- Solana price bounced strongly after experiencing a more than 7% loss on Wednesday.

- Buyers have returned but must move Solana above key resistance to maintain momentum towards new all-time highs.

- Bearish fakeout pattern in Point and Figure analysis could trigger massive spikes higher.

Solana price remains a leader in the altcoin space, giving many examples of why it’s referred to as an Ethereum-killer. While the bounce has been significant, bulls will need to add more conviction to the intraday rally to carry Solana forward; otherwise, short-sellers will likely capitalize on the weakness.

Solana price could trap short-sellers above $255, but failure by the bulls could trigger aggressive selling pressure

Solana price is highly likely to confirm a powerful bear trap pattern in Point and Figure charting known as the Bearish Fakeout pattern. This pattern develops when a multiple-bottom has two Os forms below, then an X-column forms and creates a bullish entry. This hypothetical long setup has a buy stop at $225, a stop loss at $205 and a projected profit target at $355. A trailing three-box stop would help protect any presumed profit after the breakout.

SOL/USDT $5.00/3-Box Reversal Point and Figure Chart

The bullish trade idea is invalidated if Solana price moves below $180.

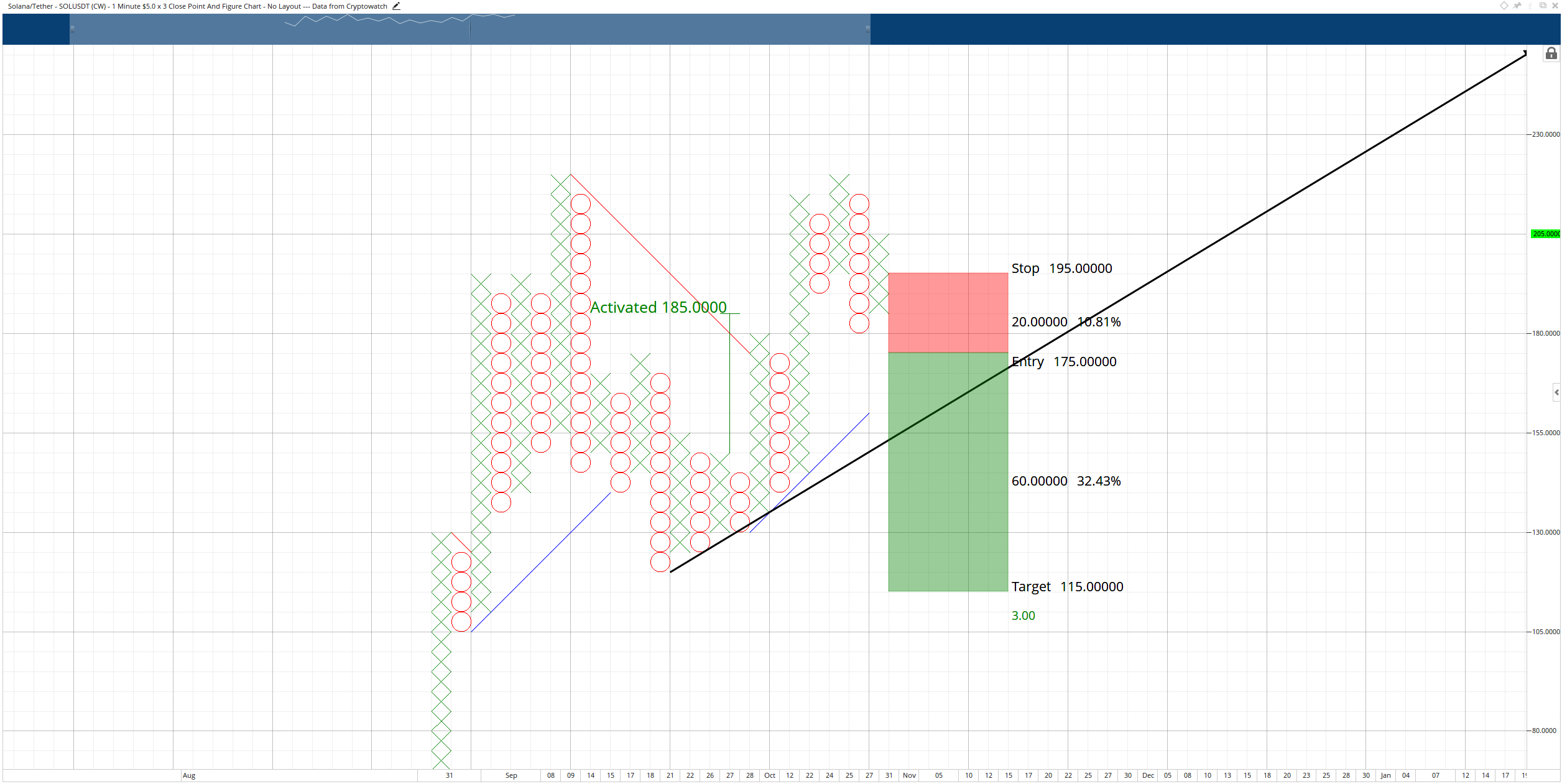

A hypothetical short trade also presents an opportunity. A break of a double-bottom at $180 would coincide with a break of the bull market trend line, thereby converting Solana price into a bear market. Additionally, momentum may be strong enough to see Solana move below the subjective trend line (black trendline), increasing selling pressure. The theoretical short idea is a sell stop order at $175, a stop loss at $195, and a profit target at $115.

SOL/USDT $5.00/3-box Reversal Point and Figure Chart

The short trade idea is invalidated if Solana price moves above $220.

This news is republished from another source. You can check the original article here

Be the first to comment