroneously minted aUSD tokens. The community overwhelmingly voted in favor of that proposal and the peg has since clawed back to the range where it was before the total collapse happened.

CoinMarketCap

While it’s true 1.3 billion aUSD tokens have been burned, the elephant in the room is that it was actually 3.022 billion aUSD tokens that were erroneously minted. That still leaves roughly 1.7 billion aUSD tokens that shouldn’t exist and that still remain in the wallet addresses of the perpetrators. The Acala network has been halted and it seems as though some of the supporters are now taking issue with some of the verbiage coming from Acala. Tuesday night, Acala Network insinuated on Twitter that there would be some sort of penalty for the arbitrage players:

Further trace reports will be published to identify arbitragers profiting from aUSD error mints, as well as outflows of aUSD error mints and tokens swapped from aUSD error mints to other accounts, parachains, and exchanges.

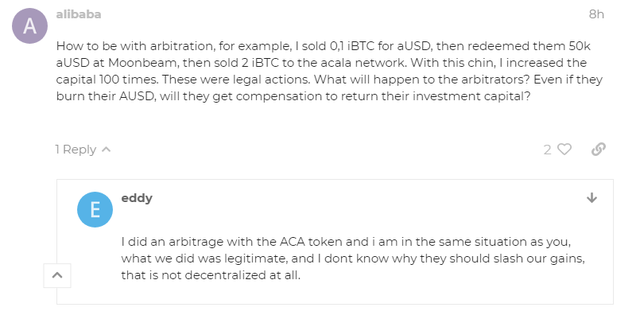

This has not been well received by some in the community who played the arbitrage:

Acala.Discourse.Group

An asset that is supposed to be valued at $1 is potentially an arbitrage opportunity when it is trading below that figure. This is totally normal free market behavior. However, it seems as though some in the Acala community are now at risk of having some sort of slashing or penalty simply for taking advantage of that opportunity. At 87 cents currently, aUSD is still theoretically an arb opportunity if you can get access to the tokens. But I’m not sure I’d make that bet at all. There are still 1.7 billion aUSD tokens that have no collateralization whatsoever.

The Decentralization Claim

I think the core issue that crypto investors should consider when assessing whether they want exposure to either ACA or aUSD is whether or not it is truly decentralized. This is true for every crypto coin and in many ways the market is still really sorting this out. Certainly Bitcoin (BTC-USD) is the north star of public blockchain decentralization.

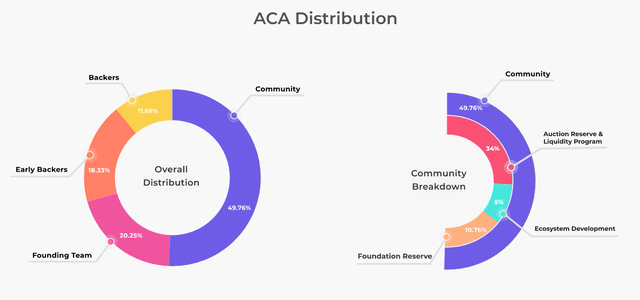

Acala.Network

But for ACA, the token supply appears to be fairly concentrated among founders and backers. Less than 50% of the ACA distribution is held by the community. This means the protocol’s founders and backers are largely determining the vote outcome. For a project that claims to be decentralized and censorship resistant, I’m not sure that claim holds up when tokens that have been minted can be burned by vote. While I don’t necessarily view centralization as a problem in certain instances, I do think claiming decentralization when it doesn’t appear to actually be the case can raise questions.

Summary

I don’t think there is systemic risk to the crypto market this time around. Acala just doesn’t have a big enough footprint in the broad crypto ecosystem yet to create the contagion risk that was obviously present for Terra. Furthermore, the impact on Polkadot’s token is likely minimal considering just over one thousand DOT tokens ended up in the bad actor wallets. For a token that has 1.1 billion in circulating supply, this is essentially a rounding error. That said, the failure of Acala is definitely not a good thing for an ecosystem that lacks a large amount of top 200 market cap projects.

I think the bigger issue that potential ACA investors or users want to consider is just how decentralized the Acala protocol actually is. The project’s supporters just watched their stablecoin collapse. If they lose faith in the governance mechanism as well, there is probably more downside risk to both aUSD and ACA. As is so often seen in crypto, there is a potentially lucrative arb opportunity in Acala, but with 1.7 billion erroneously minted aUSD still outstanding, I think buying the Acala stablecoin here is a little too close to picking up pennies in front of a steamroller.

This news is republished from another source. You can check the original article here

Be the first to comment