Welcome to the Three Ts with CoinJar. Each fortnight we explore a big Theme, an interesting Trade and some good, old-fashioned Technical Analysis (courtesy of Carl Capolingua of Thinkmarkets Australia).

Bridge to ruin

Crypto bridges are fortunate that the wholesale implosion of the DeFi lending space has drawn attention away from their own Very Bad Year.

Last week, the Nomad bridge – pitched as enabling “radically cheaper cross-chain communication” – unleashed the crypto world’s first wholesale looting incident when a routine upgrade opened a vulnerability that allowed attackers to rerun any transaction with their own ETH address and have it complete. Cue an all-in frenzy as regular users with no hacking experience started cashing out other people’s money.

US$190 million later and we have yet another superlative example of how terrible crypto-to-crypto bridges currently are. So far this year 13 different bridges have been hacked for more than US$2 billion according to Chainalysis, which ranks keeping your money on a crypto bridge as being only slightly less risky than throwing it off a literal bridge.

All of these bridge hacks are either due to implementation errors, smart contract / software bugs or compromised multisigs. Rollups are also susceptible to all of these whilst adding a lot of complexity and potentially higher payout through more TVL.

— Seq 🔺 (@CryptoSeq) August 2, 2022

Everyone is convinced that cross-chain bridges are the way of the future and the only way that crypto will reach mainstream use. But right now it feels more like we’re trying to do a BMX triple backflip before we can walk. Perhaps we should be focussing on how to make the blockchains we actually have ready for primetime before we add extra layers of ultra-hackable complexity and financial abstraction into the system.

And if you don’t take my word for it, here’s Vitalik warning about bridges seven months and US$2 billion ago.

My argument for why the future will be *multi-chain*, but it will not be *cross-chain*: there are fundamental limits to the security of bridges that hop across multiple “zones of sovereignty”. From https://t.co/3g1GUvuA3A: pic.twitter.com/tEYz8vb59b

— vitalik.eth (@VitalikButerin) January 7, 2022

DeFi’s yield problem

As the ludicrous extent of the CeFi collapse comes into focus – this interview with the disgraced founders of 3 Arrows Capital really sets out how dumb everyone was being – DeFi protocols are often held up as the good guy in the whole shemozzle. It’s a bit like the old anti-gun control logic: DeFi protocols don’t destroy billions of dollars. People destroy billions of dollars.

And yes, the established DeFi protocols – Compound, Aave, Curve, etc. – have continued doing what they’ve been doing for the last few years without any interruption. A lot of pain and unpleasantness could have been avoided if we’d all just stuck with the “simple” option.

But now these DeFi protocols face their own issues. As people look for safe havens to park their stables and tokens while the worst of the winter passes, the returns have become, well, dismal. On Compound right now the best available stablecoin APY comes in at 1.48%.

While the reason for these low returns is in many ways directly attributable to the CeFi meltdown – more coins have been funnelled to these protocols and no-one’s borrowing them because the market sucks – it’s certainly not ideal that these rates are significantly less than the Reserve Bank’s current cash rate.

Lower returns and an increased risk profile? Sign me up!

So, you want a trade idea? Open a term deposit with the Commonwealth Bank. They’re paying out 3%!

Is this what hope feels like?

Well, it’s been a while, but finally there’s some crypto TA that doesn’t look like a pile of trash that’s been set on fire and then covered in another, even bigger pile of trash.

Bitcoin is, in the words of technical analyst Carl Capolingua “doing its best to look half-decent”: a sequence of higher peaks and troughs, a turnaround in the short-term ribbon and majority green candles. However all this is happening in a fairly minor key and until we break past US$25.3k with conviction we’re still trapped in a range with a lower band around US$17.3k.

Ethereum on the other hand is showing some real pizazz. Like Bitcoin it’s putting in higher highs and higher lows and the short-term ribbon is headed in the right direction. But unlike BTC, ETH has punched through its primary supply zone at US$1,700 and is managing to hold there. Thank the Merge if you like, but expect to see some more resistance when we approach the long-term trend ribbon at US$2,000. Things begin looking grim when the price starts closing below US$1559.

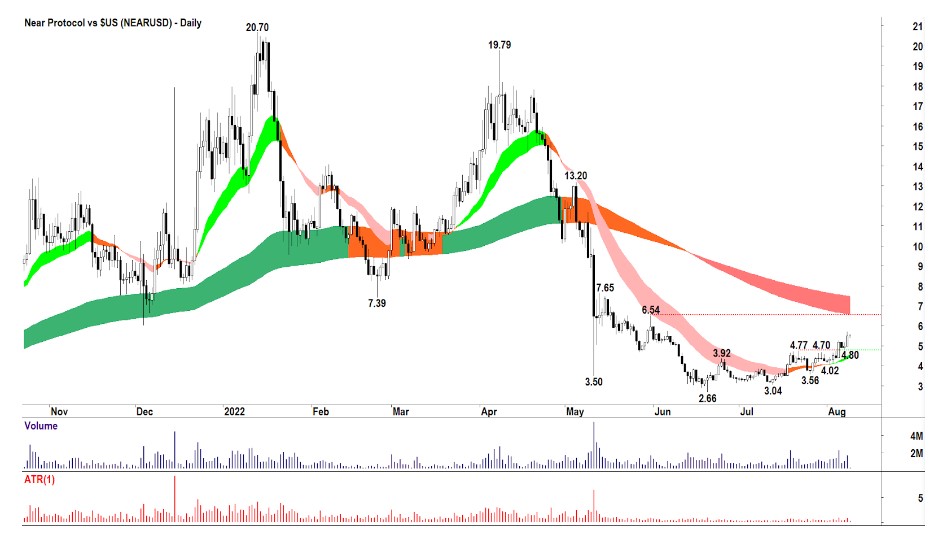

If BTC and ETH have made their moves then it’s usually time for the alts to shine and Capolingua sees plenty of green shoots pushing through – in particular ATOM, BAT, DOT, FLOW, FTT, GRT, NEAR, RVN, UNI, WOO, XDC.

Near Protocol is his pick of the bunch, where consistent green candles and a steepening short-term ribbon show robust demand building from the lows. If momentum continues, the first stop is the US$7 zone. Show strength there and US$13 could be on the agenda.

Still, let’s not get ahead of ourselves. Level by level is the name of the game. Things go south on a close below US$4.02.

CoinJar is Australia’s longest-running crypto exchange. Since 2013, CoinJar has helped more than half-a-million Australians buy and sell billions of dollars in cryptocurrency.

FX Evolution is Australia’s premier forex, stock and crypto trading community.

This news is republished from another source. You can check the original article here

Be the first to comment