Bitcoin and Ethereum have been looking in better shape over the past 24 hours on the back of prominent big-tech companies unexpectedly flipping positive again and the US Dollar Index taking a five-day dip.

Some relief materialised yesterday for recently battered US tech stocks, particularly Amazon, which experienced a dramatic 15% spike. And this appears to have flowed some positive sentiment/hopium to the world of Bitcoin and crypto investing today.

That said, the US stock markets are reopening again as this is written, so it’s probably best to not get too far ahead of ourselves, especially when there are still plenty of bears prowling and expecting BTC to sink lower again.

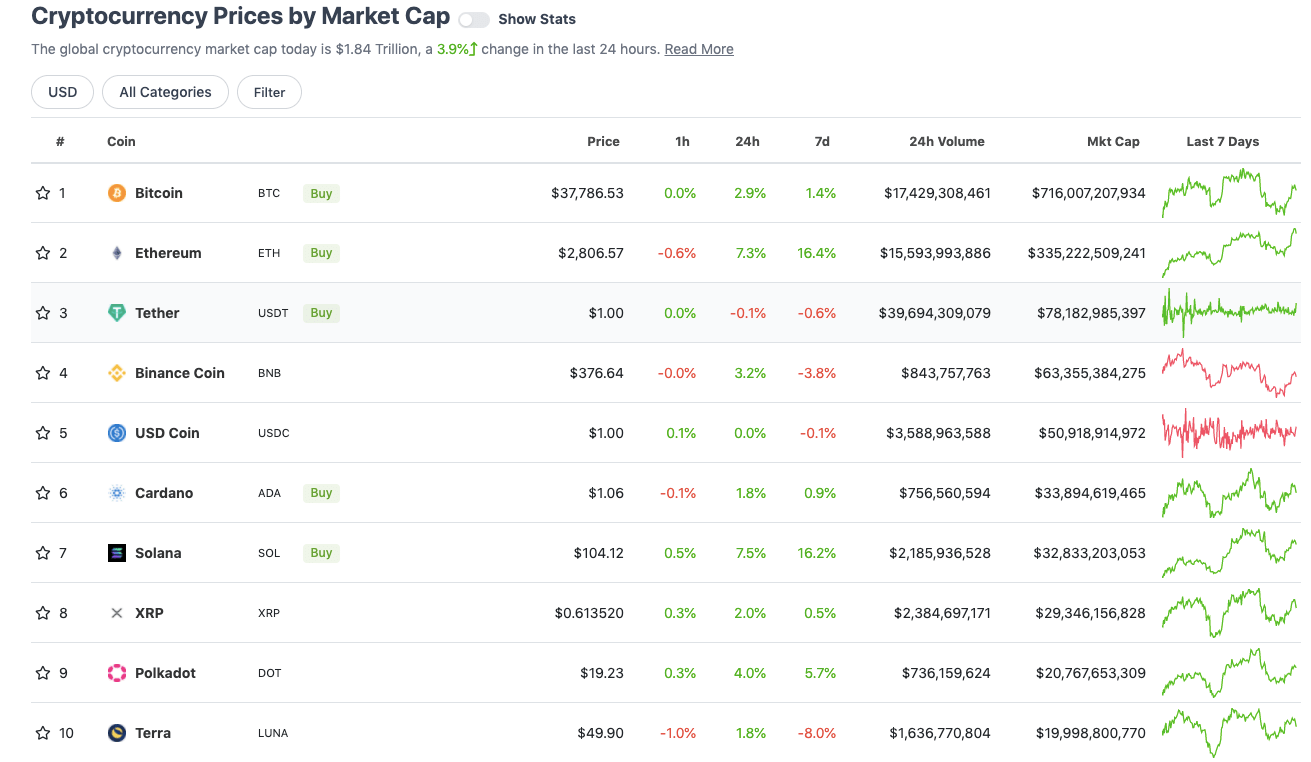

Top 10 overview

With the overall crypto market cap up about 4% over the past 24 hours, here’s the state of play in the top 10 by market cap right now – according to CoinGecko data.

Layer 1 platform tokens Ethereum (ETH) and Solana (SOL) are leading the way among top coins at the time of writing, with Polkadot (DOT) an honourable mention (+4%), along with Avalanche (AVAX), which is sitting just outside the 10 with a 6% daily gain.

It’s too early to call this a recovery, but if Layer 1-token momentum continues past unreliable weekend trading activity and stays strong on Monday, then maybe that’s more of a conversation.

A lot of eyes are on Ethereum, which, like Bitcoin, tends to act as a half-decent barometer for overall market health, considering the size and dominance of its network. Over the past 24 hours, it’s been trading at its highest levels since plummeting by more than 35% in mid-January.

Instead of searching for some short-term, price-charting analysis today, though, some recent zoom-out words from Bloomberg’s senior commodity strategist Mike McGlone have stuck with us. Not a bad reminder heading into the weekend…

#Bitcoin and #Ethereum remain in early adoption days, with increasing demand vs. declining supply and related price implications. Our bias is why complicate it — unless something unlikely reverses the proliferation of the nascent technology, prices should rise over time. pic.twitter.com/SAgqWrfIMV

— Mike McGlone (@mikemcglone11) January 29, 2022

Winners and losers: 11–100

Sweeping a market-cap range of about US$18.5 billion to about US$909 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time.

DAILY PUMPERS

• JUNO (JUNO), (market cap: US$985m) +20%

• Leo Token (LEO), (mc: US$4.6b) +20%

• Convex Finance (CVX), (mc: US$1.34b) +14%

• Monero (XMR), (mc: US$2.87b) +12%

• Neo (NEO), (mc: US$1.54b) +11%

DAILY SLUMPERS

• LooksRare (LOOKS), (market cap: US$984m) -4%

• Maker (MAKER), (mc: US$2b) -2%

• Tezos (XTZ), (mc: US$3.35b) -1%

• Decentraland (MANA), (mc: US$3.97b) -0.2%

Lower-cap winners and losers

Moving below the crypto unicorns (in some cases well below), here’s just a selection catching our eye…

DAILY PUMPERS

• Just (JUST), (market cap: US$434m) +40%

• Request (REQ), (mc: US$223m) +33%

• Acala (ACA), (mc: US$108m) +26%

• Benqi (QI), (mc: US$98m) +25%

• DigitalBits (XDB), (mc: US$361m) +23%

DAILY SLUMPERS

• Immutable X (IMX), (market cap: US$638m) -30%

• Ampleforth (FORTH), (mc: US$68m) -24%

• IDEX (IDEX), (mc: US$124m) -22%

• Strike (STRK), (mc: US$123m) -12%

• IRISnet (IRIS), (mc: US$89m) -8%

Final words

3-month long diagonal downtrend broken. $BTC

Still think 40-41K is the key level to break. pic.twitter.com/DxCKtakXrW

— Will Clemente (@WClementeIII) February 4, 2022

#Bitcoin pic.twitter.com/ZQNODAPTyN

— naiive (@naiiveclub) February 3, 2022

This news is republished from another source. You can check the original article here

Be the first to comment