da-kuk/E+ via Getty Images

Thesis

Among the currently available Blockchain ETFs, the VanEck Digital Transformation ETF (NASDAQ:DAPP) is my favorite option due to its reasonable fees, passive strategy, and appealing holdings. However, I believe that investors who are willing to put in the extra work may be better off buying a basket of individual stocks and cryptocurrencies instead of an ETF.

Why Blockchain?

Blockchain is an emerging technology that’s very high growth. In the last five years, leading cryptocurrency Bitcoin (BTC-USD) has grown at a 76% CAGR, and companies focused on blockchain like Silvergate (SI), Block (SQ), Galaxy Digital (OTCPK:BRPHF), Coinbase (COIN), and various crypto miners have posted even higher growth rates in the last few years.

In the long term, blockchain technology has the potential to do much more than create secure digital currency. It’s already starting to be applied in other areas like payments, smart contracts, decentralized finance, and NFTs. As long as some of these applications prove successful, the industry should be able to grow at an elevated rate for a long time. Thus, many people compare blockchain today to how the internet was in the 1990s: a technology that’s still too new to be very impactful, but one that has the potential to grow quickly and disrupt multiple industries.

Of course, early investors in the internet did very well. While it’s always risky to invest in new technology, I believe that early investors in blockchain technology will eventually do well, and many early Bitcoin investors have already seen incredible returns.

The ETF Approach

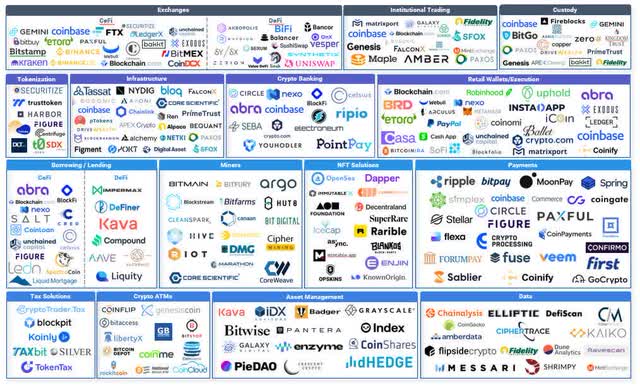

The above graphic from FT Partners shows that there are a lot of companies doing blockchain-related work. Most of the companies listed relate to crypto financial services like exchanges, trading, custody, payments, asset management, borrowing/lending, banking, wallets, and ATMs. However, there are a few other categories companies can fall into:

- Financial services

- Infrastructure and data

- Digital assets (NFTs)

- Crypto miners

- Semiconductors and hardware (not in graphic)

For an emerging and fragmented industry like this, an ETF can be a good way to get exposure. Some of the benefits of blockchain ETFs include:

- It’s difficult to pick winners in an emerging industry, so it can be preferable to just own the entire high-growth industry.

- Many of these companies are still private. ETFs will add relevant companies when they IPO, without investors having to monitor the IPO market. I recently highlighted a few private blockchain companies for members of Tech Investing Edge (my marketplace service) including Zap, Lightning Labs, and Crusoe.

- Many of these companies are not US-listed, so they can be difficult for investors in the USA to buy. However, ETFs can buy them on investors’ behalf.

The main point is that an ETF allows investors to find a low-maintenance middle ground where they’re likely to have some exposure to future blockchain winners but not be too concentrated.

Available Options

| Ticker | Manager | Objective |

| NYSEARCA:IBLC | BlackRock | Blockchain & crypto |

| NASDAQ:FDIG | Fidelity | Blockchain, crypto & payment processing |

| NYSEARCA:BLOK | Amplify | Blockchain |

| NASDAQ:BKCH | Global X | Blockchain |

| NYSEARCA:BITQ | Bitwise | Crypto |

| DAPP | VanEck | Digital assets economies |

Source: Compiled by author

This article highlights six ETFs that mention blockchain, crypto, and/or digital assets in their investment objective. Most of these ETFs are run by well-known asset managers like BlackRock (BLK) and Fidelity. Here are some more stats about them:

| Ticker | Expense Ratio | Strategy | Inception | Holdings | AUM |

| IBLC | 0.47% | Passive | 4/25/22 | 39 | $6M |

| FDIG | 0.39% | Passive | 4/19/22 | 39 | $5M |

| BLOK | 0.71% | Active | 1/17/18 | 46 | $770M |

| BKCH | 0.50% | Passive | 7/12/21 | 25 | $85M |

| BITQ | 0.85% | Passive | 5/11/21 | 30 | $84M |

| DAPP | 0.50% | Passive | 4/12/21 | 25 | $48M |

Source: Compiled by author

Based on this information, I’m already willing to eliminate a couple options. First, BITQ has the highest expense ratio, is run by one of the less well-known managers, and has too narrow of an investment objective for my liking (it only mentions crypto, which is just one application of blockchain technology).

Also, BLOK has the second highest expense ratio and is the only one of the ETFs that uses an active strategy. An active strategy can be effective with a good manager, but otherwise it can be riskier and less tax efficient than a passive strategy. BLOK has returned a total of 25% since its inception over three years ago in January 2018, compared to 47% from the S&P 500 and 143% from Bitcoin. Considering this poor track record, it’s difficult to recommend BLOK.

The four remaining options (IBLC, FDIG, BKCH, and DAPP) are all run by leading asset managers using a passive index strategy, and all have reasonable expense ratios between 0.39% and 0.5%. Unfortunately, they are all too new to meaningfully analyze their performance. So, a deeper dive into their holdings is necessary to choose between them.

ETF Breakdown

Even though most of the ETFs describe themselves as passive, it’s not possible to remove the human element completely, since at the end of the day somebody has to decide which companies have enough blockchain exposure to meet the fund’s investment objective. As a result, unlike broad market index ETFs which all have the same contents, all six blockchain ETFs have unique holdings despite five of them being passive.

The index strategy varies depending on the ETF. For example, the index that DAPP tracks states that:

The MVIS Global Digital Assets Equity Index (MVDAPP) tracks the performance of the largest and most liquid companies in the digital assets industry. This is a modified market cap-weighted index, and only includes companies that generate at least 50% of their revenue from digital asset services and products.

IBLC’s underlying index is also modified market cap-weighted, but only has the 50% revenue rule for some sub-industries (source):

The Fund seeks to track the investment results of the NYSE FactSet Global Blockchain Technologies Index (the “Underlying Index”), which is a rules-based, modified float-adjusted market capitalization-weighted equity index.

IDI selects, as “Tier 1” securities, companies generating 50% or more revenue from the following… sub-industries: Blockchain Technology; Cryptocurrency Mining; and Cryptocurrency Trading and Exchanges.

In order to capture those companies that design and manufacture graphic processing unit (gpu) chips necessary for mining, IDI next selects, as “Tier 2” securities, companies in the RBICS Focus Level 6 sub-industry Video Multimedia Semiconductors.

I found the implication of rules like this to be a bit abstract, so I instead categorized each ETF’s holdings to get an idea of how their strategies differ. I assigned each holding in each ETF one of four categories: financial services, mining, hardware, and other. Here is how each ETF is distributed:

| Ticker | Mining | Financials | Hardware | Other |

| IBLC | 45% | 30% | 15% | 10% |

| FDIG | 36% | 62% | 0% | 2% |

| BLOK | 17% | 42% | 10% | 31% |

| BKCH | 43% | 34% | 13% | 10% |

| BITQ | 28% | 48% | 7% | 17% |

| DAPP | 39% | 45% | 4% | 12% |

Source: Compiled by author

Based on this table, FDIG looks like the best option for exposure to financial services, which makes sense because it’s the only one of the ETFs to list payment processing in its investment objective. On the other hand, IBLC is the best option for exposure to mining and mining hardware.

BLOK has the highest exposure to “other” because it’s the only one of the ETFs to invest in physical Bitcoin ETFs like the Purpose Bitcoin USD ETF (TSE:BTCC.U), and it also has a large allocation towards companies like Accenture (NYSE:ACN) which currently derive very little revenue from blockchain-related services. For the other ETFs, the “other” exposure primarily comes from companies with limited Bitcoin exposure like Tesla (NASDAQ:TSLA), MercadoLibre (NASDAQ:MELI), IBM (NYSE:IBM), and Shopify (NYSE:SHOP).

Since different people have different opinions of each sub-industry, everyone will draw different conclusions from this breakdown. Personally, I’ve argued that investors should avoid Bitcoin miners in past articles, due to their significant counter-party risk and the low probability that the average miner will meaningfully outperform the asset they’re mining.

If investors want exposure to miners, there’s already the Valkyrie Bitcoin Miners ETF (WGMI) which provides more targeted exposure to this sub-industry. But for those like me who want to avoid miners, I would prefer FDIG or DAPP over IBLC or BKCH based on their lower exposure to miners.

Between these two, I have a slight preference for DAPP because FDIG includes payment processing companies in its investment objective. I recently shared a deep dive research with Tech Investing Edge members where I argued that some traditional payment processors like Visa (V) are at risk of disruption from blockchain technology because of an “innovator’s dilemma” where their banking partners may be opposed to blockchain-based credit card payments. Ironically, I believe that some payment processing companies in FDIG may actually be negatively impacted by blockchain in the long term.

Another small benefit of DAPP is that it has Silvergate Capital (SI) as its second largest holding, while FDIG doesn’t hold it at all. Silvergate is my top blockchain stock pick because I believe that in the long term, they will benefit from the growth of stablecoins.

To summarize, DAPP is my favorite blockchain ETF because:

- It has a reasonable expense ratio and clear investment objective, unlike BITQ.

- It is passively managed, unlike BLOK.

- It has less exposure to mining-related companies than IBLC and BKCH.

- It has less exposure to legacy payment companies and more exposure to some of my favorite blockchain companies than FDIG.

Risks & Alternatives

Blockchain technology has many often-cited risks, with volatility in cryptocurrencies being the biggest one. Even though these ETFs don’t invest in cryptocurrencies directly, most of the top blockchain companies grow faster when crypto prices are increasing, so the success of these ETFs is likely to correlate with the success of leading cryptocurrencies.

Thus, one alternative to investing in ETFs is to just buy leading cryptocurrencies like Bitcoin (BTC-USD) and Ethereum (ETH-USD). These assets have a longer track record than any of the ETFs, less counter-party risk, and stellar returns. They can even be purchased through brokerages using Grayscale Bitcoin Trust (OTC:GBTC) and Ethereum Trust (OTCQX:ETHE), although both of these trusts have high expense ratios and trade at an increasingly steep discount to NAV.

That said, cryptocurrency is only one application of blockchain. Long-term investors might want exposure to other applications like stablecoins, smart contracts, etc. In that case, investors who want to avoid the fees and exposure to miners in these ETFs could buy a few of their top holdings instead. My personal favorites are Silvergate (SI), Galaxy Digital (OTCPK:BRPHF), Coinbase (COIN), and Block (SQ).

Conclusion

There’s no shortage of options when it comes to investing in blockchain. Among the six blockchain-related ETFs I covered, DAPP is my favorite, but investors who want more exposure to miners and payment processors might prefer other options. I think that IBLC, FDIG, BKCH, and DAPP all look like well-managed ETFs with reasonable fees. In the long term, I expect that most of these ETFs will perform well as blockchain is more widely adopted. However, they might find it difficult to outperform their top holdings and leading cryptocurrencies.

This news is republished from another source. You can check the original article here

Be the first to comment