Editor’s note: Seeking Alpha is proud to welcome Avana Wallet as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

VR_Studio/iStock via Getty Images

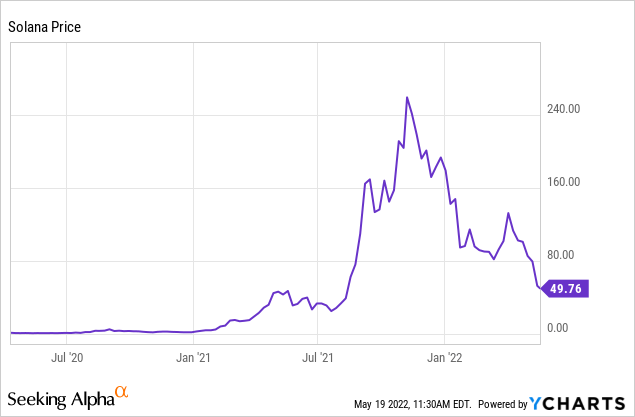

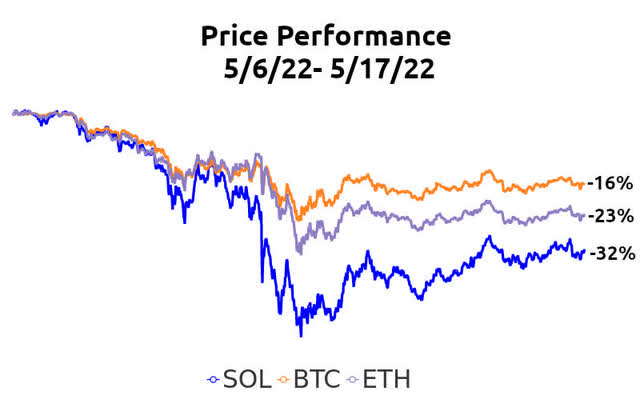

Solana (SOL-USD) was one of the best-performing cryptocurrencies in 2021 when it rose from ~$2 in early 2021 to more than $250 by November 2021. Since then, Solana’s native currency SOL retraced ~80% from its high to $50 currently. Over the past ten days the price dropped ~32%, fueled by the broader crypto market selloff stemming from Terra’s UST-USD and LUNA-USD collapse.

Relative Price Performance During Market Selloff

Source: Avana Wallet. Data available for download

The sharp selloff in SOL-USD presents a great medium-term entry point for anyone who missed the boat during 2021. Fundamentals remain strong, and the outlook is bright.

Solana will be a relative outperformer over the coming years as crypto mass-adopters find utility in the growing Solana ecosystem of NFT marketplaces, DeFi, payment systems and gaming apps. Solana is built to handle wide-scale adoption of Web3 decentralized apps.

Solana Is Structurally Different

Solana is structurally different than most blockchains. Solana is capable of handling high transactions per second capacity (currently 60,000 TPS, with the potential to scale to several hundred thousand TPS in the future), cheap, and lightning fast (transactions confirm in seconds rather than minutes and hours).

So this idea that you can write a bunch of code and change the world [was something] that I believed in, saw that happened with Google, with Facebook, with Amazon. So it’s always there. I’m glad that I have the opportunity to take a stab at it.

– Anatoly Yakovenko, Solana Co-Founder in an interview with FTX

High Transactions Per Second Throughput

Bitcoin BTC-USD is capable of 7 TPS and Ethereum ETH-USD is capable of 15 TPS – both networks require Layer 2 scaling solutions (for example, Bitcoin Lightning and Polygon MATIC-USD) to break through these structural barriers. Solana currently does not require a Layer 2 scaling solution. Many crypto users switched to Solana after Ethereum congestion issues in 2021.

Some bears have pointed to the network congestion issues that hampered the Solana network during 2022 as a reason to doubt the true TPS potential. Core developers are focused on addressing the issues, and it is important to note that none of the issues appear to be structural. Hiccups and growing pains are fairly common among emerging new technologies.

Solana Is Cheap To Use

Solana network fees are fairly stable and cheap. Most transactions cost less than a penny, and there are not unpredictable sharp swings. We all can remember the days of 2021 when Ethereum gas fees looked scarier than a natural gas chart (I can still remember trying to send a friend an NFT on Ethereum mainnet at one point when gas fees were over $600… it was not a CryptoPunk, so I had to wait well over a week for fees to moderate to “reasonable” levels).

Predictability and stability in fees are very important for all market participants. Imagine trying to trade Tesla (TSLA) when your broker commission could vary between $0 and $600. As a trader you want clarity on your transaction costs. As a broker you want pricing stability so you can better plan medium and long-term investments for the business. John D Rockefeller’s assistance in providing oil price stability was credited with increasing oil adoption rates. The same concept applies to crypto.

High gas fees and unpredictable fee swings were given a pass during the bull market run of 2018 to 2021. The stability of fees will become a critical differentiator as crypto goes mainstream – many next generation Web3 apps require high transaction velocity (for example, blockchain GameFi and payment systems).

Lightning Fast

Solana’s network is able to confirm transactions in a matter of seconds, rather than minutes and hours on other networks. This factor is very important for the average consumer who is accustomed to instant gratification and gigabyte internet speeds.

The median consumer cares most about the experience and cost, not the underlying technical wizardry of the blockchain and why it needs to take minutes or hours to confirm a transaction.

Crypto Is Now Established

Solana is perfectly positioned for a large influx of crypto users as the penetration rate S-Curve accelerates with mainstream adoption. The network is built for high throughput and speed.

The average consumer is well-aware of crypto, and many central banks and governments have come to the conclusion that embracing blockchain technology is a better bet than taking a hostile approach and being left in the dust. Europe is still trying to catch-up with Asia and North America after missing the tech wave – politicians have acknowledged they do not want to make the same mistake with blockchain.

We see crypto adoption accelerating through 2030 to over one billion global users as the adoption S-curve rate continues increasing.

Similar to the adoption cycle of smartphones, most people will soon integrate blockchain technology into their daily lives – the same technology they first perceived as too complicated to use.

More Developers Are Focusing On Solana And Rust

Solana’s core smart contract language is Rust, which is a very efficient and fast low-level programming language. Ethereum and EVM-compatible blockchains use Solidity.

The bulk of today’s Web3 developers are using Solidity, but the Rust’s growth rate is faster and it is gaining ground quickly. Rust has been Stack Overflow’s most loved language for four consecutive years.

rust is a perfect programming language

– @jack December 24, 2021

An increasing number of Solana developer tools are emerging, which helps onboard newcomers. The Anchor framework, created by Armani Ferrante, is one of the more helpful tools that many Solana developers use to create Rust smart contracts. Anchor enables developers to build and ship apps faster by handling much of the low-level code and security logic.

Electric Capital 2021 Developer Report (a great resource, we recommend reading the report) showed two interesting trends last year:

- Developers are branching out. Growth rate of ecosystems outside Bitcoin and Ethereum was meaningfully faster than Bitcoin and Ethereum

- Solana experienced the largest rate of growth – the number of developers increased by ~5x

Risks

Cryptocurrencies are volatile, and bear markets can persist for many years. The recent bear market started in November 2021, which is less than one year ago. A new bull run could take several months or longer to start. Our thesis is a three to five year view.

Solana congestion issues affected the network in 2022. Users and developers could find alternatives if these issues persist or take longer than expected to address.

The S-Curve adoption rate is difficult to forecast accurately with secular growth sectors. The adoption rate curve could be less steep than anticipated, which would imply lower growth rates.

Valuation

We believe SOL-USD will reach new highs above its prior peak of ~$250 in coming years (implies a market capitalization of ~$135 billion). Solana can be seen as a combination of a cloud services provider, payments processor and a fiat currency combined.

Solana’s current fully diluted market capitalization is under $30 billion, which makes it attractive relative to public equities in these sectors. The total market cap of the three largest traditional payment processors is just shy of $1 trillion: Visa (V) $438 billion, Mastercard (MA) at $327 billion and American Express (AXP) at $121 billion.

Comparison of cryptocurrency market capitalization to equities is not apples-to-apples because cryptocurrencies also offer consumers a native coin that is a store of value similar to paper money, gold (GLD), and silver (SLV). Also, payment processors can charge higher fees than Solana due to the consolidated market structure.

Cryptocurrencies store value with a defined inflation schedule determined by computer code. As the quantity of fiat money printed continues to outpace cryptocurrency inflation rates, cryptocurrencies should see relative price appreciation all else equal.

As of today, Coinmarketcap estimates the total cryptocurrency market cap is $1.3 trillion dollars. This is down more than 50% from the peak of > $2.5 trillion in late 2021. While $1.3 trillion sounds like a large number, it is still a drop in the bucket compared traditional global financial markets.

Conclusion

We are very optimistic on the future of Solana and the broader crypto space. The recent pullback offers newcomers a great medium-term entry point to gain exposure to one of the best-positioned blockchains in the coming years.

Solana’s growing ecosystem of DeFi apps, NFT marketplaces, payment systems and GameFi apps will continue attracting the expanding population of crypto newcomers.

This news is republished from another source. You can check the original article here

Be the first to comment