Chinnapong/iStock Editorial via Getty Images

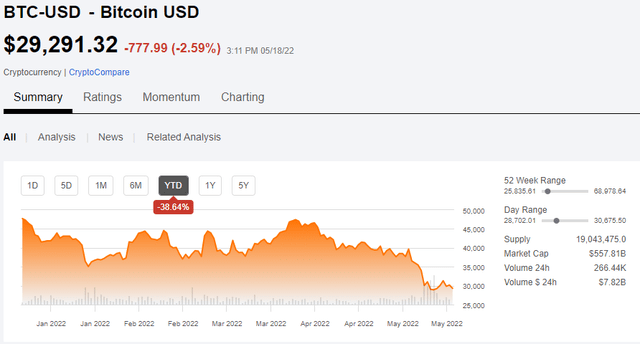

Cryptocurrency such as Bitcoin (BTC-USD) is such an unusual asset class in that it is uniquely bad when its price falls. As a value investor, I like investments that have fallen and are now cheap. Crypto has collapsed, but it still isn’t cheap.

SA

In fact, there is no price at which it becomes cheap. It is one of very few assets that does not become a better value as the price falls.

- When the S&P drops such as the ~20% it has dropped this year, it becomes a higher return investment going forward.

- When the Dow or NASDAQ drops its constituents on average become higher returning investments going forward.

- Even binary speculative stocks get a better reward to risk ratio as they get cheaper.

The mechanism in each of these is similar in that they offer earnings or in the case of speculative stocks the potential for earnings. When price gets lower, one’s investment buys more earnings which makes these better buys as the market price drops.

Why Earnings Matter

I get that the stock market feels like a popularity contest. Stocks go up and down based on preferences and whims, but if we take a step back and really learn the underlying mechanisms of valuation, there is an inevitability to market prices moving toward fundamental earnings potential.

In the long run, it is a mathematical certainty that earnings will matter.

It all boils down to what present value actually is – all future payments to shareholders discounted back to the present.

Every dollar earned eventually goes toward payment to shareholders.

The most direct route is dividends paid by current earnings.

The indirect route is retained earnings being reinvested in the business and in turn generating more earnings. The extra earnings will eventually facilitate higher dividends.

Even in the extreme case of a company that never intends to pay a dividend, the earnings accretion still benefits shareholders by raising the value at which the company is eventually bought out. See, the future buyers of the company will get the earnings stream as compensation for the buyout, so the higher the earnings, the higher the price tag.

As such, earnings matter for all stocks, even growth companies that don’t pay dividends. The earnings growth still leads to an acceleration of value that is eventually paid to shareholders in some fashion.

Why crypto is different

Earnings yield is inversely proportional to price and as the denominator of earnings yield (earnings/price) drops, the earnings yield rises.

Crypto is unique. Its earnings are $0, so it has a numerator of 0.

When crypto was on top of the world with a multi-trillion dollar aggregate market cap, its earnings yield was $0 over a few billion. As crypto collapses, it becomes $0 divided by a much smaller number.

Zero is a mathematically interesting number when it comes to ratios. When it is the numerator, it doesn’t matter what the denominator is, the result will always be zero. 0/X = 0.

This means that crypto as an asset class is uniquely positioned to drop excessively and potentially permanently. It does not get cheap. It does not get attractive as the price gets low. It has always and will always have zero earnings.

Now, when I say crypto has zero earnings I frequently get confronted with a slew of dissenting opinions, so let me address some of those ideas right here.

False notion of earnings #1: Blockchain is valuable technology that will produce tons of earnings

I agree that blockchain is valuable technology and I think it will be used for some important applications and generate ample earnings as a result. The problem here is that owning cryptocurrency does not convey any ownership of any kind. In owning Bitcoin cryptocurrency, one is not entitled to any sort of fee or royalty when blockchain is used, even if it is the Bitcoin blockchain being used.

There is no mechanism by which the owner of Bitcoin crypto actually gets paid no matter how phenomenal blockchain turns out to be. I wrote more extensively here on how owning crypto does not convey ownership of blockchain.

False notion of earnings #2: Staking crypto generates earnings similar to dividends

Staking is essentially a form of financial engineering in which the sharecount is increased proportionally to the amount granted. It is akin to a stock split in which everyone who owns McDonald’s stock now gets 2 shares for each share they previous owned. When this happens, the value of each share drops in half.

So investors now have two $50 bills instead of a one $100 bill. No value has been created, just some numbers shifted around.

It is similar to when companies pay dividends in stock rather than in cash. A stock dividend is meaningless because the dilution to value per share nets out one’s increase in share count.

False notion of earnings #3: Legitimate companies are getting involved in crypto and making money doing it

Yes, there are countless respectable companies getting profitably involved in crypto. Their involvement is often seen as some sort of endorsement of crypto and it is used to promote the legitimacy of crypto.

I don’t see it that way at all.

I see it as opportunistic companies coming in to profit on the latest market craze. In fact, the earnings they generate are functionally negative earnings for crypto investors. Allow me to elaborate.

Interactive Brokers (IBKR), Coinbase (COIN), Robinhood (HOOD) and plenty of others collect fees and commissions in exchange for facilitating transactions. They make legitimate earnings doing this, but where are those earnings coming from?

The commissions and fees are coming out of the pockets of those who invest in cryptocurrency. Therefore, it is functionally negative earnings for Bitcoin and other crypto investors.

Not too late to get out

I sincerely hope that investors in crypto do not see this article as a personal attack. Please consider it as a warning and an opportunity to salvage the remaining value of your investment.

While I firmly believe that crypto will go to $0, there is still time to get out. The hype machine is still going strong with crypto purveyors continuing to pump billions of dollars into advertising. As such, it is still possible to find someone willing to relieve you of your position.

I’ll conclude with one final thought – when an asset is truly valuable it does not need billions of dollars of marketing to convince others of its value.

This news is republished from another source. You can check the original article here

Be the first to comment