Source: gettyimages

Summary Table

Best Ethereum IRA Companies at a Glance:

‘Regal Assets Logo from regalassets.com’#1 Regal Assets |

‘BitCoin IRA Logo from bitcoinirainvestment.com’#2 Bitcoin IRA |

‘Retire With Choice Logo from retirewithchoice.com’ |

‘Trust ETC Logo from trustetc.com’#4 Trust ETC |

‘iTrust CapitaLogo from itrustcapital.com’ |

|

|---|---|---|---|---|---|

| Full-Service Gold IRA |

✅ |

✅ |

❌ |

❌ |

❌ |

| Fees | $250 Annually | $195 Annually + $50 Setup Fees | 1% Annually | $70 Annually + $50 One-time Fee | $30 Monthly |

| Offers Other Alternative Assets |

✅ |

❌ |

✅ |

✅ |

✅ |

| Storage | Cold Storage | Cold Storage | Cold Storage | Cold Storage | MPC Cold Storage |

| Headquarters | Los Angeles, CA | Los Angeles, CA | Murray, KY | West Lake, OH | Irvine, OH |

| Free Investment Kit | REQUEST FREE KIT |

❌ |

❌ |

❌ |

❌ |

Introducing Ethereum IRAs

Cryptocurrencies have become the latest craze for people to add to their Individual Retirement Accounts (IRAs). Gold IRAs and Silver IRAs are common avenues for people to protect their nest eggs with tangible assets, stable stores of value, diversification, and protection from economic risks. With high inflation and interest rate hikes that may only get harsher in today’s environment, this has become a popular way to start an IRA. Especially with gold’s value known to act as a hedge and inversely correlate with the stock market.

While newer to the scene, Crypto IRAs offer some of these same qualities but with more potential long-term upside.

According to Bank of America, digital currencies could have a $2 trillion+ market value with 200 million+ users and spearhead the new age of global finance. Crypto makes international financial transactions borderless, efficient, and seamless while offering attributes akin to potential “digital gold.” As MicroStrategy CEO Michael Saylor says, “it is pretty clear digital gold is going to replace gold this decade.”

Bitcoin IRAs are the more established choice for crypto IRA enthusiasts. As the largest and most established cryptocurrency, they offer those curious to add crypto exposure to their retirement accounts a semblance of stability with long-term upside. These IRAs have been around for roughly six years, give or take.

Mainstream adoption is increasing, too, with Colorado recently becoming the first U.S. state to accept crypto for tax payments.

Furthermore, 2021 marked Bitcoin’s third consecutive year, outperforming gold and the broader equity market. A CNBC report also showed that Bitcoin IRAs surged in popularity in 2021 as a vehicle for building long-term wealth while reaping the tax benefits of IRA accounts.

Bitcoin IRA accounts, however, don’t exclusively contain Bitcoin. While Bitcoin is the primary crypto holding, these IRA accounts often possess several other cryptocurrencies and altcoins.

Recently, many savvy investors have shifted their crypto IRA accounts to become Ethereum IRAs. Although Bitcoin IRAs, to date, are better known, Ethereum provides investors with a whole new avenue of exposure to a different segment of the crypto universe and long-term potential.

What is Ethereum, and How Does it Differ From Bitcoin?

Comparisons between Bitcoin and Ethereum, especially when it comes to IRA accounts, are inevitable. Bitcoin remains the largest and most established cryptocurrency. Ethereum has rapidly gained ground as the second-largest cryptocurrency by market cap over the last few years.

Source: CoinMarketCap

Bitcoin (BTC) and Ethereum (ETH) have inherent similarities. Both are investable cryptocurrencies, decentralized, and deregulated. Each is on the blockchain, stored in digital wallets, and powered by distributed ledgers and cryptography.

However, that is about where the similarities end.

Primary Purposes

Satoshi Nakomoto created Bitcoin in 2009 on the heels of the financial crisis recession. Its purpose was to compete with fiat currencies as an electronic P2P currency system, medium of exchange, and store of value comparable to digital gold. Whether or not it’s accomplished all of those goals is debatable.

Ethereum, on the other hand, was built with a different purpose. It’s an avenue for developers to monetize smart contracts, create decentralized apps (dApps), and build on top of existing programming languages. Vitalik Buterin co-created Ethereum in 2013 as a Blockchain to facilitate immutable, programmatic contracts. Chances are, it’s served its initial purpose more than Bitcoin has.

Numerous surging areas in the crypto ecosystem, such as Decentralized Finance (DeFi), exchanges, NFTs, crypto gaming, and more, were built and monetized on the Ethereum blockchain.

So in many ways, Bitcoin and Ethereum are not direct competitors but rather cohabitors in the same universe. Yet the Ethereum ecosystem, especially as it upgrades to Ethereum 2.0, is growing exponentially. It is “open-sourced” and decentralized and offers “smart contracts,” making it fully programmable. Ethereum, more so than Bitcoin, has revolutionized the crypto ecosystem for developers as a medium to build real-world, fully customizable applications.

Perhaps that’s why over the last 2 years, Ethereum’s skyrocketing value has dwarfed that of Bitcoin’s by almost a whopping 2,000%.

Source: Stockcharts

“Digital Gold vs. Digital Silver”

Gold and silver are precious metals that naturally compete, especially when it comes to IRA accounts. Gold is considered a store of value and inflation hedge because of limited supply and stability. Silver has similar attributes while offering more widespread industrial uses, affordability, and liquidity. Russ Koesterich of BlackRock notes that silver has more industrial uses than gold, such as electronic devices, electrical systems, and solar panels. Silver is also integral to an EV industry that could be a potential $46 trillion juggernaut industry by 2050, notably for “the electric engine, battery pack, and battery management system.” According to Morgan Stanley, silver is significantly cheaper than gold and more accessible to small retail investors. Moreover, silver is liquid, ubiquitous, and versatile in trading.

Of course, similar to Bitcoin and Ethereum, gold and silver are 1 and 2 regarding precious metal market value.

Bitcoin is often compared to digital gold because it was the first cryptocurrency. It also has the largest market cap and is in limited supply, making it a digital store of value. Ethereum is often compared to digital silver because it is the second-largest cryptocurrency. Like silver, it serves various purposes for a wide range of applications. It is also cheaper than Bitcoin and more liquid.

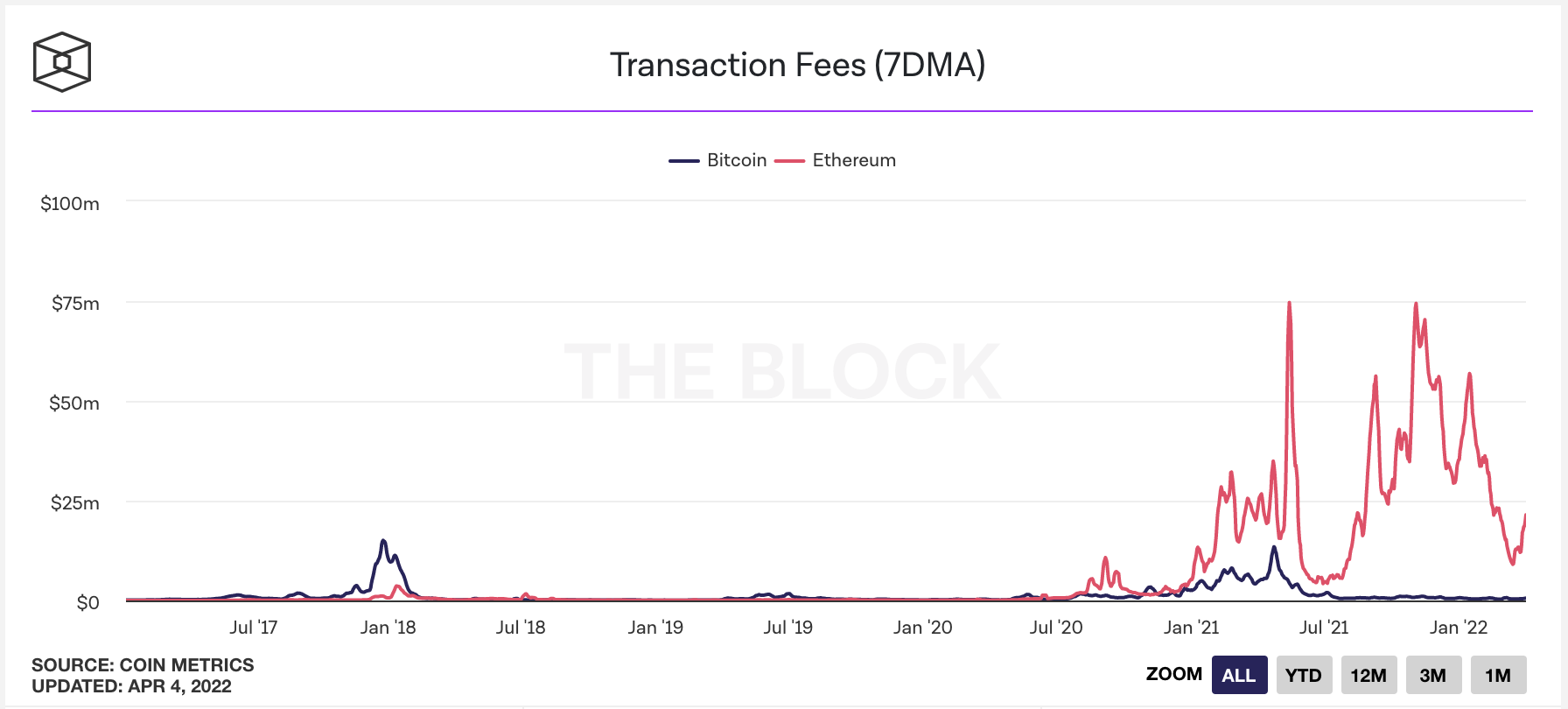

Transactions

When it comes to transaction fees, Bitcoin remains significantly cheaper than Ethereum. Bitcoin’s transactions are also monetary, with notes and messages affixed and encoded within data fields in its transactions. In contrast, Ethereum transactions contain executable code for creating smart contracts or self-executing contracts and applications built on top of them.

Source: TheBlockCrypto

However, you often get what you pay for. Ethereum’s transaction speed is infinitely faster than Bitcoin’s. The block time, which determines how long it takes for transactions to get confirmed, takes roughly 10 minutes for Bitcoin and 15 seconds for Ethereum. Bitcoin’s transaction throughput is only about 7 per second, compared to Ethereum’s 30 per second.

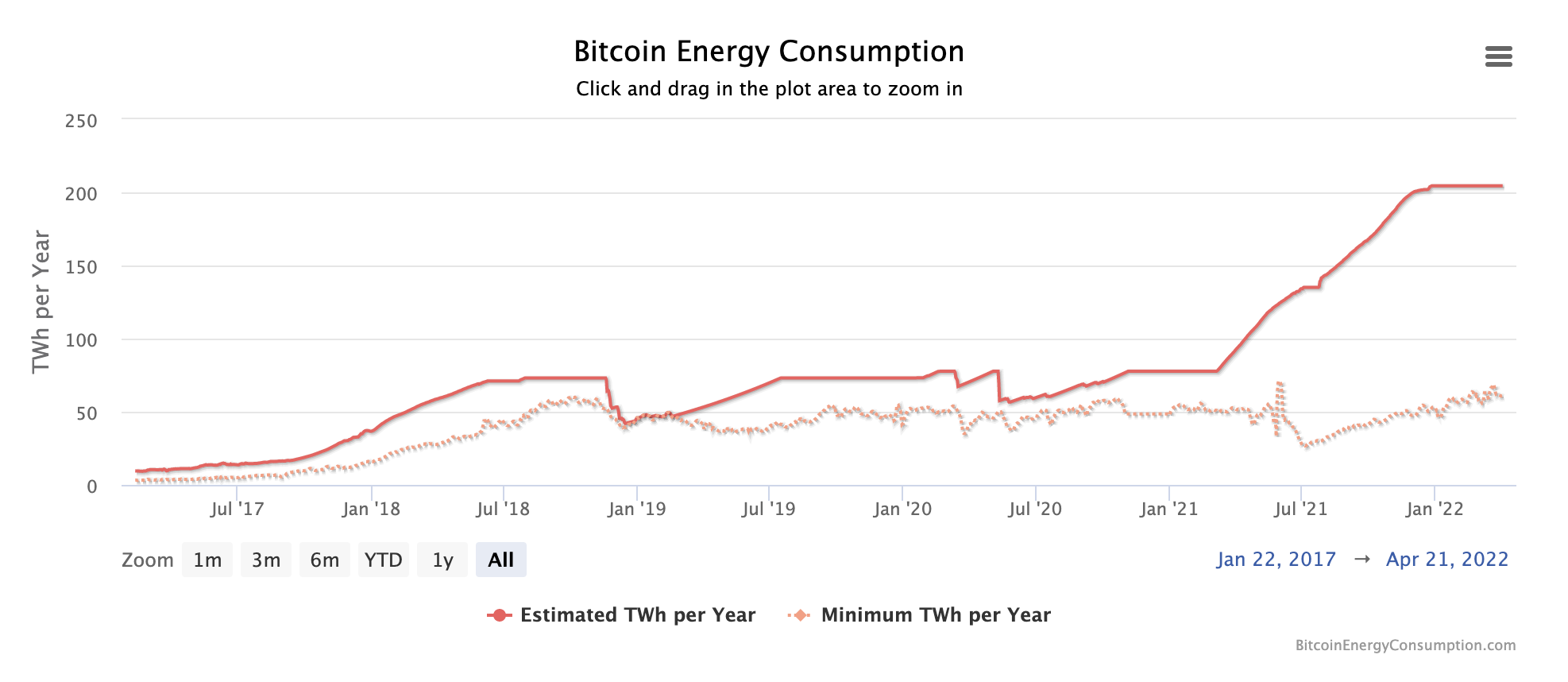

Energy Consumption/Staking

Both Bitcoin and Ethereum use proof of work (PoW) protocol. Proof of Work is a mechanism for networks to validate information recorded on their blockchains and is used widely in cryptocurrency mining for new tokens.

Outside of congestions and lag times with proof of work protocols, proof of stake consumes enormous energy. While Ethereum plans to move to proof of stake (PoS) technology, Bitcoin will remain with PoW. PoS substitutes computational power with staking—making it less energy-intensive—and replaces miners with validators.

Currently, machines performing the “work” for Bitcoin consume vast amounts of energy primarily sourced from fossil fuels.

Source: DigiConomist

Per year, Bitcoin’s Carbon Footprint is comparable to the carbon footprint of the Czech Republic. Its power consumption compares to Thailand, and its small IT equipment waste is on par with the Netherlands.

That doesn’t even take into account what ONE single Bitcoin transaction wastes. One transaction is equivalent to the carbon footprint of 2,645,939 VISA transactions or 198,972 hours of watching Youtube, wastes about as much power as an average U.S. household over 73.36 days, and wastes about as much electricity as the weight of 2.18 iPhones 12 or 0.73 iPads.

How to Add Ethereum to Your IRA Account

Now that we’ve gone through how Ethereum differs from Bitcoin let’s go through how you can add Ethereum to your IRA account. With more and more people realizing the widespread benefits of Ethereum, especially with how DeFi, NFTs, and the blockchain space continue evolving and growing, many are starting to see the long-term benefits of Ethereum and are opting to add it to their IRA accounts.

Bitcoin IRAs are still a new phenomenon, and Ethereum IRAs are even more recent. So it’s essential to understand what to do from start to finish, especially considering how traditional brokerage accounts typically do not support crypto IRAs.

It’s a simple process and takes 4 steps.

Step 1: Choose the type of IRA account you want

Ethereum IRA accounts, like Bitcoin IRAs or Gold and Silver IRAs, are self-managed or self-directed accounts. As the account holder, you are entirely in charge of selecting the assets in the IRA account.

You will have the option to choose between two types of self-directed retirement accounts:

Roth Ethereum IRA

- After-tax retirement savings account that works just like any Roth IRA.

- No upfront tax deduction with contributions.

- Zero requirements to pay taxes later on when you retire and begin to take distributions.

Traditional Ethereum IRA

- Tax-deferred retirement savings account.

- Contributions and gains will not be taxed.

- Typically tax-deductible contributions.

- Annual contribution limits are $5,500 if under age 50 and $6,500 if above 50.

- Must pay taxes on distributions during retirement.

Beyond account type, you have to consider storage solutions and exchange solutions. Storage Solutions digitally stores and encrypts your crypto assets to protect them from theft or loss. Exchange Solutions facilitates live crypto trading.

Step 2: Use a reputable Ethereum IRA company to set up your account

Ethereum IRA accounts are self-managed; however, it’s essential to partner with a trusted third-party custodian to help set up your account. In reality, though, a reputable custodian does so much more. They provide FDIC insurance and technical support, ensure full IRS compliance, and handle all storage and exchange solutions.

When choosing a provider, make sure to exercise discretion and go with one that provides all the required services. They must also understand crypto just as much as retirement accounts. Most importantly, they must have a sterling reputation from multiple sources and a strong track record.

Step 3: Fund your account

There are several ways you can choose to fund your IRA account. You can do a direct bank transfer, IRA rollover, or direct IRA-to-IRA transfer. A top-notch IRA custodian can help facilitate any of these if you want to start an Ethereum IRA.

Custodians are especially useful when it comes to rollovers, aka transferring funds from an existing IRA or any employer-sponsored account (barring restrictions) to a new Ethereum IRA.

Step 4: Choose your assets

Just because it’s called an Ethereum IRA doesn’t mean you have to limit yourself to only owning Ethereum. Working with your IRA provider can help you select a basket of crypto assets to hold in your retirement account and store in secure digital wallets.

The Benefits of an Ethereum IRA

There are several benefits that an Ethereum IRA can offer you.

1. Diversification

Whether or not you are a crypto bull, crypto is now an asset class, just as any equity sector or commodity. In today’s economic and geopolitical environment, diversifying with multiple asset classes, including crypto, is paramount.

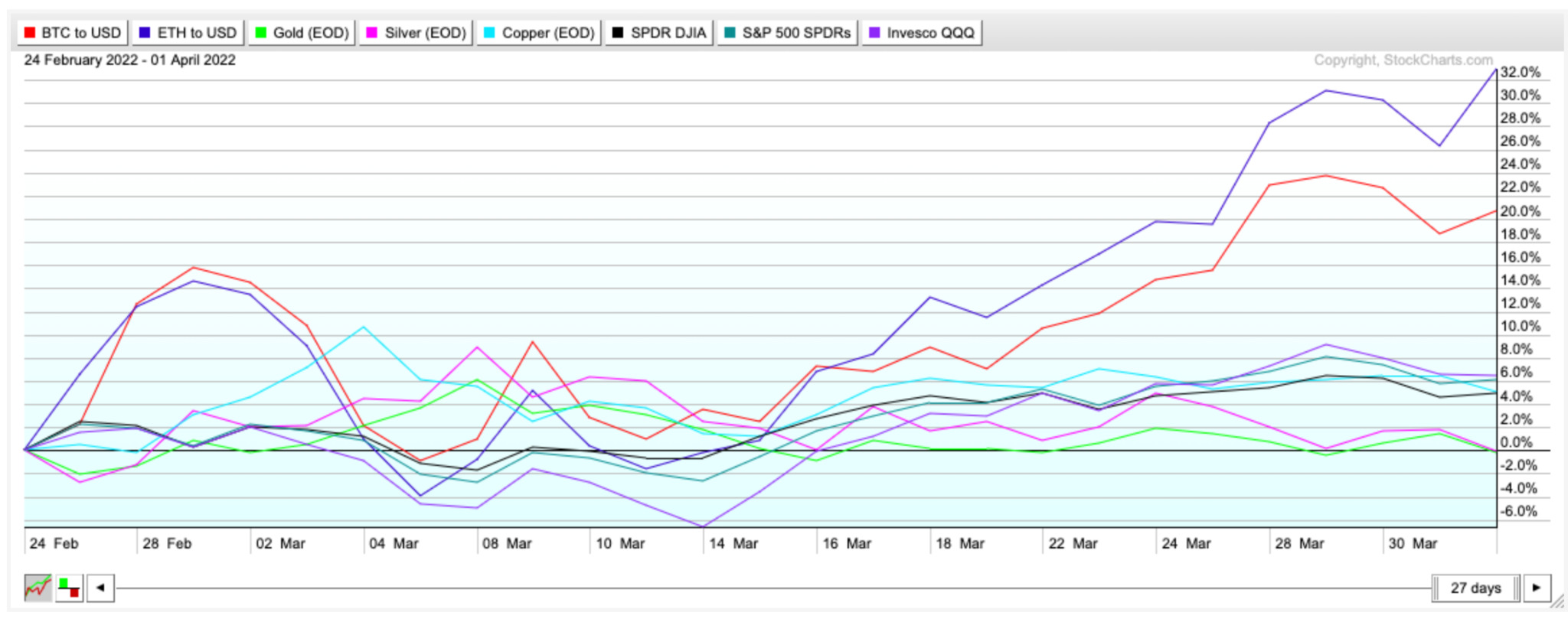

You can see it first hand too, when you compare the returns of Ethereum to those of Bitcoin, Gold, Silver, Copper, and Dow Jones, S&P 500, and Nasdaq ETFs. Ever since Russia invaded Ukraine on February 24, 2022, as of April 1, 2022, Ethereum has been the biggest gainer, dwarfing the others with a 33% rally.

Source: Stockcharts

Many reputable financial sources recommend allocating a portion of your portfolio to crypto assets. Fidelity’s Bitcoin Investment Thesis suggests dedicating 5% of a multi-asset portfolio to Bitcoin. Other studies, however, say to allocate assets into other cryptos, namely a 2019 Yale study that recommended allocating 4% to 6% towards a basket of cryptos. Many other financial advisors, CFPs, and financial experts are beginning to adopt a roughly 1% to 5% asset allocation recommendation.

2. IRS-Compliant

Ethereum IRA accounts are fully IRS-compliant for one simple reason. The IRS sees crypto as a capital asset, like any other security. Therefore, it is fully acceptable under IRS guidelines to hold cryptocurrencies in an IRA.

You should be fine as long as you aren’t purchasing life insurance, a collectible, or directly violating the Internal Revenue Code Section 4975(c).

3. Tax benefits

The tax benefits of an IRA account are their strongest selling point over a regular bank account, or in this case, a crypto wallet. Tax benefits work the same way for Ethereum IRA accounts as with any traditional IRA account. You need to make sure you pick the right one, though.

Like other types of IRA accounts, Ethereum in an IRA is a capital gains tax shelter. Depending on the type of IRA you choose, you can have tax deductions for deposits or tax-deferred or tax-free growth on earnings.

However, what makes an Ethereum IRA especially attractive is that dealing with crypto taxes is a headache. Not only do you have to account for capital gains any time you sell crypto at a profit for USD or any other fiat currency. To ensure tax compliance, you must physically record every trade and document precisely what each trade gained. With an Ethereum IRA, you don’t have to worry about that nonsense.

4. Exposure to Ethereum’s rise and Web3

Ethereum is one of the most exciting investible digital assets today. The short-term rise of Ethereum has been apparent compared to Bitcoin, other tangible assets, and the broader equity markets.

Long-term, it has a robust development roadmap that can offer enormous potential, significantly as it upgrades to Ethereum 2.0. Moreover, because of Ethereum’s programmability, it not only gives you exposure to booming DeFi and dApp spaces. It powers an NFT space that’s more than just pricey animations. Digital Journal says the global NFT market could multiply by nearly 5x at a 23.3% CAGR by 2028 and could power the next iteration of the internet: Web 3.0.

Understanding the Cons

Ethereum’s long-term potential is clear. Yet, before adding it to your IRA, understand some of the cons and drawbacks first.

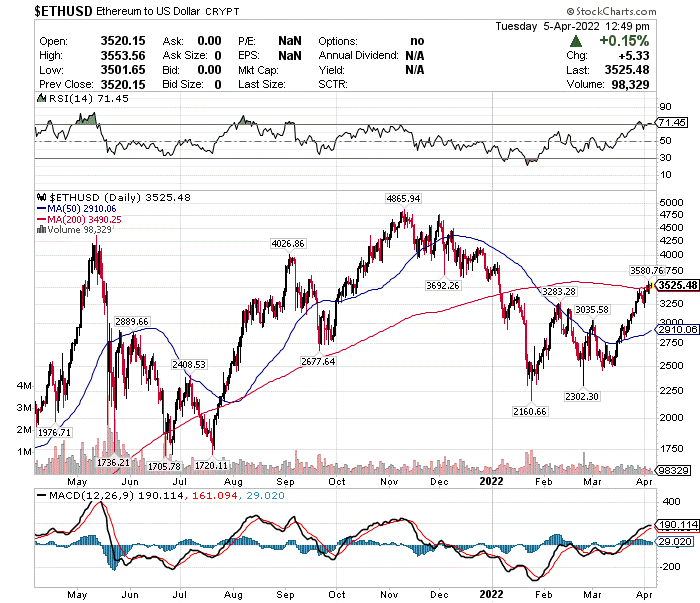

First and foremost, there are significant volatility risks. Ethereum’s volatility even compared to Bitcoin, is high. Yes, Ethereum has massive return potential and has crushed other asset classes ever since its inception and recently. Yet, with significant returns come big risks and instability.

For instance, we discussed how well Ethereum had performed ever since the Ukraine invasion. However, if you backtrack and look at its 1-year chart, you can see violent price swings and distinct peaks and valleys. Just understand that this is par the course with crypto assets and newer assets perceived as riskier.

Source: Stockcharts

Opportunity Costs are another issue. Allocating a certain amount of funds in your IRA to a particular asset, such as Ethereum, uses up precious, limited contribution space ($6,000-7,000 per year) that could go towards other assets. Crypto IRAs typically come with higher minimum investment requirements than other IRAs. That doesn’t even include recurring management, custodial, and maintenance fees, which, mind you, are typically higher. Not to mention the complex fee structures that most Ethereum IRA providers possess.

Signs also look like increased regulation for crypto is inevitable, as President Biden recently signed an executive order for federal strategy regulating digital assets.

Top 5 Ethereum IRA Companies

If you want to start an Ethereum IRA, choosing a high-quality Ethereum IRA provider is easily the most critical step. Ensure your due diligence and go with a provider that offers the following characteristics:

- Longevity

- Ease of Use

- Ratings and Customer Reviews

- Fees

- Storage Capabilities

- Founder and Executive Team

- Data Security and Customer Safety

- Customer Service

Considering these characteristics, we made your research a little bit easier with this list of our Top 5 Ethereum IRA companies.

Best Ethereum IRA Companies

‘Regal Assets Logo from regalassets.com’

#1 – Regal Assets

- Website: regalassets.com

- Phone: 1-877-205-1104

- Founded: 2009

- Founder: Tyler Gallagher

- Annual Fees: $250

- Assets offered: Cryptocurrencies, IRA-approved Gold/Silver/Platinum/Palladium Bullion Coins & Bars.

- Storage: Cold Storage, Segregated

- Offices: Los Angeles (CA), Waco (TX), Toronto (Canada), Dubai (UAE), London (UK)

Regal Assets possesses the qualities anyone would want in an Ethereum IRA company. Established roughly 12 years ago, it covers the longevity criterion off the bat. It’s user-friendly and straightforward to start an account. Highly respected and a top-rated alternative asset firm, it received a Top 20 ranking by the famous INC 500 and recognition from Forbes, Smart Money, the Huffington Post, and more.

Regal also offers exceptional customer service and has crypto experts providing customers with the necessary support to make wise investment decisions.

It offers cold storage and segregated storage, minimal annual fees of $250, and exposure to various asset classes, including precious metals and numerous cryptocurrencies, with its “Regal IRA.”

Specific cryptos, besides Ethereum and Ethereum Classic, you can add with Regal include:

- Bitcoin

- Aave

- Basic Attention Token (BAT)

- Bitcoin Cash

- Bitcoin SV

- Cardano (ADA)

- ChainLink

- Cosmos (Atom)

- Dash

- Dogecoin

- EOS

- Icon (ICX)

- Litecoin

- Maker (MKR)

- STASIS EURO (EURS)

- Stellar (XLM)

- Tezos (XTZ)

- XRP

- Zcash

‘Bitcoin IRA Logo from BitcoinIRA.com’

#2 – Bitcoin IRA

- Website: www.bitcoinirainvestment.com

- Phone: 877-936-7175

- Founded: 2016

- Founder: Chris Kline

- Annual Fees: One-time service fee depending on account size

- Assets offered: Bitcoin, Ethereum, Ethereum Classic, Bitcoin Cash, Litecoin, Ripple, Stellar Lumens, Z Cash, and Digital Gold

- Storage: Segregated Cold Storage

- Offices: Sherman Oaks, California

If you want longevity, BitcoinIRA.com is your pick. This company was the world’s first to offer Bitcoin IRA services and now provides a cutting-edge way to include Ethereum and other cryptos in a retirement account. In addition to cryptos like Bitcoin and Ethereum, customers can hold numerous other digital assets in an IRA, such as

- Litecoin

- Ripple

- Stellar Lumens

- Z Cash

One of the biggest strengths of BitcoinIRA.com is its “IRA Earn program,” in which customers can earn up to 6% interest on cash and cryptos. There are monthly payouts made directly to the IRA. However, this feature also comes with a minimum $10,000 investment. The company also does not disclose how much administrative and storage fees cost.

If you don’t choose to go with this program, its minimum $3000 investment for an IRA is not cheap either.

‘Choice Logo from retirewithchoice.com’

#3 – Choice By KT (Kingdom Trust)

- Website: www.retirewithchoice.com

- Founded: 2020

- Founder: Ryan Radloff

- Annual Fees: Variable

- Assets offered: Cryptocurrencies, gold, stocks, ETFs

- Storage: Cold Storage

- Offices: Murray, Kentucky

Since its inception in 2009, Kingdom Trust has become one of the more popular IRA custodians. In 2020, it launched Choice, an all-in-one platform for customers to have full autonomy of their retirement accounts.

Although Choice allows customers to buy and sell Bitcoin, gold, stocks, and ETFs on Kraken or Interactive Brokers, the website, unfortunately, does not list which cryptocurrencies are available.

Regardless, Choice offers simplicity, transparency, and easy access to multiple types of assets.

‘Equity Trust Logo from www.trustetc.com’

#4 – Trust ETC

- Website: www.trustetc.com/investments/cryptocurrency/

- Phone: (855) 233-4382

- Founded: 1974

- Founder: Richard Desich

- Annual Fees: Variable

- Assets offered: N/A

- Storage: Cold Storage or Multisig Online Wallet

- Offices: Westlake, Ohio

Longevity is Equity Trust’s strong suit, as it’s been one of the oldest and most respected IRA custodians in the industry since 1974. Equity Trust, however, serves as a custodian for Crypto IRAs and only offers custodial services rather than investment products. It does, though, offer a simple platform to invest in crypto through established relationships with Crypto IRA providers such as Blockmint, BitIRA, BitTrustIRA, CoinIRA, and MyDigitalMoney. A customer only has to set up an account with one of those providers, and Equity Trust will take care of the rest.

‘iTrust Capital Logo from itrustcapital.com’

#5 – iTrust Capital

- Website: www.itrustcapital.com

- Phone: (866) 308-7878

- Founded: 2018

- Founder: Morgan Steckler

- Annual Fees: Variable

- Assets offered: Bitcoin, Ethereum, Litecoin, Dogecoin, Cardano, Chainlink, etc

- Storage: Cold Storage

- Offices: Encino, California

iTrustCapital offers a user-friendly platform with access to extensive educational resources and informative articles. It also offers a transparent fee structure without a monthly fee. All customers have to pay is the following:

- Cryptocurrency – 1% trade fee

- Gold – $50 over spot per ounce

- Silver – $2.50 over spot per ounce

On top of easy access to investment-grade gold and silver, iTrustCapital offers users an impressive arsenal of crypto assets, including:

- Bitcoin

- Ethereum

- Cardano

- Chainlink

- Polkadot

- Litecoin

- Dogecoin

- Bitcoin Cash

- Stellar

- EOS

- Uniswap

- Compound

- Sushi

- Yearn.finance

- Polygon (Matic)

- Aave

- Solana

- Curve DAO

- Basic Attention

- Enjin

- Algorand

- Cosmos

- Tezos

- Maker

- Shiba Inu

Summary Table

Best Ethereum IRA Companies at a Glance:

‘Regal Assets Logo from regalassets.com’#1 Regal Assets |

‘BitCoin IRA Logo from bitcoinirainvestment.com’#2 Bitcoin IRA |

‘Retire With Choice Logo from retirewithchoice.com’ |

‘Trust ETC Logo from trustetc.com’#4 Trust ETC |

‘iTrust CapitaLogo from itrustcapital.com’ |

|

|---|---|---|---|---|---|

| Full-Service Gold IRA |

✅ |

✅ |

❌ |

❌ |

❌ |

| Fees | $250 Annually | $195 Annually + $50 Setup Fees | 1% Annually | $70 Annually + $50 One-time Fee | $30 Monthly |

| Offers Other Alternative Assets |

✅ |

❌ |

✅ |

✅ |

✅ |

| Storage | Cold Storage | Cold Storage | Cold Storage | Cold Storage | MPC Cold Storage |

| Headquarters | Los Angeles, CA | Los Angeles, CA | Murray, KY | West Lake, OH | Irvine, OH |

| Free Investment Kit | REQUEST FREE KIT |

❌ |

❌ |

❌ |

❌ |

Conclusion: Wrapping Up

Crypto IRAs are not the risky gamble they once were. Day after day, crypto continues progressing as an established asset class widely accepted by the investment community.

Ethereum, however, is not like other crypto assets. It offers the potential for explosive near-term returns coupled with long-term possibilities. Ethereum is so much more than just a digital token. It is a customizable and programmable blockchain force that can add exposure to DeFi, NFTs, or Web 3.0 to your IRA account. Not to mention, Ethereum could play a significant role in the Metaverse, as well.

Adding Ethereum to your IRA can add some sizzle without a tax burden if you are a long-term bull. The risks are genuine, and there will be volatility. However, if you are a long-term investor, a few hiccups and corrections should not worry you. The most important thing you can do is your homework on the asset itself and IRA custodians.

When it comes to your strategy for retirement, we recommend that you consider all the options. If you do your due diligence and partner with a reputable custodian, properly starting an Ethereum IRA account could add immense potential to your nest egg.

To find out more about how an Ethereum IRA can work for you, take advantage of Regal Assets FREE Investment Kit or give them a call on 1-877-962-113 for more information.

REQUEST FREE KIT

About the Author

Robert Samuels is a financial copywriter and business consultant who has worked with various clients in numerous industries and sectors. He received his undergraduate degree from the University of Maryland and worked in music, sports, and entertainment for several years. Capped by a successful exit after selling a boxing website, Robert soon relocated overseas for a few years. After teaching himself stock market basics and financial fundamentals, he leveraged this newfound passion into a Master’s Degree from Harvard University’s ALM Finance extension program, where he received a 3.87 GPA and Dean’s List distinction.

Through this program, Robert also acquired a graduate certificate in Real Estate Investment and a graduate certificate in Corporate Finance. With a diverse professional background, both as an employee and entrepreneur, Robert is highly driven, passionate, and a great communicator who loves discussing finance.

![]()

This news is republished from another source. You can check the original article here

Be the first to comment