XRP was one of the pioneers of the early cryptocurrency market, experiencing some tremendous price increases back in 2017. It hasn’t been plain sailing since then, with numerous regulatory issues rearing their heads that have halted growth – although these could all be put in the past this year, providing a pathway towards sustained upward momentum.

This guide will discuss our XRP price prediction for the months and years ahead, highlighting how the coin’s value may be affected and showing you how to invest in XRP today – with low trading fees.

XRP Price Prediction 2022

The XRP price today is $0.7763, following some sustained bullish movement since early January. Detailed below is a brief overview of our XRP forecast for the coming years, ensuring you have a rough idea of the coin’s value potential:

- End of 2022: The XRP price live has been increasingly volatile over the past year, mainly due to regulatory issues and macroeconomic factors. However, due to the slight reversal since the turn of the year, we estimate that XRP could reach the $1.90 level by the end of 2022.

- End of 2023: The $1.90 level will be challenging for XRP to break, especially since price plummeted the last time it neared this area. If XRP can close past this resistance level, we could see price push towards $3 by the end of 2023.

- End of 2025: Assuming the price of XRP reaches $3, this means that the coin will be sitting just below 2017’s all-time highs. We’d expect some consolidation around this area, although if XRP breaks through, there’s a clear path towards $5.50 by the end of 2025.

Cryptoassets are a highly volatile unregulated investment product.

XRP Price History

When buying cryptocurrency it’s important to explore the price performance and market movements leading up to the current date. This way you can ensure you’re making an informed decision and are gaining exposure to the best long term crypto investments out there.

Those who invest in cryptocurrency regularly will undoubtedly have heard of XRP, as the coin was at the forefront of the ‘crypto revolution’ a few years ago. XRP has consistently been in the top 10 largest cryptocurrencies globally, although it has had a rocky period of late. With that in mind, let’s look at how XRP reached this point and where it may go in the future.

When discussing XRP, you’ll often hear it referred to as ‘Ripple’. A common misconception is that XRP and Ripple are one and the same – this isn’t the case. Put simply, Ripple is a blockchain-based payments protocol (created by Ripple Labs) that can make speedy international money transfers. XRP is actually the native cryptocurrency of the Ripple network and plays a crucial role in how these transfers are facilitated.

The idea for Ripple was formed back in 2004, although this was well before the concept of cryptocurrency became mainstream. It wasn’t until 2011 when Jed McCaleb started developing the XRP cryptocurrency using blockchain technology that Ripple became an actual entity. XRP was officially launched in 2012 and immediately began attracting attention from banks and other financial intermediaries.

Over the following years, XRP became one of the best altcoins in the market due to Ripple’s transformative potential within the banking sector. Many banks became interested due to the Ripple network’s (RippleNet) ability to facilitate fast and cost-effective cross-border payments. Given that the widely-used SWIFT network was becoming outdated, RippleNet seemed to be a natural progression for the sector as a whole.

The coin’s first bull run occurred in December 2017, when the Ripple price soared by over 1200% in a matter of weeks. This resulted in an all-time high of $3.84, which still stands to this date. Price immediately retreated from these lofty heights and trundled along until November 2020, with few notable increases occurring during this period.

Looking at the XRP price chart, the coin begins picking up steam in late 2020, with a 184% increase followed closely by a 795% surge. Notably, XRP could not sustain this bullish momentum – anytime a new high was posted, the coin’s price would immediately retreat. This trend continued until we reached the current XRP price of $0.7763 as of April 2022.

Here’s a quick overview of the significant events that have occurred during XRP’s lifespan:

- Began development in 2011 by programmer Jed McCaleb and was officially launched in 2012.

- Attracted huge attention from banks and other financial intermediaries, resulting in a massive surge in 2017.

- Hit an all-time high of $3.84 in January 2018, although immediately retreated from these heights.

- Experienced flat sentiment until late 2020, when volatility ramped up again.

- Has struggled to maintain upwards momentum in early 2022, with highs followed immediately by lows.

Cryptoassets are a highly volatile unregulated investment product.

XRP Price Prediction 2022

To ensure that you buy cryptocurrency safely, it’s crucial to understand a cryptocurrency’s prospects over the short and long term. Relating this to XRP, the coin has undoubtedly been volatile in recent months, making it challenging to predict where the price may go next. With that in mind, let’s take a closer look to see if we can make any estimations about the coin’s value potential.

At this point, it’s wise to touch on the regulatory issues that Ripple and XRP have been facing. As reported by CNBC, the Securities and Exchange Commission (SEC) filed a lawsuit against Ripple, claiming that the company sold $1.3 billion worth of unregistered securities through XRP. This started a protracted legal battle, in which Ripple claim they have done nothing wrong since XRP is not technically a security.

Essentially, the SEC want Ripple to pay this $1.3 billion as a fine (plus interest), which would stop the issue from reaching the courts. Over the past year and a half, there have been consistent rumours that the two parties would settle – yet this has not come to fruition. As it stands, the lawsuit looks likely to go to trial sometime this year, with the constant speculation causing intense volatility in the XRP stock price.

Ultimately, this volatility generates angst among investors who wish to buy XRP yet are not keen to see their capital wiped out by aggressive price swings. If the SEC were to win the case, the huge fine levied on Ripple would significantly impact their resources. However, if Ripple were to win, it would clear the way for the project to continue expanding – which would be hugely bullish for XRP.

Given these factors, our XRP price prediction 2022 estimates that the coin could be worth $1.90 by the end of the year – a 143% increase from today’s price.

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

XRP Price Prediction 2023

Effective long term investments within the cryptocurrency market tend to come in the form of cryptocurrencies with valuable real-world utility. XRP certainly has this, as the Ripple network offers a viable (and more attractive) alternative to current payments systems. Given that most banks in the developed world still use the SWIFT network, there’s undoubtedly a gap in the market that XRP could fill.

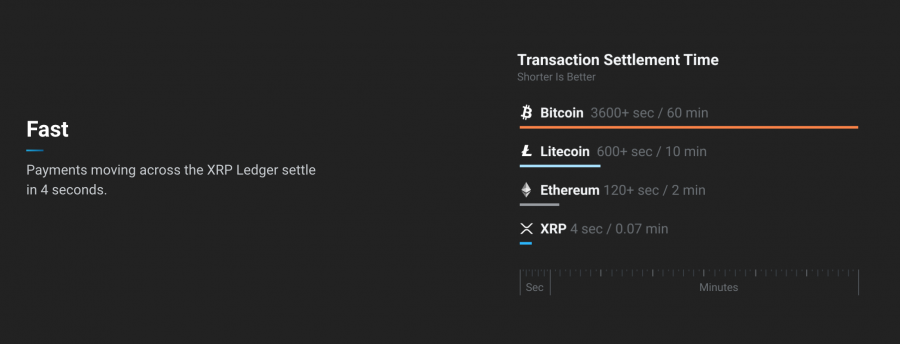

Firstly, the average speed of a cross-border transaction using RippleNet is only five seconds. Contrastingly, the average speed of a SWIFT transfer is 30 minutes – although they can sometimes take up to 24 hours. Naturally, a move to the Ripple Network would suit most parties, given the fast-moving nature of today’s economies.

Ripple also appears superior in terms of fees, as each transaction costs only 0.00001 XRP. This equates to a fraction of a cent, with the cost being so low that it would still be negligible, even if the Ripple XRP price showcased a 10x in value. Again, this is much cheaper than using the SWIFT network, which can charge upwards of 3% in exchange fees when making international payments.

XRP’s role in this payments system is as a ‘bridge currency’, making it cheaper to conduct FX transactions. If a bank wishes to convert USD to EUR, it can first purchase XRP using Dollars and then use the XRP to buy EUR – thereby avoiding exchange fees. Combine this with RippleNet’s fast processing times, and it’s clear to see why this cryptocurrency is viewed so highly.

If Ripple can move past the lawsuit and begin expanding once more, we’ll likely see many financial institutions start using the Ripple Network. Assuming this occurs, our XRP price prediction estimates the coin could reach $3 by the end of 2023.

XRP Price Forecast Long Term Outlook – 2025 Prediction

Given the information presented until this point, it’s natural to think that XRP could be one of the most undervalued cryptos in the market at present. Many analysts would agree with this assessment, as RippleNet already has numerous major partners, even considering the company’s legal issues.

According to Ripple’s website, the network is used by hundreds of companies in over 55 countries. These companies include household names such as Santander, Bank of America, and Itau Unibanco. Ultimately, this gives XRP tremendous credibility – and could lead to further partnerships in the future.

XRP’s technology is another reason why the coin could have a lucrative future, as it doesn’t use a Proof-of-Work (PoW) algorithm to achieve consensus like Bitcoin does. Instead, XRP uses its own consensus protocol where the network’s validators review proposed transactions, and if the majority accept it, it will be verified.

This approach to consensus is much less energy-intensive than PoW protocols, meaning XRP could be the best crypto to invest in for eco-friendly investors. However, in the interest of a balanced discussion, XRP is still considered ‘centralized’, given that it is controlled by Ripple Labs. As such, many crypto enthusiasts have steered clear of investing in the coin since it is not entirely decentralized.

Overall though, it does seem that XRP has an exciting future ahead of it, meaning our XRP price prediction 2025 estimates that the coin could reach a valuation of $5.50.

Cryptoassets are a highly volatile unregulated investment product.

Potential Highs & Lows of XRP

Those who buy Bitcoin will be well aware of the inherent volatility within the crypto market. This is no different with XRP, as the coin has experienced dramatic highs followed immediately by steep lows – often over the course of just a few days.

While conducting our research for this XRP price prediction, we noted some critical areas of support and resistance on the price chart, which are crucial to keep in mind going forward. These areas will cause consolidation or rejection, leading to greater short-term volatility.

The table below presents these areas, ensuring you know what to keep an eye out for in the years ahead:

| Year | Potential High | Potential Low |

| 2022 | $1.90 | $0.50 |

| 2023 | $3 | $1.40 |

| 2025 | $5.50 | $2 |

What is XRP Used For?

As you’ll be aware by now, XRP has a use case with real-world value, which could help drive the price over the coming years. However, there are other reasons to hold XRP, aside from its payment-processing power. With that in mind, let’s dive in and look at the coin’s primary use cases:

Fast and Cost-Effective Money Transfers

Naturally, sending money transfers is the main use case for XRP. Ultimately, this is why many consider it the best crypto under $1 since there are no other projects with the same scale as XRP. Cryptocurrencies such as Stellar offer a similar service, although they have not generated as much traction as the Ripple Network.

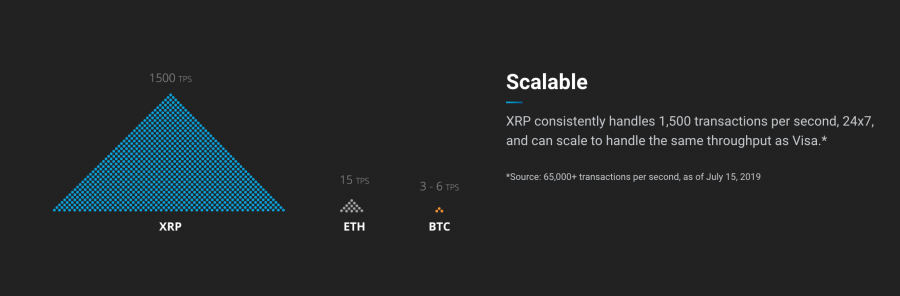

Furthermore, Ripple seems to have the upper hand in terms of scalability, with the network able to handle up to 1500 transactions per second. Finally, although XRP is still relatively centralized, this does mean that it benefits from support from Ripple Labs in terms of marketing and partner acquisition.

Speculation

Like all cryptocurrencies, XRP can also be used by investors for speculation. Given the coin’s growth over the past few years, XRP can be purchased on all of the best crypto exchanges with instant execution due to its high liquidity.

A glance at the XRP price chart will show the coin’s returns potential – especially for traders who are happy to take both long and short positions. Price has increased by over 43% in the last few weeks alone, although it surged a remarkable 165% during mid-2021. As you can imagine, these returns are improbable to be achieved with other asset classes.

Helping the Unbanked

Finally, XRP could also be used in developing nations to help residents without bank accounts. This can help accelerate financial inclusion and allow these people to transfer money quickly and easily. If this trend were to gather steam, it would naturally increase the demand for XRP – and result in greater returns for investors over the longer term.

What Drives the Price of XRP?

Up until this point, we’ve discussed XRP’s price movements and the coin’s use cases. But what actually drives the price of XRP? Detailed below are three of the main factors that influence the XRP price over the short and long term:

Ongoing Litigation

As discussed earlier, the ongoing legal battle between the SEC and Ripple Labs is one of the main drivers of XRP’s price. Naturally, investors are hesitant to commit vast amounts of capital to XRP positions because Ripple may have to pay a considerable fine, which would severely impact any future progress.

According to Yahoo Finance, both parties must begin presenting their motions this month with the hope that there will be some sort of agreement. However, if no deal is reached, the lawsuit will likely go to trial later in 2022.

Crypto Market Sentiment

Like most altcoins, XRP is still affected by the broader market sentiment. Due to its size, it isn’t affected as much as smaller coins, yet XRP still tends to follow the overall trend. There hasn’t been much in the way of crypto news over the past few weeks. However, macroeconomic factors (such as the war in Ukraine) have dampened the sentiment on crypto overall and forced investors into ‘safe haven’ assets.

Diminishing Coin Supply

Finally, XRP also has an inherent ‘burn’ implemented into its structure, meaning that 0.00001 XRP is destroyed after each transaction. Since there are 100 billion XRP tokens, this burn is negligible and unlikely to affect the price significantly. However, Ripple CEO Brad Garlinghouse has stated that he isn’t against burning the coins held in escrow, which would dramatically impact the total supply – and the coin’s price.

Where to Buy XRP

Now that you have a comprehensive understanding of our XRP price prediction over the short and long term, let’s focus on the investment process. If you’d like to buy XRP today, you’ll need to set up an account with one of the best altcoin exchanges that offer the coin as a tradable asset. Although there are numerous to choose from, we recommend opting for eToro.

Now that you have a comprehensive understanding of our XRP price prediction over the short and long term, let’s focus on the investment process. If you’d like to buy XRP today, you’ll need to set up an account with one of the best altcoin exchanges that offer the coin as a tradable asset. Although there are numerous to choose from, we recommend opting for eToro.

eToro is an online trading platform with over 24 million users, offering a wide array of stocks, ETFs, commodities, currencies, and cryptos to trade. The platform has a fantastic reputation in terms of its safety, boasting regulation from the FCA, ASIC, CySEC, FinCEN, and FINRA. In addition, eToro ensures traders can trade cost-effectively thanks to its transparent fee structure.

If you buy XRP (or any other crypto), eToro charges a flat 1% transaction fee, plus the bid-ask spread. This ensures that eToro’s trading fees are as low as possible and remain competitive with other top brokers and exchanges. In addition, since eToro offers fractional investing, clients can open crypto trades from as little as $10.

The deposit process is also streamlined, as users can fund their account using a credit/debit card, bank transfer, or e-wallet – with full support for PayPal, Skrill, and Neteller. Deposits are free to make (if made in USD) and arrive instantly for all payment methods other than bank transfer. The minimum deposit threshold is only $10, making it easy for beginner traders to start small and build their positions up.

eToro also offers a selection of helpful trading features, most notably, the platform’s ‘CopyPortfolio’ feature, which allows traders to invest in a professionally-managed portfolio with no management fees. Finally, eToro even offers one of the best crypto wallets on the market (called eToro Money), which can be downloaded for free and features advanced security protocols and support for a massive range of crypto assets.

- Low fees when crypto trading

- Over 50 cryptocurrencies available to trade

- Free crypto wallet app

- Handy CopyTrader feature

- The minimum deposit is only $10

- Regulated by numerous top organizations

Cons

- 0.5% fee when making a non-USD deposit

- USD is the only supported base currency

Cryptoassets are a highly volatile unregulated investment product. No UK or EU investor protection.

Is XRP the Best Crypto to Buy in 2022?

XRP is undoubtedly one of the top cryptocurrencies on the market, primarily due to its valuable use case and future price potential. However, due to Ripple’s ongoing legal issues, you may wish to consider investing in an alternative cryptocurrency. If that is the case, we recommend checking out Lucky Block.

XRP is undoubtedly one of the top cryptocurrencies on the market, primarily due to its valuable use case and future price potential. However, due to Ripple’s ongoing legal issues, you may wish to consider investing in an alternative cryptocurrency. If that is the case, we recommend checking out Lucky Block.

Lucky Block is an innovative crypto-lottery platform built on the Binance Smart Chain that seeks to improve the fairness and transparency of the lottery process. Unlike current lotto systems, Lucky Block is entirely decentralized and leverages blockchain technology to enhance the user experience.

Since Lucky Block’s draws are held on the blockchain, this removes geographical barriers and allows people worldwide to enter. In addition, Lucky Block’s native token, LBLOCK, plays a vital role in the ecosystem and is used for distributing prizes to winners. As noted in Lucky Block’s whitepaper, LBLOCK holders will receive regular dividend payments – simply for holding the token in their connected crypto wallets.

Based on conservative estimates, the yield on offer to LBLOCK holders is set to be upwards of 19% per year. Notably, the yield is directly correlated with the number of users on Lucky Block’s lottery platform. Therefore, once lotto draws commence and more people gravitate to the platform, the yield could rise even further.

With over 44,000 people now part of Lucky Block’s Telegram group, the hype is undoubtedly ramping up for this crypto. Given the quadruple-digit gains experienced by investors since LBLOCK was listed on PancakeSwap, it’s natural that LuckyBlock has attracted this much attention. However, with LBLOCK hovering around the $0.0030 level at the time of writing, there’s an excellent opportunity for investors to purchase tokens at a discount before the next upwards surge.

If you’re looking to buy Lucky Block today, you can do so by following the steps presented below:

- Step 1 – Set Up a Crypto Wallet: Open a crypto wallet compatible with the Binance Smart Chain, such as MetaMask or Trust Wallet.

- Step 2 – Buy Binance Coin: Purchase some Binance Coin (BNB) from a trusted broker or exchange and transfer your holdings to your crypto wallet.

- Step 3 – Link Wallet to PancakeSwap: Go to PancakeSwap’s homepage, click ‘Connect Wallet’, and follow the steps to link your crypto wallet.

- Step 4 – Buy Lucky Block: Enter Lucky Block’s contract address into the order box (0x2cD96e8C3FF6b5E01169F6E3b61D28204E7810Bb), choose the amount of BNB you’d like to swap for LBLOCK, and confirm the transfer.

Cryptoassets are a highly volatile unregulated investment product.

XRP Price Prediction – Conclusion

In summary, this guide has presented our in-depth XRP price prediction, derived through technical, fundamental, and macroeconomic analysis. XRP has undoubtedly had a tough time in recent months, driven primarily by the ongoing legal battle with the SEC. However, if XRP can come out the other side unscathed, there’s great potential for the coin going forward.

If you’re looking for an alternative crypto to purchase or are interested in diversifying your crypto portfolio, we recommend checking out Lucky Block. Lucky Block’s rise to prominence in 2022 has been remarkable, with investors already experiencing quadruple-digit gains. With plans for the token to potentially be listed on numerous centralized exchanges (including Binance), now could be a great time to invest in LBLOCK before it surges once more.

Cryptoassets are a highly volatile unregulated investment product.

FAQs

Will XRP ever reach $1?

What will XRP be worth in 2025?

What is the current price of XRP right now?

What was the starting price of XRP?

What was XRP’s highest price?

This news is republished from another source. You can check the original article here

Be the first to comment