The crypto market is generally about where it was sitting this time yesterday, stabilising again after a bit of a Bitcoin dip back under US$50k earlier in the day.

Meanwhile, a group of six crypto chiefs have been meeting on Capitol Hill with US Congressional members of the House Financial Services Committee.

The hearing is titled “Digital Assets and the Future of Finance” and the identities being queried about stablecoins, regulatory matters and the US crypto industry in general, include: Circle CEO Jeremy Allaire; FTX CEO Sam Bankman-Fried; Bitfury CEO Brian Brooks; Paxos CEO Charles Cascarilla; Stellar Development Foundation CEO Denelle Dixon; and Coinbase CFO Alesia Haas.

Notably, Brooks was the Comptroller of the Currency in the Trump administration, worked as Coinbase’s chief legal officer, and was also the Binance.US CEO for a few months, before resigning from that post in August.

Today we have a hearing on digital assets and blockchain (web3). The bulk of commentary in Congress has been on individual assets and relating to the traditional finance world. This misses the bigger picture entirely.

— Rep. Anthony Gonzalez (@RepAGonzalez) December 8, 2021

Believe it not he’s also playing League here. pic.twitter.com/S6LHfieIU5

— Sam Trabucco (@AlamedaTrabucco) December 8, 2021

The hearing is a full house, meaning roughly 50 committee members all get their chance to ask the crypto CEOs questions and attempt to gain clarity on any industry-related concerns they may have.

How the market responds to what comes from all this is anyone’s guess just at this very moment. But the fact the crypto conversation continues to be an important part of the agenda at the highest levels is testament to how far the industry has come on a global scale.

In response to requests from the crypto CEOs to provide regulatory clarity, congressperson Patrick McHenry said that the technology in the crypto space was “already regulated”. However, he did acknowledge that:

“We need reasonable rules of the road. We know that. We don’t need knee-jerk reactions by lawmakers to regulate out of fear of the unknown rather than seeking to understand. And that fear of the unknown in the move to regulate before understanding will only stifle American ingenuity and put us at a competitive disadvantage.”

There will be a separate Senate Banking Committee hearing to follow up early next week, and that will focus specifically on stablecoins.

6 minutes in and Crypto Twitter already gets a shout out. https://t.co/HnoocEfJGR

— Nathaniel Whittemore (@nlw) December 8, 2021

Mooners and shakers

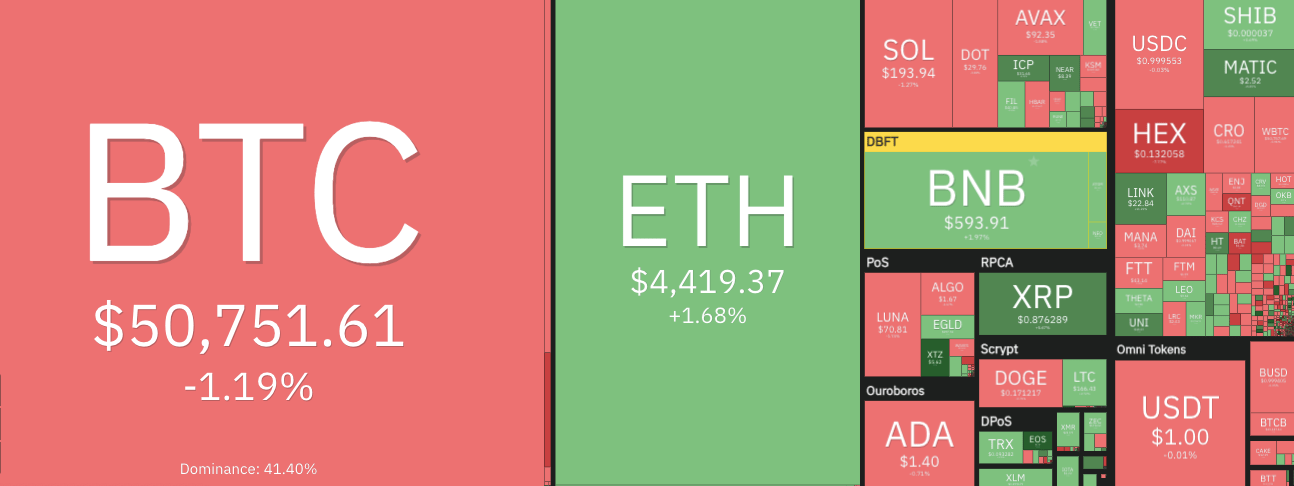

At the time of writing, the entire crypto market cap is about 0.1 per cent down from this time yesterday, with a total valuation of roughly US$2.52 trillion, give or take a few hundred million.

Right now at least, Bitcoin (BTC) is back above US$50k again, having dipped below US$49k a few hours ago, while Ethereum (ETH) is looking good at the moment for potential continued upside to many observers – including the popular trader Bluntz…

$eth low timeframe structures on usd pair and btc pair are promising, it wants higher. pic.twitter.com/3uPyaDdeJk

— Bluntz (@SmartContracter) December 7, 2021

#BTC investors are still fearful but that doesn’t mean you should be, too$BTC #Crypto #Bitcoin pic.twitter.com/E1B88frxjm

— Rekt Capital (@rektcapital) December 8, 2021

With not much else of note happening in the top 10 by market cap, let’s look further down the list…

Chainlink (LINK) is currently posting a 10.2% spike across the past 24 hours. While other notable gainers include: layer 1 platforms Near (NEAR) +16%, Tezos (XTZ) +30%, and EOS (EOS) +14%; and, curiously, a Chinese-built supply-chain solution that was a big pumper back in 2017 – Waltonchain (WTC) +30%.

Tezos is still pumping pretty hard on the back of the announcement of its NFT-based collaboration with gaming giant Ubisoft.

So…@Ubisoft released their first in-game playable NFTs on @tezos.

You will ACTUALLY be able to use them in the game Ghost Recon: Breakpoint!

Let’s unpack this whole thing,

1/ Thread, pic.twitter.com/blLXutdAe1

— Matty (@DCLBlogger) December 8, 2021

No time for losers? We can spare another minute or two. In fact, TIME, aka the Avalanche-based DeFi protocol WonderLand, is one of them today – it’s down 17% in the past 24 hours. While some others taking a bit of a hit include: the Chainlink oracle competitor API3 -16%; and some promising gaming-related tokens: Altura (ALU) -15%, and UFO Gaming (UFO) -13%.

This news is republished from another source. You can check the original article here

Be the first to comment