There was never a time when something could come so close to challenging the domination of the stock market – until 2021, a year that changed all dynamics.

Major players of the stock market, including institutional investors, indices creators, and investment funds acknowledged these changing dynamics and jumped onto the bandwagon. As you read this, you know it is the cryptocurrency world that is the challenger to the hegemony of the stock market. As we enter 2022, let us know how the two investment instruments differ from each other and which can be the preferred choice in 2022.

Also read: Explained: Cryptocurrency categories – DeFi, NFT, Metaverse

Cryptocurrencies vs. Stock Market – Back to Basics

First, not every cryptocurrency is a part of a homogeneous group. Similar to shares, which represent any specific company operating in a particular industry, crypto assets represent a specific project.

Bitcoin, for example, is a blockchain-based digital currency that works independently as one project and has nothing to do with other crypto assets. Others like Ethereum’s Ether and Solana’s SOL are project-specific native tokens used within that project alone. Each and every crypto asset, which you may want to trade in the coming year, is a representative of a venture. It is hence advisable to know a little about the venture and the problems it is aiming to solve before making an investment decision.

But cryptos aren’t shares. Shares are basically ownership in the company. If any investor holds 100 shares of electric car maker Tesla, it represents a small ownership. By using the services of brokerages – online zero-commission brokers are the favorite of retail investors – the holding can be liquidated. Owning any crypto asset may not necessarily mean ownership in the project, though a few decentralized autonomous organizations, referred to as DAO, claim this feature. A BTC holding is an independent holding and has nothing to do with project’s future moves as there is no annual general meeting of shareholders.

Second, the stock market runs more on fundamentals, less on sentiments.

For example, if a new player like Tesla or Netflix is likely to displace a conventional player like Ford or Disney from top position in a specific industry the demand of shares of these new companies will rise. In cryptocurrencies, more often than not, demand of any asset rises or falls on sentiments, which are shaped by strange things. A tweet by Elon Musk can lead to a multi-fold rise in a meme token, and the name of a new variant of Covid can be a trigger for demand of a crypto having an identical name.

Also read: Is Bitcoin better than gold as hedge against high inflation?

Returns of cryptocurrencies vs. stock market

There is no single valid argument here. Returns in both stocks and cryptocurrencies can be overwhelming.

© 2021 Kalkine Media®

Data provided by CoinMarketCap.com

In 2020, the year that saw bloodbath in the global stock market in the wake of the pandemic, Tesla’s stock soared by over 700 per cent. The selloff of stocks was limited and share markets rebounded in the second half of 2020, but Tesla’s rise was literally incomparable. In 2021, it was the turn of ‘meme stocks’. The humble GameStop Corp. was trading at under US$20 at the beginning of January 2021, but by month’s end the share breached US$300. The share fell sharply and then rose again, all in a matter of a few weeks.

Also read: Can Bitcoin be termed as the ‘asset of the century’?

But these are just the aberrations. The average annual return of the world’s most closely watched index, S&P 500, was up 18 per cent in 2020. This year, the returns have followed a similar trend. The index is the favorite of ace investor Warren Buffett.

In cryptocurrencies, the aberrations were a normal happening in 2021. One crypto asset, Axie Infinity was up more than 20,000 per cent in just a few weeks. A major cryptocurrency, Solana, also gave similar kind of returns to its backers. Even, the second largest crypto Ether, which is expected to be less volatile, grew multifold. And then were some that literally fell to zero. Squid Game crypto fell from nearly US$2,800 to zero in a matter of a few minutes. These events reveal the underlying hyper-volatility in cryptos.

Stocks, too, are volatile but such sharp rise and fall is usually a one-off incident. Bitcoin, the largest crypto by market cap, is expected to be less volatile like the S&P 500 Index, but it too can surge or fall in double digits in a single trading day.

Also read: Is investing in altcoins better than Bitcoin?

Cryptos or stocks in 2022

Some developments make cryptos very interesting. The S&P Dow Jones created Bitcoin and Ether indices in 2021 to track the movement in their prices. This is no mean feat. One can either say that S&P is riding the crypto wave or it can be said that this is just the beginning of a future where stocks will have a neck-and-neck competition with crypto assets.

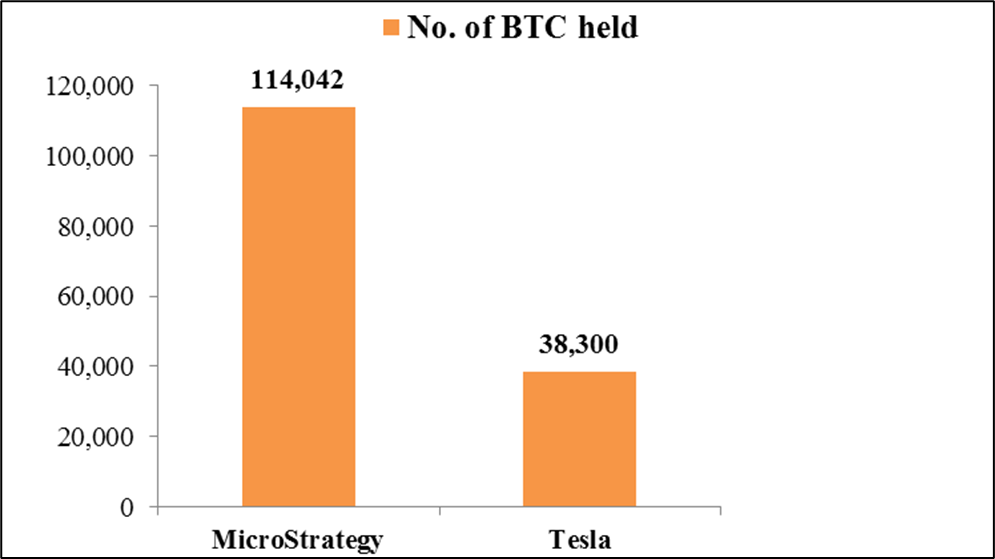

Despite all the criticism around their volatility, major economies have refused to ban trade in cryptos. In China, crypto trading was outlawed, but no other big economy followed the lead. In fact, companies like MicroStrategy bought more Bitcoin in 2021. In the US and Canada, Bitcoin and Ether ETFs emerged as a big rival to conventional funds.

Also read: MicroStrategy bitcoin holding soars, dwarfs Tesla’s

The year 2022 could bring more mainstreaming of crypto assets. One key factor that could prompt investors to look at cryptos instead of stocks is inflation. Cryptos, when bought and sold at opportune times, can be a better hedge against inflation as compared with stocks. But crypto investments are also prone to heavy losses. In this light, an investor should assess his/her risk appetite before picking between cryptos and listed shares.

© 2021 Kalkine Media®

Also read: 5 breakout altcoins with metaverse underpinning

Viewpoint

Cryptos are volatile, and so are listed shares of even the biggest companies. But the former trade more on sentiments and less on fundamentals. In fact, there is a dearth of fundamentals an investor can rely on in crypto investments. All crypto projects are in their infancy, and there is no certainty that the decentralized ledger technology will truly become mainstream one day. Stocks have fundamentals like revenue, market share and a fairly predictable future growth.

This news is republished from another source. You can check the original article here

Be the first to comment